In the fast-paced world of trading, managing risk is paramount for success and survival. A trading risk calculator serves as an invaluable tool for traders, empowering them to make informed decisions and mitigate potential losses. This comprehensive guide delves into the intricacies of trading risk calculators, their significance, and the various strategies employed to assess and manage risk.

Image: www.youtube.com

What is a Trading Risk Calculator?

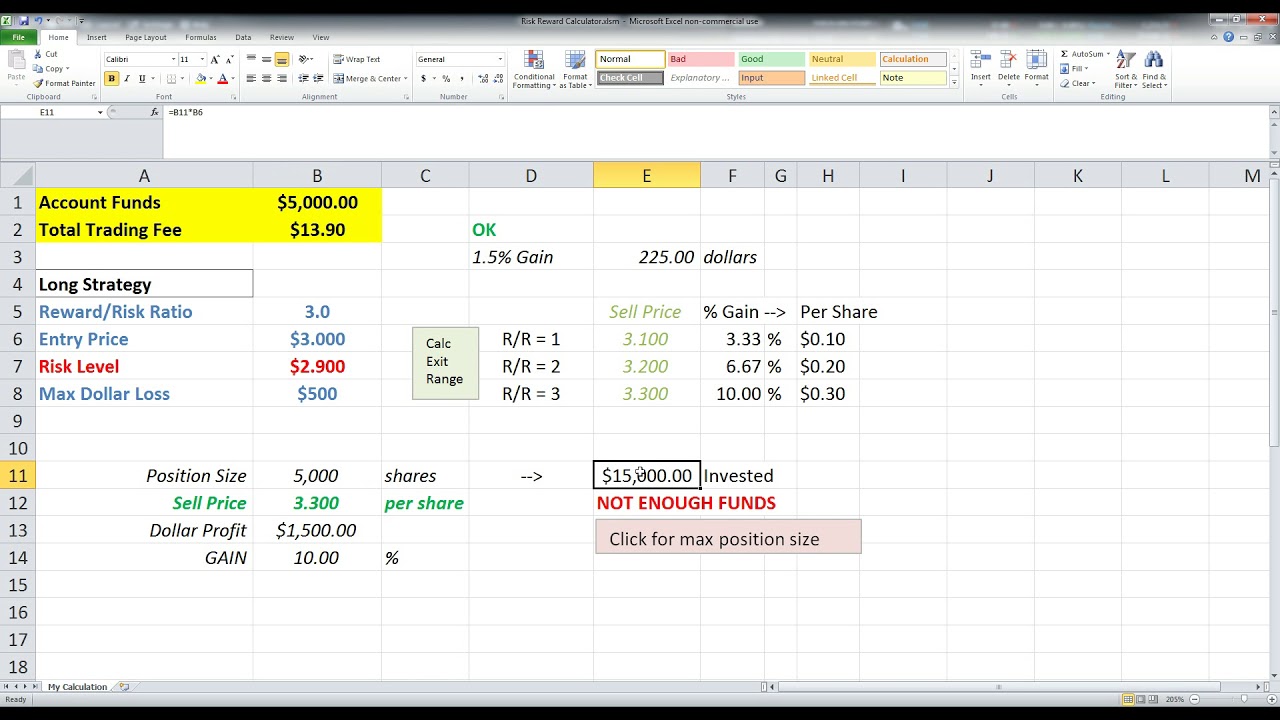

A trading risk calculator is a software or web-based tool designed to help traders quantify and manage the potential risks associated with their trades. It incorporates various input variables, such as account balance, position size, stop-loss levels, and market volatility, to generate a risk-to-reward ratio and other metrics that inform trading decisions. By leveraging this information, traders can fine-tune their trading strategies, set appropriate position sizes, and establish optimal profit and loss targets.

Importance of Trading Risk Calculators

-

Risk Quantification: Trading risk calculators provide a precise measurement of potential risk, allowing traders to make data-driven decisions rather than relying on gut instinct or guesswork.

-

Position Sizing Optimization: By calculating risk levels, traders can determine the appropriate size for each trade relative to their account balance and tolerance for risk. Overtrading, a common pitfall among novice traders, is effectively curbed through prudent position sizing.

-

Stop-Loss Placement: A well-positioned stop-loss order can minimize losses in adverse market conditions. Risk calculators assist traders in determining optimal stop-loss levels based on their risk appetite and market volatility.

-

Risk-Reward Analysis: Trading risk calculators provide an objective assessment of the potential reward in relation to the calculated risk. This analysis helps traders identify trades with favorable risk-reward ratios, increasing the probability of profitable outcomes.

-

Trading Discipline: Discipline is crucial for successful trading, and risk calculators instill discipline by forcing traders to consider the potential risks before executing trades. This calculated approach promotes rational decision-making and prevents impulsive actions based on emotions.

Types of Trading Risk Calculators

-

General Risk Calculators: These calculators calculate basic risk metrics, such as maximum drawdown and risk-to-reward ratio, based on the trader’s inputs. They are suitable for traders with a fundamental understanding of risk management.

-

Advanced Risk Calculators: Designed for experienced traders, these calculators incorporate Monte Carlo simulations and probability distributions to generate more sophisticated risk assessments. They often account for factors such as historical market data and correlation between assets.

-

Strategy-Specific Risk Calculators: Tailored to specific trading strategies, these calculators consider unique risk factors associated with the strategy and provide specialized risk metrics. For example, a day trading risk calculator may assess the risks associated with high-frequency trading.

![[FREE DOWNLOAD] Position Size Calculator Forex, Stocks And Commodity ...](https://2.bp.blogspot.com/-PB0zircpIAw/T8tbxYU5OzI/AAAAAAAAA8w/F3JRqpdCaRM/w1200-h630-p-k-no-nu/Position+Size+Calculator+For+Stock,+Commodity+Forex+Trading+Risk+to+Reward+Trade+Size.png)

Image: financeandtradingmadeeasy.blogspot.com

Strategies to Assess and Manage Trading Risk

-

Risk Assessment: Before placing a trade, traders should conduct a thorough risk assessment by considering their account balance, position size, stop-loss levels, and market conditions. A trading risk calculator automates this process, providing quantitative risk measurements.

-

Position Sizing: Position sizing determines the number of units to trade. It is crucial to balance potential reward with risk tolerance. Risk calculators guide traders in determining the optimal position size based on their risk parameters.

-

Stop-Loss Placement: A stop-loss order automatically closes a losing trade at a predetermined price, limiting potential losses. Risk calculators assist traders in setting stop-loss levels that balance risk aversion with the possibility of locking in profits.

-

Trailing Stop-Loss: Trailing stop-loss orders adjust dynamically as the trade moves in the profitable direction, protecting profits while allowing for further gains. Risk calculators help optimize trailing stop-loss placement based on market volatility and trading strategy.

-

Risk Diversification: Spreading risk across multiple trades or asset classes mitigates the impact of losses on a single position. Trading risk calculators can be used to assess the overall risk of a diversified portfolio and identify potential correlations.

Trading Risk Calculator

https://youtube.com/watch?v=84_LMFavJJg

Conclusion

A trading risk calculator is an indispensable tool for traders seeking to navigate the complexities of the financial markets prudently. By providing quantitative risk assessments and facilitating informed decision-making, traders can enhance their risk management strategies and increase their chances of achieving long-term success. Understanding the types and strategies associated with trading risk calculators empowers traders to make confident trades, minimize losses, and maximize profits in the dynamic world of investing.