Introduction

Image: www.top1insights.com

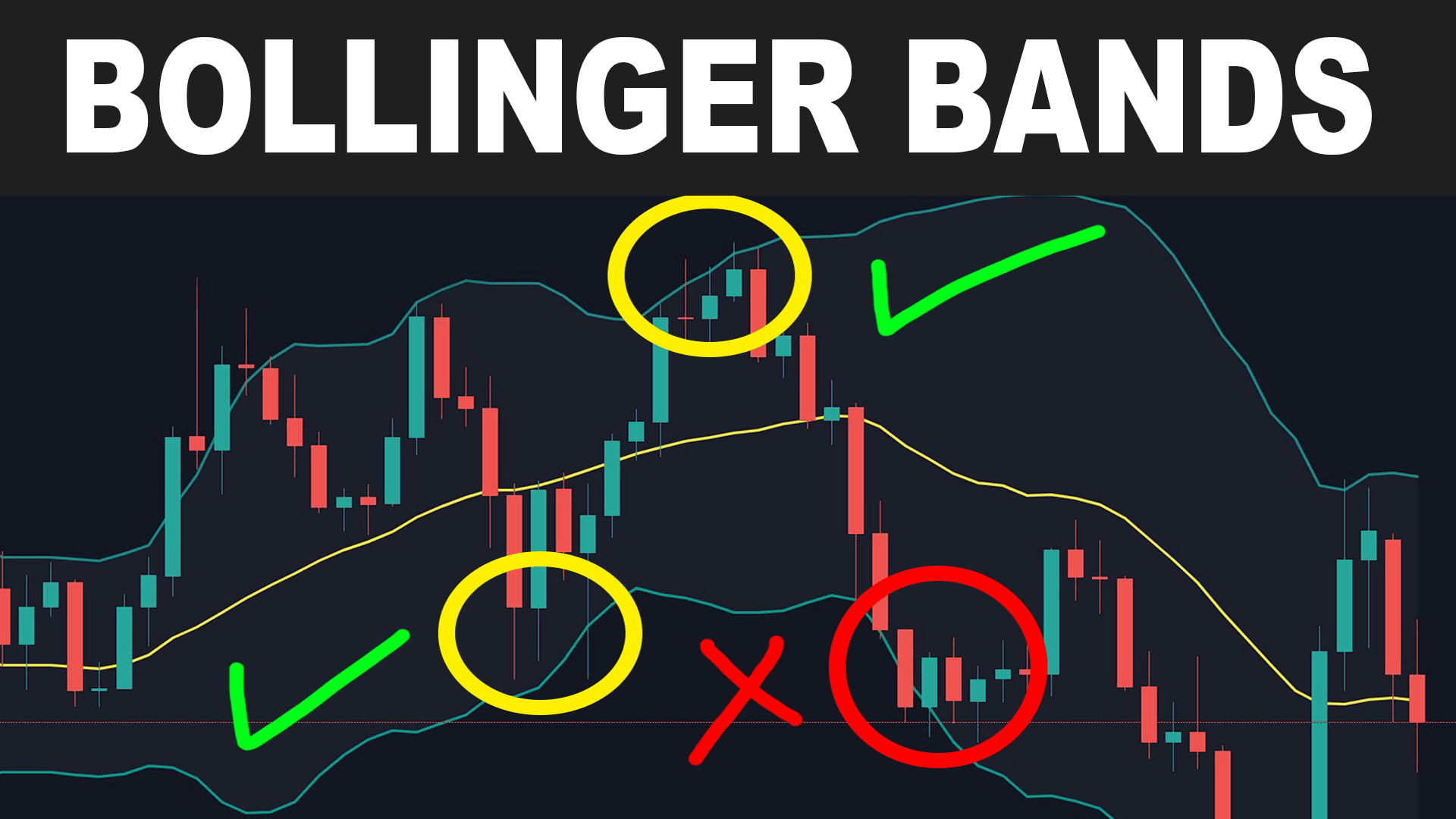

Do you long for trading consistency in the ever-volatile Forex market? Behold the power of Bollinger Bands, a revolutionary trading tool that can transform your trading journey. In this comprehensive guide, we delve into the world of Bollinger Bands, unlocking the secrets of identifying market trends, gauging volatility, and boosting your winning percentage. Prepare to elevate your trading game to unprecedented heights and witness the market bend to your will.

Understanding Bollinger Bands: The Powerhouse Indicator

Envisioned by the legendary trader John Bollinger, Bollinger Bands are an indispensable technical indicator that measures the volatility of an asset over a specific timeframe. They comprise three lines:

- Middle Band (Moving Average): Represents the simple moving average (SMA) of the asset’s price.

- Upper Band: Plotted a specified number of standard deviations above the middle band.

- Lower Band: Plotted a specified number of standard deviations below the middle band.

The width of the bands fluctuates, indicating the market’s volatility. When the bands narrow, volatility decreases, suggesting a potential period of consolidation. Conversely, expanding bands signal heightened volatility, often associated with market swings.

Trading with Bollinger Bands: A Method to Success

1. Identifying Market Trends:

Bollinger Bands provide valuable insights into market trends. When the price sustains above the upper band, it indicates a bullish trend. Conversely, sustained breaks below the lower band signal a bearish trend.

2. Gauging Market Volatility:

The width of the bands directly correlates with market volatility. Narrowing bands indicate low volatility, ideal for swing trading or scalping. Expanding bands, on the other hand, suggest increased volatility, favoring breakout strategies.

3. Playing the Bounce:

Bollinger Bands often act as support and resistance levels. When the price touches or bounces off the upper band, it may signify a potential reversal to the downside. Similarly, touches or bounces from the lower band may indicate a potential reversal to the upside.

4. Squeeze and Volatility Breakouts:

When the Bollinger Bands contract to their lowest width, it signals a “squeeze” phase. Often, a sharp breakout follows this phase, which can yield substantial profits. Trailing stops can help secure these gains effectively.

Expert Insights and Actionable Tips:

- John Bollinger’s Wisdom: Bollinger advises traders to adjust the standard deviation settings based on their risk tolerance and trading style.

- Analyze Multiple Timeframes: Combining Bollinger Bands analysis across various timeframes can provide a broader market perspective.

- Confirm with Other Indicators: While Bollinger Bands are versatile, cross-referencing with other technical indicators enhances trade accuracy.

- Manage Risk: Use stop-loss orders to mitigate potential losses and preserve capital.

Conclusion

Harnessing the power of Bollinger Bands is a game-changer for Forex traders. By understanding market trends, gauging volatility, and executing strategic trades, you can unlock the winning percentage you’ve always dreamed of. Remember, the Forex market can be unforgiving, but with Bollinger Bands at your disposal, you can trade confidently, seize opportunities, and witness your account balance skyrocket. Embrace the Bollinger Bands revolution and become a force to be reckoned with in the Forex arena.

Image: tradingrush.net

Winning Percentagetrading Forex With Bollinger Bands