Harnessing the Power of Candlesticks to Unlock Market Insights

Imagine you’re gazing out onto a vast ocean, trying to decipher its ever-changing patterns. Financial markets often resemble this enigmatic realm, with their constant fluctuations and complex dynamics. However, just as mariners rely on charts and lighthouses to navigate the open seas, traders have a powerful tool at their disposal: candlesticks. These seemingly simple patterns hold a wealth of information, illuminating the markets like distant stars. Embark on a journey with us as we unravel the enigmatic world of candlestick charts, empowering you with the knowledge to navigate the financial waters with confidence.

Image: www.vlr.eng.br

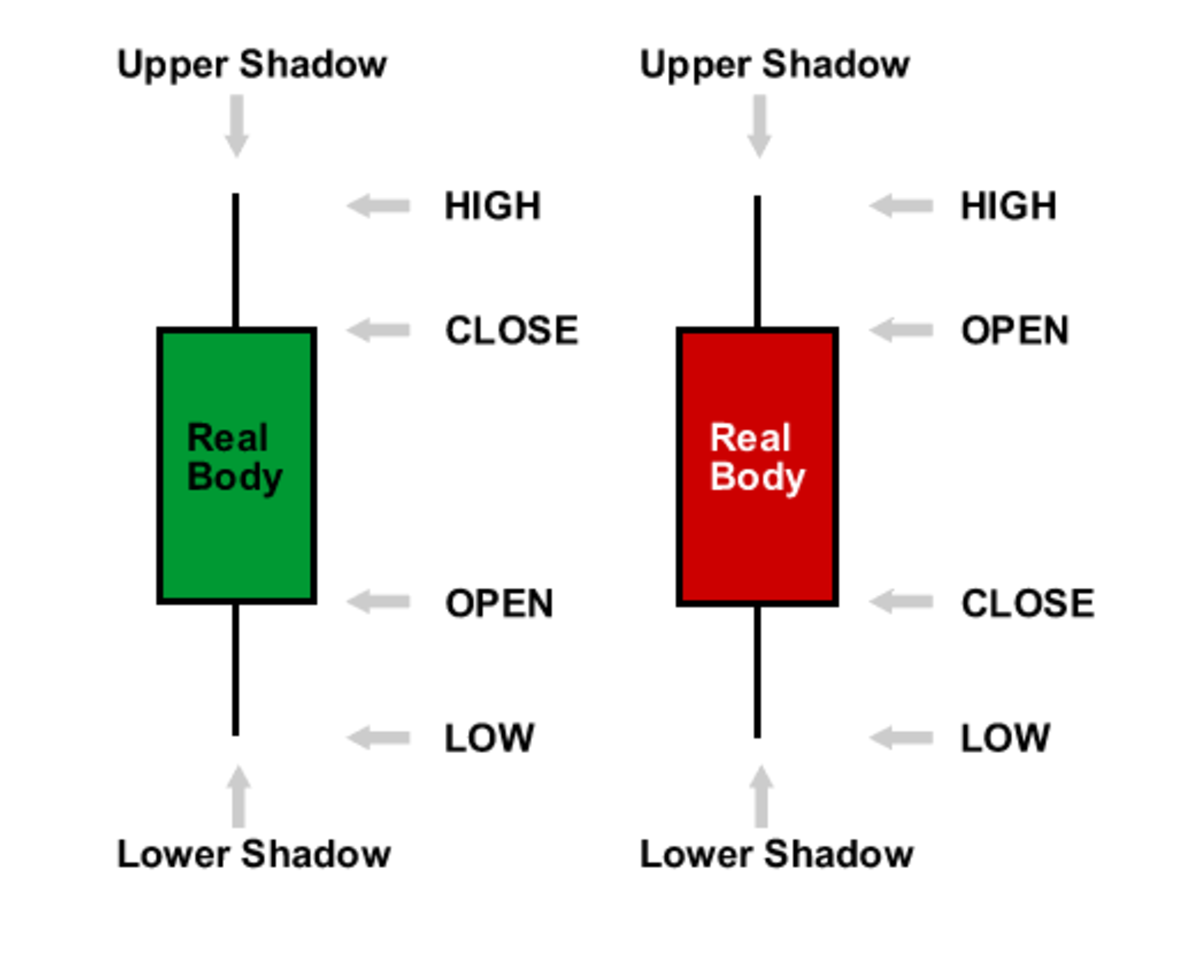

Exploring the Anatomy of Candlesticks

A candlestick represents a single period of time, typically one day, during which a security, such as a stock or currency pair, is traded. It comprises two main elements: a body and one or more wicks (or tails). The body depicts the difference between the security’s opening and closing prices. If the body is hollow, it indicates a price decline, while a filled body represents a rise in price. The wicks, meanwhile, extend above and/or below the body, depicting the highest and lowest prices reached during the period.

Deciphering Candlestick Patterns

Beyond their basic anatomy, candlesticks come in a variety of patterns, each with its own implications for market sentiment and future price movements. Some of the most common candlestick patterns include:

– Bullish patterns:

These patterns suggest a potential uptrend, including the “hammer,” which resembles a hammer with a long wick below and a short body; the “engulfing pattern,” where one candle completely encompasses the previous one; and the “three white soldiers,” a series of three consecutive long-bodied candles.

Image: nl.pinterest.com

– Bearish patterns:

Conversely, bearish patterns indicate a potential downtrend, such as the “hanging man,” a candle with a long wick above and a small body; the “piercing pattern,” where a long-bodied candle penetrates a previous candle’s range; and the “three black crows,” a series of three consecutive large-bodied candles.

– Neutral patterns:

Neutral patterns, such as the “doji,” which resembles a cross or plus sign, and the “spinning top,” a small-bodied candle with long wicks, indicate indecision or market consolidation.

Integrating Candlesticks into Your Trading Strategy

Candlesticks are a valuable tool for both technical and fundamental analysis. By combining candlestick patterns with other indicators, such as moving averages and support and resistance levels, traders can gauge market sentiment and identify potential trading opportunities.

For example, a hammer candle at the end of a downtrend may signal a potential reversal, suggesting the beginning of an uptrend. Conversely, a hanging man candle at the end of an uptrend could indicate a potential change in momentum, signaling the possibility of a reversal.

Incorporating Candlesticks into Your Trading Toolkit

Harnessing the power of candlesticks requires practice and experience. Here are some tips for incorporating them into your trading strategy:

- Use candlesticks in conjunction with other technical indicators for confirmation.

- Consider the broader market context and incorporate fundamental analysis to enhance your readings.

- Backtest your candlestick strategies on historical data to gauge their accuracy and profitability.

- Continuously educate yourself and stay abreast of the latest candlestick patterns and variations.

What Are Candles In Trading

Conclusion: Unlocking the Secrets of Candlesticks

Candlestick charts are a captivating and indispensable tool for discerning traders and investors. By understanding the anatomy of candlesticks, deciphering common patterns, and incorporating them into your trading strategy, you can harness the power of the markets and make informed decisions that guide your financial journey.

With patience and practice, you can unlock the secrets of candlestick charts and confidently navigate the ever-changing landscape of financial markets.