In the tumultuous world of trading, the weight of swift and astute decisions can determine the difference between triumph and adversity. Among the arsenal of tools at a trader’s disposal, the Margin Call Calculator emerges as an indispensable ally.

Image: www.wallstreetprep.com

Navigate Market Fluctuations with Precision

A Margin Call Calculator serves as your guiding star, illuminating the complexities of margin trading and safeguarding your financial well-being. With its advanced algorithms, the calculator empowers you to:

- Instantly calculate the amount of margin required for a specific trade.

- Identify potential margin calls based on changing market conditions.

- Monitor your account’s health and risk profile in real-time.

Comprehensive Margin Call Calculator: Definition and Significance

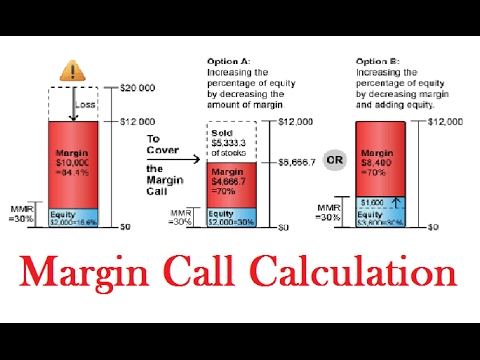

In the realm of trading, margin refers to the amount of capital borrowed from a broker to amplify trading leverage. The Margin Call Calculator provides a comprehensive understanding of this crucial concept:

- Definition: The calculator measures the ratio between the amount of equity in an account and the amount of margin being utilized.

- Significance: Maintaining a healthy margin level is essential to avoid a margin call, a situation where the account’s equity falls below a predetermined threshold.

Expert Tips and Advice: Mastering Margin Trading with Confidence

Seasoned traders and financial experts advocate the following tips for navigating margin trading with precision:

- Know Your Margin Levels: Continuously monitor your margin levels and adjust your trading strategies accordingly.

- Manage Risk Prudently: Use the calculator to determine how much margin you can prudently use without overextending yourself.

- Diversify Your Portfolio: Spread your investments across multiple assets to mitigate risk and minimize potential losses.

Image: www.youtube.com

Frequently Asked Questions: Unraveling Margin Trading Mysteries

To dispel any lingering uncertainties, here’s a brief FAQ to clarify the fundamentals of margin trading:

- Q: What is the advantage of using a Margin Call Calculator?

A: It provides real-time insights into your margin levels, enabling you to make informed trading decisions. - Q: How does the calculator determine potential margin calls?

A: It compares your margin levels against predetermined thresholds, alerting you to potential risks. - Q: Can I avoid margin calls entirely?

A: While not guaranteed, maintaining sufficient equity and managing risk diligently can minimize the likelihood of a margin call.

Margin Call Calculator

Conclusion: Embrace the Power of Informed Trading

By harnessing the Margin Call Calculator, you are not merely a trader but a strategist, confidently navigating the ebb and flow of the markets. Embrace its power to mitigate risk, maximize returns, and elevate your trading journey.

Are you ready to unlock the secrets of margin trading and unleash the full potential of your financial endeavors?