In the world of international finance, foreign exchange reserves play a critical role in managing economic stability and facilitating international trade. These reserves, held by central banks and other monetary authorities, serve as a buffer against economic shocks and provide the necessary liquidity for foreign exchange transactions. Understanding the dynamics of forex reserves is essential for investors, economists, and policymakers alike.

Image: forextraders.guide

Forex Reserves: Definition and Significance

Foreign exchange reserves refer to the assets held by a nation’s central bank or other monetary authority in various foreign currencies and gold. These reserves are accumulated through the sale of domestic currency to foreign entities, usually in exchange for the purchase of exports, foreign direct investment, or other international transactions. Forex reserves play a crucial role in maintaining macroeconomic stability by providing:

- A buffer against economic shocks: Forex reserves offer a safety net for countries during times of economic stress, such as currency crises, recessions, or political instability. They enable governments to intervene in the foreign exchange market to stabilize their currencies or support their balance of payments.

- Liquidity for international transactions: Forex reserves provide the necessary liquidity for international trade and financial transactions. They ensure that countries have the ability to meet their foreign obligations, such as purchasing imports, servicing external debt, or making foreign investments.

- Confidence in the national currency: Ample forex reserves instill confidence in the domestic currency, making it more attractive to foreign investors and mitigating exchange rate volatility.

Top Countries with the Highest Forex Reserves

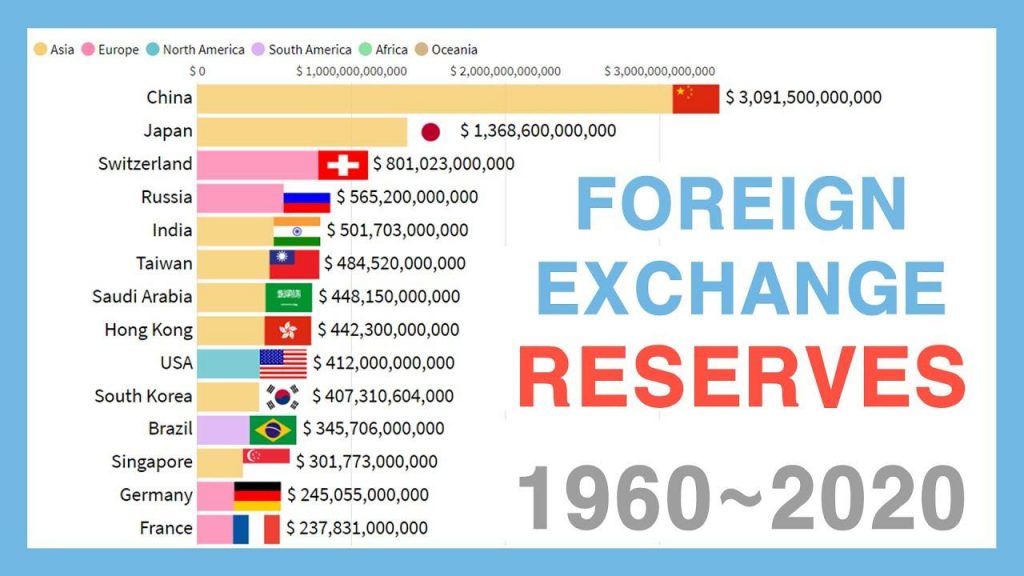

As of 2023, China has the highest forex reserves in the world, with holdings of over $3.21 trillion. This significant level of reserves gives China a substantial cushion against economic vulnerabilities and allows it to exert influence in the international financial system. Japan ranks second with $1.37 trillion in forex reserves, followed by Switzerland with $1.13 trillion. Other countries with notable forex reserves include:

- India ($612 billion)

- Russia ($582 billion)

- Saudi Arabia ($448 billion)

- South Korea ($408 billion)

- Singapore ($348 billion)

Factors Influencing Forex Reserves

The level of forex reserves held by a country is influenced by several factors, including its:

- Current account balance: A surplus in the current account, which measures the difference between exports and imports, leads to an increase in forex reserves.

- Foreign direct investment: Inflows of foreign direct investment boost forex reserves as foreign investors convert their currencies into domestic currency.

- Capital flows: Speculative capital inflows can result in an appreciation of the domestic currency and an increase in forex reserves.

- Central bank intervention: Monetary authorities may intervene in the foreign exchange market to influence the exchange rate and manage their reserves.

Image: www.philstar.com

Implications of Forex Reserves

The adequacy of forex reserves is a key indicator of a country’s economic health and its ability to withstand external shocks. Sufficient reserves provide flexibility and confidence in the economy, while inadequate reserves can lead to currency depreciation, capital flight, and economic instability.

Which Of The Amongst Country Has Highest Forex Reserve

Conclusion

Foreign exchange reserves are a crucial component of a nation’s economic stability and international financial status. The highest forex reserves are held by China, Japan, and Switzerland. The level of reserves is influenced by various factors and has significant implications for economic growth, exchange rate stability, and international trade.

If you are interested in learning more about forex reserves, consider reaching out to economists specializing in monetary and international finance.