Introduction: The Role of Position Sizing in Trading

Image: otrabalhosocomecou.macae.rj.gov.br

As a trader, calculating your position size accurately is crucial for optimizing returns and minimizing risks. Position size, the number of shares or units traded, directly impacts your profit potential and portfolio’s overall health. Especially when commissions are involved, understanding how to calculate position size becomes even more important. This guide will delve into the concept of position sizing with commission, empowering you with the knowledge and tools to determine your optimal trade size and maximize your trading success.

Understanding Position Sizing with Commission

Position sizing involves determining the appropriate number of units to trade based on your risk tolerance, account size, and market conditions. When commissions are factored in, it adds another layer of complexity to the equation. Commission fees, charged by brokers for executing trades, can vary depending on the broker and the size of the trade.

For instance, if you have a $10,000 account and a commission of $5 per trade, each buy and sell order will incur a cost of $10. If you trade with a position size of 100 shares, the commission cost per share is $0.10. However, if you increase the position size to 500 shares, the commission cost per share drops to $0.02. As you can see, understanding the relationship between position size and commission is essential for calculating the net profit or loss of each trade.

Key Factors Influencing Position Size

Several key factors influence the calculation of your optimal position size:

- Account Size: A larger account can support larger position sizes, allowing for greater profit potential.

- Risk Tolerance: Your tolerance for potential losses determines the appropriate position size based on your comfort level.

- Volatility: The level of price fluctuations in the market influences the amount of risk associated with a position. Higher volatility requires smaller positions to mitigate risk.

- Market Correlation: If your portfolio contains correlated assets, a smaller position size is advisable since losses may accumulate across multiple positions.

Calculating Position Size with Commission

To calculate your position size with commission, you can use the following formula:

Position Size = (Account Size Risk Factor) / (Market Entry Price + ((Commission / 2) Average Holding Period))

- Account Size: The total value of your trading account.

- Risk Factor: A percentage that represents your risk tolerance. It typically ranges from 0.5% to 5%.

- Market Entry Price: The price at which you enter the trade.

- Commission: The total commission charged for both the buy and sell orders.

- Average Holding Period: The estimated length of time you intend to hold the position.

Example Calculation:

Let’s say you have a $50,000 account, a risk factor of 2%, a market entry price of $10 per share, a commission of $0.05 per share, and an estimated holding period of 2 weeks.

Using the formula:

Position Size = (50,000 0.02) / (10 + ((0.05 / 2) (2 * 7)))

= 1,000 shares

This calculation indicates that you should trade with a position size of 1,000 shares to align with your risk tolerance and account size while factoring in the impact of commission costs.

Conclusion: Precision and Smart Trading

Precision in position sizing is key to maximizing your chances of success as a trader. By factoring in commission costs and considering the other influencing factors, you can determine the optimal position size for each trade. Remember, the goal is not merely to enter or exit trades but to do so with well-informed decisions that support your overall trading strategy. By understanding and applying the principles outlined in this guide, you can empower yourself to calculate your position size accurately, trade with confidence, and unlock the full potential of your trading endeavors.

Image: www.thetraderisk.com

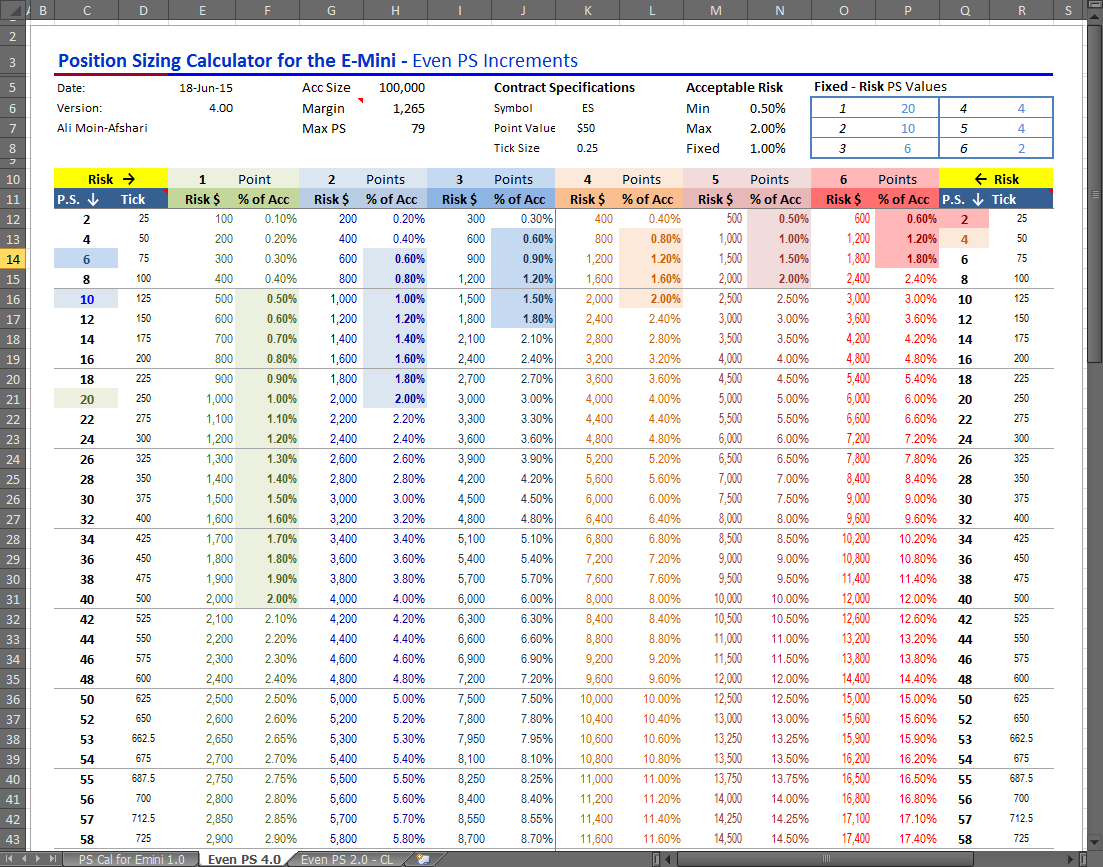

Position Size Calculator With Commission