When it comes to managing your finances, knowing the required margin is crucial for leveraging your investments strategically. A required margin calculator is an invaluable tool that empowers you to determine the minimum amount of equity you need to maintain in your margin account to cover potential losses.

Image: www.forexfreshmen.com

Understanding the concept of a required margin is essential. It acts as a safety cushion for brokerages, ensuring they have sufficient funds to cover any potential risks associated with lending money to investors. By maintaining an adequate margin level, you can avoid margin calls, which can force you to sell your investments at an unfavorable time.

Types of Required Margins

There are two main types of required margins:

1. Regulation T Margin

Regulation T, set by the Federal Reserve, establishes a standard margin requirement of 50% for most securities. This means that you must have at least 50% of the purchase price of a stock in your account to buy it on margin.

2. Portfolio Margin

Portfolio margin is a more complex calculation that takes into account your overall investment portfolio. If you qualify for a portfolio margin account, you may be able to access lower margin requirements, typically ranging from 25% to 40%. However, this requires a comprehensive analysis of your portfolio’s risk profile.

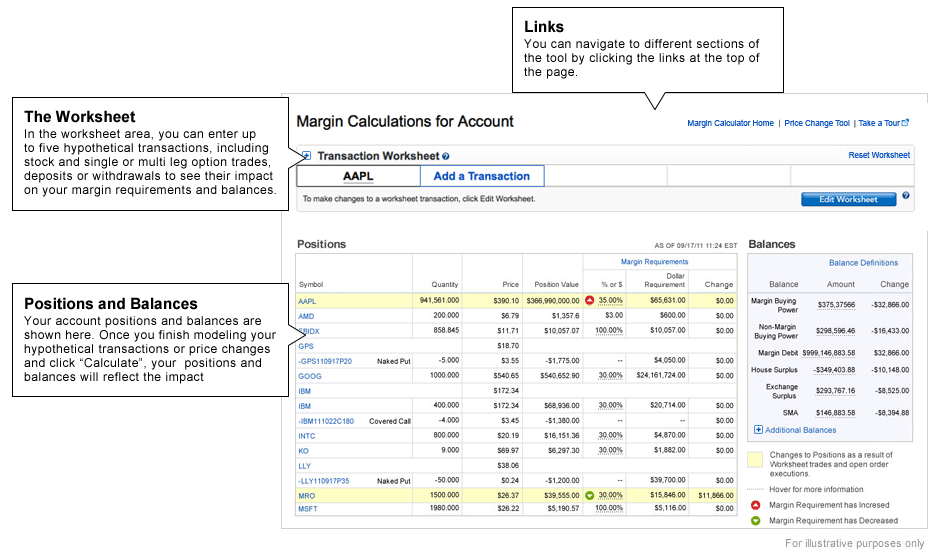

Image: www.fidelity.com

Calculating Required Margin

Calculating your required margin is relatively straightforward using the formula:

Required Margin = (Purchase Price × Required Margin Percentage) – Equity in Account

For example, if you want to buy 100 shares of a stock with a share price of $100 and a required margin of 50%, your required margin would be:

Required Margin = ($100 × 0.50) – $0 = $5,000

This means you would need at least $5,000 in your margin account to cover any potential losses.

Benefits of Using a Required Margin Calculator

Using a required margin calculator offers several advantages:

- Accurate Calculations: The calculator ensures precise computations, minimizing potential errors in margin calculations.

- Time-Saving: It eliminates the need for manual calculations, saving you valuable time.

- Informed Decisions: Having accurate margin requirements helps you make informed investment decisions regarding the amount of leverage you wish to employ.

Required Margin Calculator

Conclusion

A required margin calculator is a powerful tool for investors who want to maximize their investment potential. By harnessing its capabilities, you can confidently determine your margin requirements, manage your account effectively, and mitigate financial risks. Remember, it’s crucial to use this tool in conjunction with sound investment principles and a comprehensive understanding of the risks associated with margin trading.