Introduction

Are you planning a trip to Australia and wondering which HDFC Forex Card is the best option for you? In this blog post, we will compare the two most popular HDFC Forex Cards – the Multicurrency ForexPlus Card and the Global ForexPlus Card – to help you make an informed decision. We will discuss the benefits of each card, as well as the fees and charges associated with each, so that you can choose the card that best suits your needs.

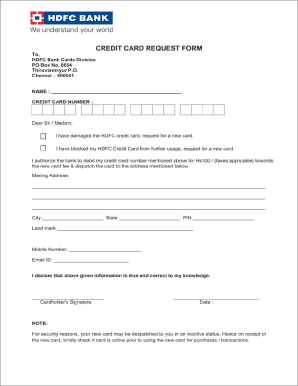

Image: equlogosat.web.fc2.com

Traveling to Australia is an adventure. Enjoy the country’s amazing natural beauty, vibrant cities and friendly locals. Experience Uluru (Ayers Rock), Great Barrier Reef, Sydney Harbour Bridge and the Sydney Opera House. Meet kangaroos and koalas in their natural habitat. Go hiking, swimming, surfing or relax on one of Australia’s world-famous beaches.

HDFC Forex Card

HDFC Forex Card is a prepaid card that allows you to load multiple currencies and use it for transactions in over 100 countries. It is a convenient and secure way to manage your money while traveling, as you do not have to carry cash or exchange currency at unfavorable rates. HDFC offers two types of Forex Cards – the Multicurrency ForexPlus Card and the Global ForexPlus Card.

Multicurrency ForexPlus Card

The Multicurrency ForexPlus Card is a good option for travelers who are planning to visit multiple countries on their trip. It allows you to load up to 10 currencies on the card, and you can switch between currencies at any time without incurring any fees. The card also offers competitive exchange rates and low transaction fees.

Global ForexPlus Card

The Global ForexPlus Card is a good option for frequent travelers or those who plan to spend a significant amount of money in a single country. It allows you to load up to 100 currencies on the card, and you can lock in a specific exchange rate for each currency up to 1 year in advance.

Image: isycihe.web.fc2.com

Fees and Charges

The Multicurrency ForexPlus Card has an annual fee of Rs. 500 and a reload fee of Rs. 100. The Global ForexPlus Card has an annual fee of Rs. 1,000 and a reload fee of Rs. 200. Both cards also have a transaction fee of 3.5% of the transaction amount.

Tips for Choosing the Right HDFC Forex Card

Here are a few tips for choosing the right HDFC Forex Card for your needs:

- Consider the number of countries you will be visiting on your trip.

- Consider how much money you plan to spend.

- Compare the fees and charges of both cards.

- Read the terms and conditions of both cards carefully.

Conclusion

I hope this blog post has helped you understand the difference between the Multicurrency ForexPlus Card and the Global ForexPlus Card. By choosing the right card, you can save money on fees and exchange rates, and enjoy a more convenient and secure travel experience.

Are you planning a trip to Australia? I would love to hear about your travel plans in the comments below.

Which Hdfc Forex Is Better For Australia

https://youtube.com/watch?v=Svltjvvg69Y

FAQs

- What is an HDFC Forex Card?

- An HDFC Forex Card is a prepaid card that allows you to load multiple currencies and use it for transactions in over 100 countries

- What are the benefits of using an HDFC Forex Card?

- There are many benefits to using an HDFC Forex Card, including convenience, security, and cost savings.

- What are the fees and charges associated with HDFC Forex Cards?

- The fees and charges associated with HDFC Forex Cards vary depending on the type of card you choose. The Multicurrency ForexPlus Card has an annual fee of Rs. 500 and a reload fee of Rs. 100. The Global ForexPlus Card has an annual fee of Rs. 1,000 and a reload fee of Rs. 200. Both cards also have a transaction fee of 3.5% of the transaction amount.

- How can I choose the right HDFC Forex Card for my needs?

- To choose the right HDFC Forex Card for your needs, you should consider the number of countries you will be visiting on your trip, how much money you plan to spend, and the fees and charges associated with each card.

- I am planning a trip to Australia. Which HDFC Forex Card should I get?

- If you are planning a trip to Australia, I recommend getting the HDFC Multicurrency ForexPlus Card. It allows you to load up to 10 currencies on the card, and you can switch between currencies at any time without incurring any fees.