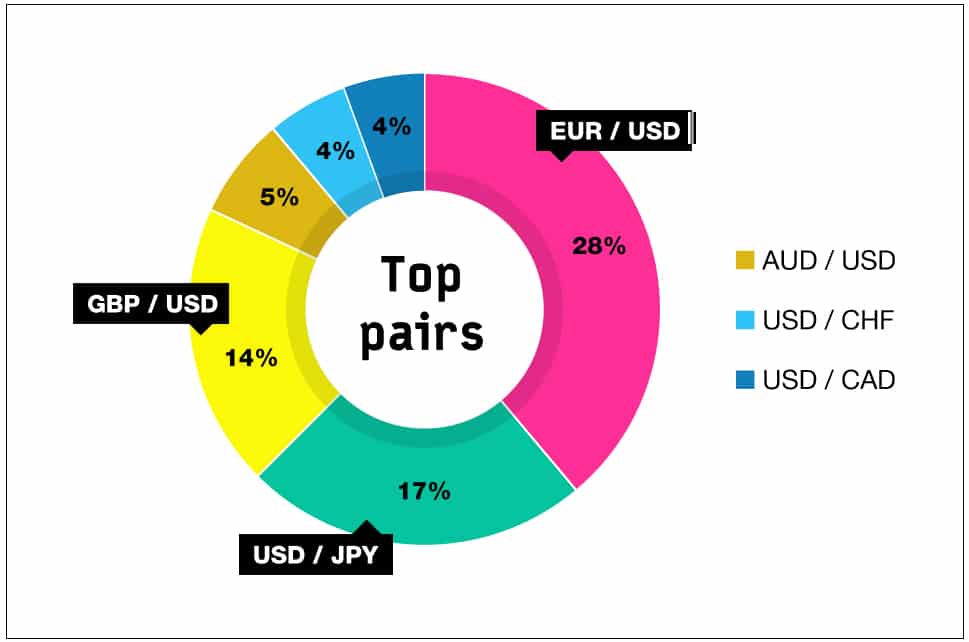

The bustling Indian foreign exchange market, brimming with opportunities, also encompasses risks that can impact your trading endeavors. Among the various currency pairs traded, some stand out due to their dynamic and unpredictable nature, offering vast trading potential but also posing significant challenges. To navigate these volatile waters, it is essential to understand these pairs and tread cautiously while exploiting their profitability.

Image: forextraders.guide

Defining Volatility and Its Impact

In the realm of forex, volatility gauges the magnitude of a currency pair’s price fluctuations over a specific period. High volatility indicates wild price swings, while low volatility suggests more stable movements. Volatile pairs present traders with amplified return possibilities but also heighten the risks associated with trading. Therefore, recognizing and comprehending the most volatile currency pairs in the Indian forex market is paramount for both seasoned traders and beginners seeking to harness volatility’s potential.

Unveiling India’s Most Volatile Forex Pairs

The Indian forex market boasts a wide range of currency pairs, each exhibiting unique characteristics. However, a few pairs consistently display elevated volatility, making them alluring yet potentially treacherous trading instruments:

1. USD/INR: The US dollar (USD) paired against the Indian rupee (INR) ranks as India’s most traded and volatile currency pair. Its sensitivity to global economic news, interest rate decisions, and geopolitical events makes it highly susceptible to abrupt price movements, offering both lucrative opportunities and substantial risks.

2. EUR/INR: The euro (EUR) against the INR exhibits significant volatility, influenced by economic developments within the European Union and India. The pair’s behavior is closely tied to global economic growth, monetary policies, and political stability, creating both challenges and prospects for traders.

3. GBP/INR: Trading the British pound (GBP) versus the INR involves navigating a volatile pair that responds swiftly to political and economic events in the United Kingdom and India. Brexit’s impact, interest rate fluctuations, and the overall health of both economies contribute to GBP/INR’s high volatility and potential profitability.

4. JPY/INR: The Japanese yen (JPY) paired with the INR adds a layer of complexity due to its safe-haven status. Yen demand surges during global uncertainties, which in turn influences the pair’s volatility. Economic indicators, geopolitical tensions, and market sentiment significantly impact JPY/INR’s movements, presenting both rewards and risks to traders.

Embracing Volatility: Strategies for Navigating the Storm

While volatile currency pairs may seem intimidating, they can also be a source of exceptional profits for astute traders. Mastering the art of managing risk while exploiting volatility requires a combination of strategic planning and disciplined execution:

1. Technical Analysis: Studying price charts, patterns, and indicators helps traders identify potential price movements and trading opportunities. Technical analysis provides valuable insights into volatile pairs, allowing traders to make informed decisions.

2. News and Events: Volatility often stems from economic news and geopolitical events. Monitoring such events through forex trading news feeds or economic calendars enables traders to anticipate market reactions and adjust their positions accordingly.

3. Risk Management: Effective risk management safeguards your capital from excessive volatility. Techniques like stop-loss orders, position sizing, and prudent leverage utilization minimize potential losses while preserving trading potential.

4. Demo Trading: Before venturing into live trading, practice your strategies on a demo account. Simulated trading allows you to experiment, refine your skills, and gain confidence without risking real funds.

Image: www.alphaexcapital.com

Most Volatile Currency Pairs In Forex In India

Conclusion: Weighing Risks and Rewards

The world of volatile currency pairs in the Indian forex market offers a tantalizing blend of opportunities and challenges. Understanding the inherent volatility and implementing robust trading strategies are crucial for capitalizing on this potential while mitigating risks. Prudent risk management, continuous learning, and a disciplined approach can guide you toward consistent profits, even in the face of unpredictable market behavior. Remember, volatility can be a trader’s friend or foe; the key lies in embracing the risk while respecting its dangers.