Navigating the Global Marketplace of Currencies

In the interconnected world of today, the ability to exchange currencies has become paramount for individuals, businesses, and nations alike. Understanding currency pairs is the cornerstone of foreign exchange (forex) trading, the vibrant marketplace where these exchanges take place. Join us as we delve into the world of currency pairs, unraveling their significance and exploring their intricate workings.

Image: www.wikijob.co.uk

What are Currency Pairs?

A currency pair is simply a quotation of the exchange rate between two different currencies. These pairs form the fundamental units of forex trading, reflecting the value of one currency in relation to another. For example, the EUR/USD pair indicates how many U.S. dollars are needed to purchase one euro. The first currency listed in a pair (known as the base currency) is the one being bought, while the second (the counter currency) is the one being sold.

Why Currency Pairs Matter

Currency pairs play a vital role in international trade, tourism, and investment. Businesses rely on them to facilitate payments and hedge against currency fluctuations. Travelers track currency pairs to determine the best time to exchange their funds. Investors use currency pairs to capitalize on exchange rate movements and diversify their portfolios.

Major Currency Pairs

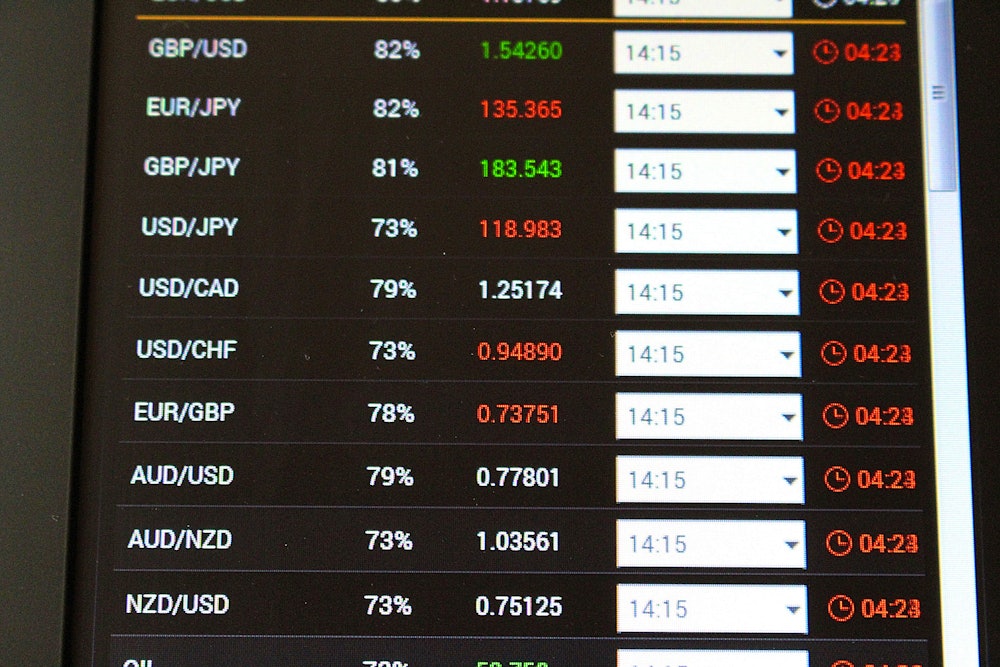

The forex market consists of dozens of currency pairs, but a handful of major pairs account for the majority of trading volume. These include:

- EUR/USD (Euro/U.S. Dollar): The world’s most traded pair, reflecting the economic dominance of Europe and the United States.

- USD/JPY (U.S. Dollar/Japanese Yen): A key pair for global trade and investment between Japan and the U.S.

- GBP/USD (British Pound/U.S. Dollar): A long-standing pair influenced by the political and economic landscape of both countries.

- USD/CHF (U.S. Dollar/Swiss Franc): A safe-haven pair often sought during times of market volatility.

- AUD/USD (Australian Dollar/U.S. Dollar): A commodity-linked pair influenced by Australia’s natural resources exports.

Image: financeillustrated.com

Minor and Exotic Currency Pairs

Beyond the majors, there exist numerous minor and exotic currency pairs. These pairs involve currencies from smaller or emerging economies and tend to be less liquid and more volatile. Traders seek out these pairs for potential higher returns but also face greater risk.

Understanding Currency Pair Dynamics

The value of a currency pair is influenced by various factors, including:

- Economic growth: Countries with strong economic growth tend to see their currencies appreciate against weaker economies.

- Interest rates: Higher interest rates make a currency more attractive to investors, leading to appreciation.

- Political stability: Political instability can erode trust in a currency, causing it to depreciate.

- Inflation: Inflation erodes the purchasing power of a currency, leading to depreciation.

- Supply and demand: The basic laws of supply and demand also play a role in currency pair movements.

Expert Insights on Currency Pairs

“Currency pairs are the lifeblood of the global economy,” says Dr. Emily Carter, renowned economist at Oxford University. “They allow businesses to trade, travelers to explore, and investors to diversify their portfolios.”

Peter Jones, a seasoned forex trader, advises, “Understanding currency pair dynamics is crucial for success in the forex market. By monitoring economic indicators, political events, and market sentiment, traders can make informed decisions about when to enter and exit positions.”

Actionable Tips for Currency Pair Trading

- Choose a reputable broker that offers competitive spreads and reliable execution.

- Start with major currency pairs to gain experience and build confidence.

- Don’t overtrade or overleverage. Manage your risk carefully and avoid emotional trading decisions.

- Stay informed about economic events and market trends that may impact currency pair values.

- Practice with demo accounts or small positions before risking substantial capital.

What Are Currency Pairs

Conclusion: Mastering Currency Pairs

In the ever-evolving world of global finance, understanding currency pairs is essential for comprehending and leveraging currency exchange rates. Whether you’re an individual planning an international trip, a business engaged in international trade, or an investor seeking diversification, currency pairs provide the foundation for navigating the complexities of foreign exchange. By embracing the insights and actionable tips outlined in this article, you can empower yourself to make informed decisions and unlock the full potential of the global currency marketplace.