Initiated in March 2007, M-Pesa has revolutionized mobile banking in Kenya, enabling the transfer and storage of funds through mobile phones. It has significantly enhanced financial inclusion, making it easier for Kenyans to send and receive money, pay bills, and access other financial services. However, one aspect of M-Pesa that users often find dissatisfactory is the charges associated with withdrawing funds. This article aims to provide a comprehensive guide to understanding and minimizing these charges, empowering M-Pesa users to make informed decisions and optimize their financial transactions.

Image: centwarrior.com

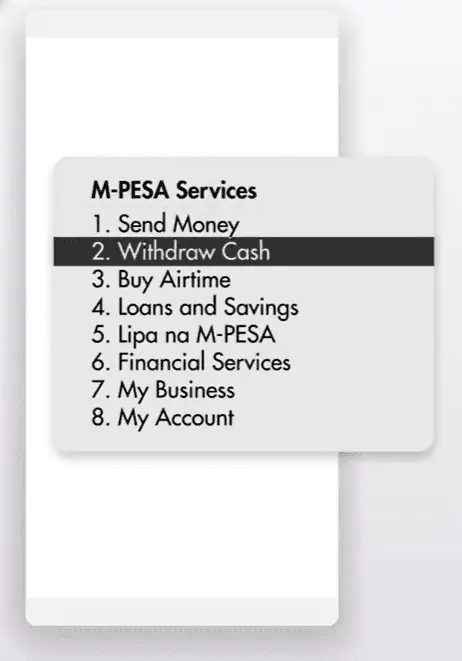

Understanding M-Pesa Withdrawal Charges

M-Pesa charges a withdrawal fee for transferring funds from your mobile money account to a bank account or for cash withdrawal via an M-Pesa agent. The withdrawal fee varies depending on the amount withdrawn and the method used. Generally, withdrawing large amounts of money attracts higher charges compared to smaller withdrawals. Additionally, withdrawing M-Pesa funds through an agent usually incurs higher charges than withdrawing directly from an ATM using an M-Pesa Visa card.

Strategies to Minimize Withdrawal Charges

-

Leverage M-Pesa Withdrawals to Other M-Pesa Users: Transferring funds directly to another M-Pesa account is free, eliminating any withdrawal charges. This option is ideal for peer-to-peer transactions or transferring funds within your own M-Pesa accounts.

-

Utilize M-Pesa VISA Card: Using an M-Pesa Visa card to withdraw funds from an ATM is often cheaper compared to agent withdrawals. M-Pesa Visa card withdrawals attract a withdrawal fee of KES 25 for amounts less than KES 2,000, a significant reduction compared to agent charges.

-

Negotiate Lower Agent Withdrawal Fees: When withdrawing through an M-Pesa agent, consider negotiating a lower withdrawal fee. Agents often offer flexible charges based on the amount withdrawn and their individual business margins. By negotiating a lower fee, you can minimize the cost of agent withdrawals.

-

Withdraw Funds from KCB Bank ATM: KCB Bank (the issuer of M-Pesa Visa cards) allows M-Pesa users to withdraw funds from KCB ATMs free of charge. If you have an M-Pesa Visa card and access to a KCB ATM, this is the most cost-effective method of withdrawing M-Pesa funds.

-

Consider Withdrawal Limits and Transaction Costs: M-Pesa has daily withdrawal limits and transaction costs associated with large withdrawals. For instance, withdrawing KES 100,000 attracts a higher transaction cost compared to withdrawing KES 50,000. Understanding these limits and costs can help you plan your withdrawals and minimize overall charges.

-

Maximize Monthly and Daily Withdrawal Limits: If you have frequent withdrawal needs, consider using your monthly and daily withdrawal limits to your advantage. Once you reach your daily limit, wait until the following day to continue withdrawing to avoid additional withdrawal charges.

-

Explore Alternative Withdrawal Methods: M-Pesa has partnered with various institutions to offer alternative withdrawal methods with potentially lower charges. These methods include merchants, businesses, and financial institutions that offer M-Pesa withdrawal services at competitive rates. Exploring these options can provide you with additional savings.

Image: nashthuo.com

Withdrawing Mpesa Charges

Conclusion

M-Pesa withdrawal charges can significantly impact your financial management. By understanding these charges and implementing the strategies outlined in this guide, you can effectively minimize your withdrawal costs, optimize your financial transactions, and enjoy the full benefits of M-Pesa’s mobile banking services. Remember to use M-Pesa responsibly, plan your withdrawals wisely, and always prioritize secure financial practices to safeguard your funds.