Imagine yourself strolling through the vibrant streets of Montevideo, Uruguay, the aroma of freshly brewed mate filling the air. You’re captivated by the colorful architecture, the friendly locals, and the overall charm of this South American gem. But as you browse local markets and plan your next adventure, a question arises: How will the Uruguayan peso (UYU) fare against the US dollar (USD)?

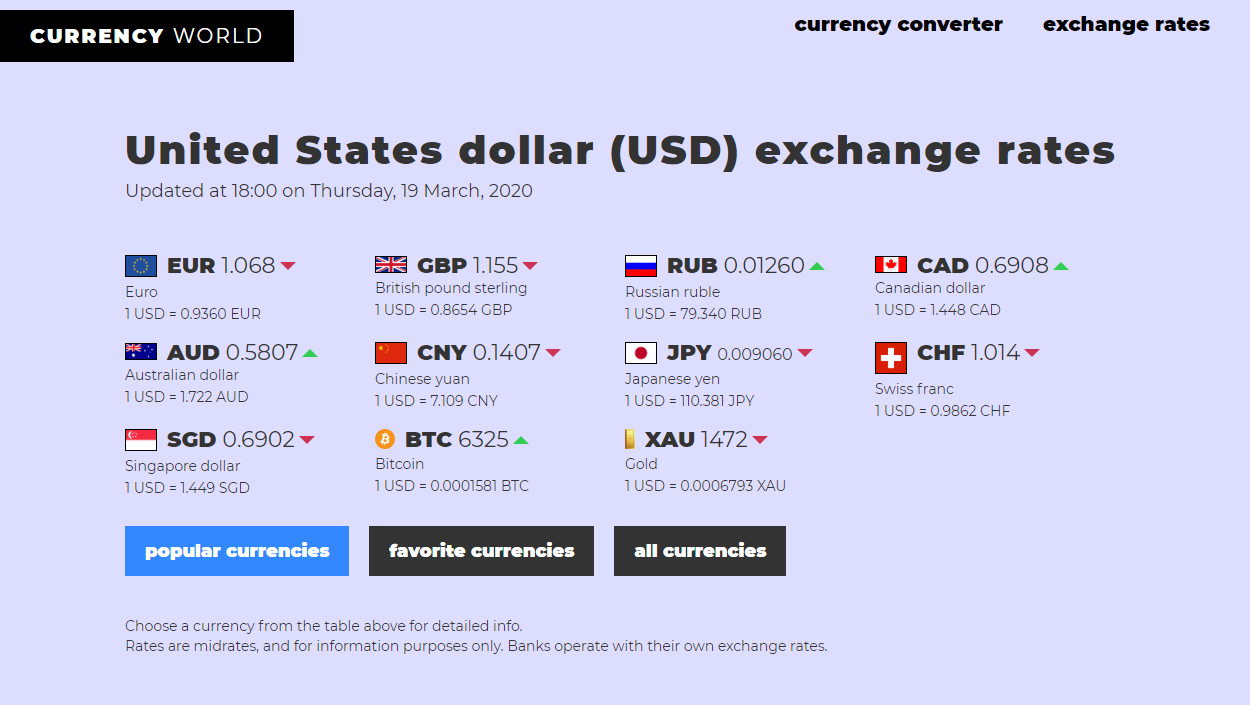

Image: currency.world

This guide will delve into the intricacies of the UYU/USD exchange rate, exploring its history, key factors influencing its fluctuations, and practical tips for navigating currency exchange in Uruguay. Whether you’re a seasoned traveler or a curious investor, this comprehensive exploration aims to empower you with the knowledge to confidently navigate the world of Uruguayan currency.

Understanding the Uruguayan Peso: A Journey Through History and Economic Landscape

The Uruguayan peso, with its unique symbol “$U”, has been a cornerstone of Uruguayan economic life since 1993. Prior to this, the country had experienced bouts of hyperinflation, culminating in the introduction of a new peso with a stable value. This pivotal move aimed to restore confidence in the currency and provide a solid foundation for economic growth.

Uruguay’s economy is heavily reliant on agricultural exports, primarily beef and soy, alongside tourism and financial services. These sectors have a significant impact on the UYU/USD exchange rate, as fluctuations in commodity prices or global tourism trends can directly affect the value of the Uruguayan peso.

Diving Deeper: Key Drivers of the UYU/USD Exchange Rate

The UYU/USD exchange rate is influenced by a complex interplay of economic factors. Here’s a breakdown of the key drivers shaping its fluctuations:

- Interest Rates: The Central Bank of Uruguay closely manages interest rates to control inflation and maintain currency stability. Higher interest rates can strengthen the peso, attracting foreign investment seeking lucrative returns, while lower rates can weaken the currency.

- Inflation: When inflation rises in Uruguay, the peso tends to weaken, causing a rise in the UYU/USD exchange rate. This is because rising prices diminish the purchasing power of the peso.

- Government Spending and Debt: The government’s fiscal policies, including spending levels and debt management, have a significant impact on the currency. Excessive spending can lead to inflation and a weakening peso, while responsible fiscal policies can stabilize the currency.

- International Trade: Export performance influences the peso’s value. Strong exports, particularly agricultural commodities, can strengthen the peso, while weak exports can exert downward pressure on the currency.

- External Factors: Global economic trends, commodity price fluctuations, and international investor sentiment can influence the UYU/USD exchange rate. For instance, a global recession or increased risk aversion in global markets can lead to capital flight from Uruguay, weakening the peso.

Navigating the Flow: Tips for Managing UYU/USD Exchange Rates

Understanding the factors influencing the UYU/USD exchange rate can empower you to make informed decisions regarding currency exchange in Uruguay. Here’s a collection of practical tips to help navigate the currency landscape:

- Research and Compare Exchange Rates: Before traveling to Uruguay, research different exchange bureaus, banks, and online platforms to find the most favorable exchange rates. Consider factors such as commission fees and hidden charges.

- Utilize ATMs for Local Currency: When in Uruguay, it’s generally advantageous to use local ATMs to withdraw Uruguayan pesos, as these often offer better exchange rates than exchanging currency at airports or exchange bureaus.

- Travel Cards and Pre-Paid Currency: Consider using a travel card or a pre-paid currency card to manage your expenses. These cards allow you to withdraw local currency or make payments in USD, potentially offering favorable exchange rates and protecting your funds from fluctuations.

- Stay Updated with Economic Indicators: Keep an eye on key economic indicators in Uruguay and globally, as they can provide insights into potential fluctuations in the UYU/USD exchange rate.

- Negotiate When Possible: Don’t hesitate to negotiate exchange rates, especially when exchanging substantial amounts of currency.

Image: onebluewindow.com

Expert Insights and Actionable Tips: Maximizing Your Currency Experience

For those seeking further guidance, consulting with a currency exchange specialist or a financial advisor with expertise in Latin American markets can provide valuable insights. These professionals can offer personalized recommendations tailored to your specific needs and goals.

Uf Currency To Usd

Conclusion: Embracing the Uruguayan Currency Landscape

Understanding the dynamics of the UYU/USD exchange rate is crucial for travelers and investors seeking to maximize their experiences and financial gains in Uruguay. By staying informed about key economic indicators, utilizing practical tips for currency management, and potentially seeking expert advice, you can confidently navigate the world of Uruguayan currency and unlock the full potential of your journey.