Introduction

In the ever-evolving realm of financial markets, understanding and utilizing technical indicators have become indispensable tools for traders and investors alike. Among these indicators, Jump 50 Index stands out as a valuable tool for identifying potential market movements and maximizing profit opportunities. This comprehensive guide will delve into the fascinating world of Jump 50 Index, equipping you with the knowledge to navigate market volatility and achieve your financial goals.

Image: news.ltn.com.tw

Understanding Jump 50 Index

Jump 50 Index is a technical indicator that assists traders in identifying potential reversal points within a trend. Its calculation is based on the principle of Market Profile, which divides the trading session into fixed price ranges known as Value Areas. The index measures the percentage of volume that occurs within these Value Areas, providing insights into buying and selling pressure at specific price levels.

When Jump 50 Index spikes above or below specific thresholds, it can signal potential market reversals. Rising above 75% indicates strong buying pressure, while dropping below 25% suggests intensified selling pressure. By recognizing these signals, traders can anticipate market shifts and position themselves accordingly.

Identifying Market Reversals

One of the primary benefits of Jump 50 Index lies in its ability to identify potential market reversals. When the index crosses above 75% from a downtrend, it indicates a shift in market sentiment toward buying. Conversely, when the index falls below 25% from an uptrend, it suggests a reversal toward selling.

Traders can utilize these signals to adjust their positions accordingly. For instance, if Jump 50 Index crosses above 75% after a prolonged downtrend, it may prompt them to switch to long positions, anticipating a market rally. Similarly, if the index falls below 25% during an uptrend, they may consider closing or reducing their long positions and moving to short positions.

Managing Risk and Maximizing Profits

Jump 50 Index is not solely an indicator for identifying market reversals but also a crucial tool for risk management and profit maximization. By recognizing potential turning points, traders can limit their exposure to potential losses.

For example, if a trader initiates a long position based on a Jump 50 Index signal, the index falling below 50% could serve as an exit signal, allowing them to minimize losses. Additionally, by identifying potential market rallies and pullbacks, traders can adjust their stop-loss and take-profit levels to optimize their profit potential.

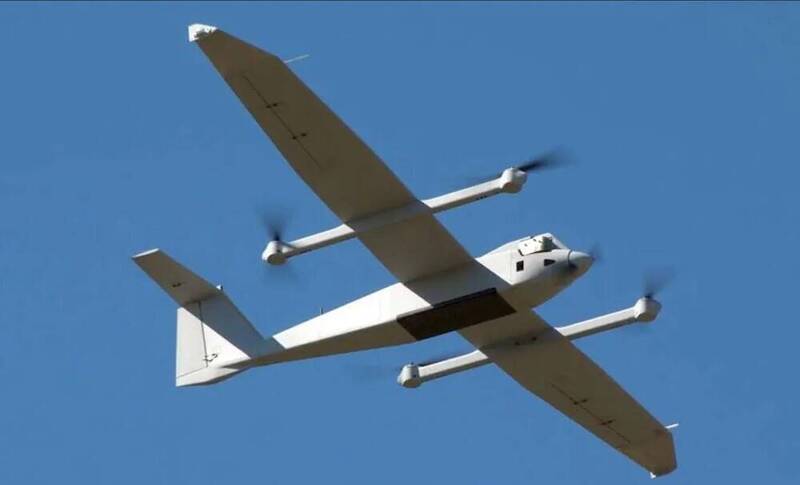

Image: www.militaryfactory.com

Expert Insights and Actionable Tips

John Bogle, Founder of Vanguard Group: “The Jump 50 Index provides a valuable perspective on market momentum and can help investors make informed decisions.”

Dr. Alexander Elder, Author of Trading for a Living: “By understanding and utilizing Jump 50 Index, traders can gain an edge in the dynamic world of financial markets.”

Actionable Tips:

- Combine Jump 50 Index with other technical indicators for more robust market analysis.

- Consider the overall market context and fundamental factors before making trading decisions.

- Remember, no indicator is foolproof; use Jump 50 Index as one part of your trading strategy.

Jump 50 Index

Conclusion

Jump 50 Index is an invaluable tool that empowers traders and investors to navigate market volatility, identify potential reversals, and optimize their trading strategies. By understanding its mechanics and applying it diligently, individuals can gain a competitive edge in the financial markets. Remember, constant learning, continuous practice, and diligent research are crucial for maximizing the potential of Jump 50 Index and achieving desired trading outcomes.