Introduction:

In the dynamic world of forex trading, speed and efficiency are key to maximizing profits and minimizing losses. Enter STP (Straight-Through Processing) forex accounts – the gateway to lightning-fast order execution and enhanced trading performance. This comprehensive guide will delve into the intricacies of STP accounts, highlighting their benefits, drawbacks, and how they can revolutionize your forex trading experience.

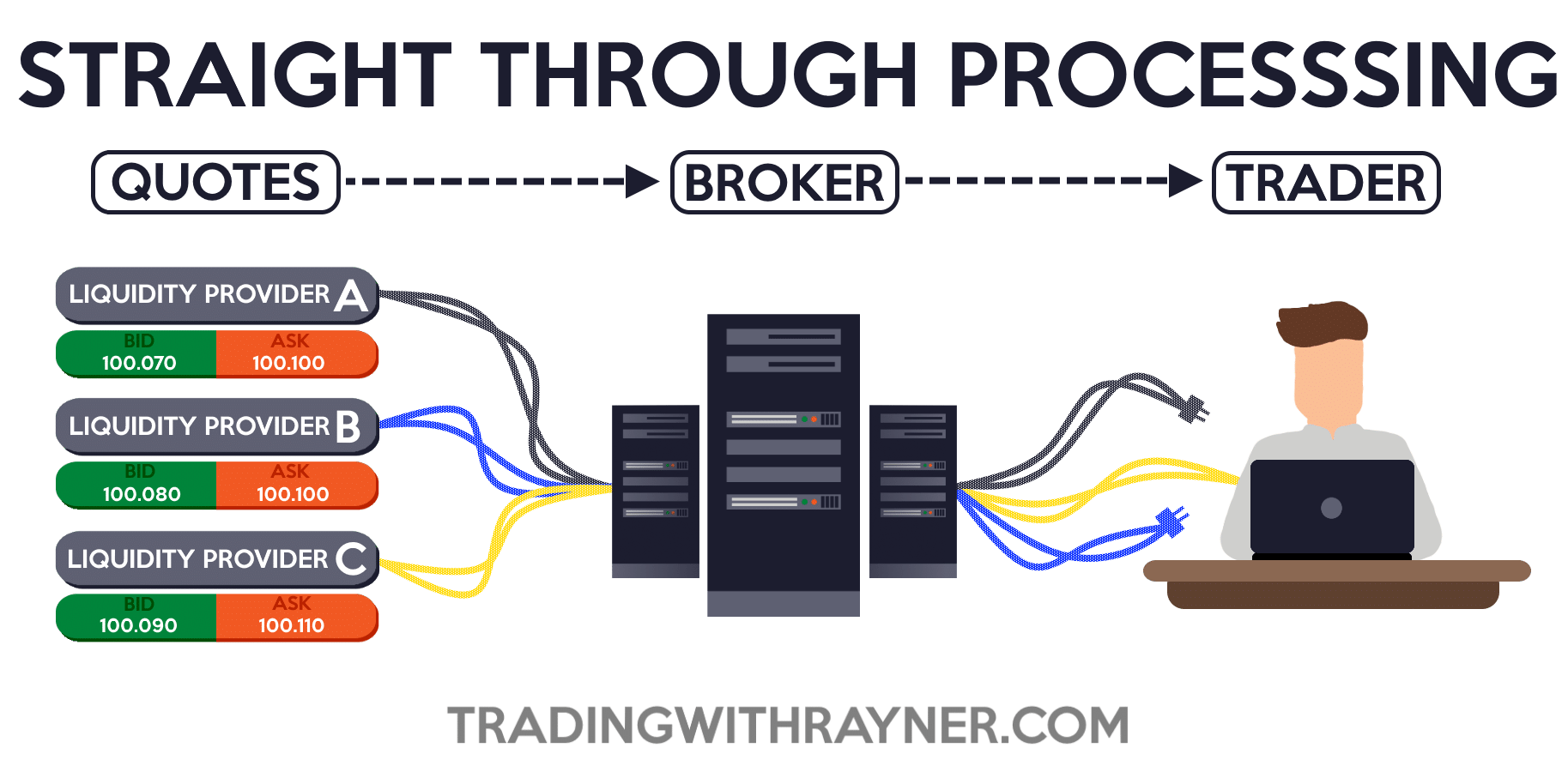

Image: www.tradingwithrayner.com

What is an STP Forex Account?

STP forex accounts connect traders directly to liquidity providers, bypassing dealing desks and intermediaries. Orders are routed directly to the market, eliminating potential delays and conflicts of interest. With STP, execution is automatic and virtually instantaneous, providing traders with unparalleled control and transparency.

Benefits of STP Forex Accounts:

-

Lightning-Fast Execution:

STP accounts boast unrivaled speed, ensuring orders are executed within milliseconds. This lightning-fast execution is crucial in volatile markets, where even the slightest delay can mean the difference between success and loss.

-

Image: admiralmarkets.comReduced Slippage:

STP eliminates the presence of dealing desks, reducing the risk of slippage – the unwanted difference between the requested and executed price. This ensures that traders receive fair and accurate pricing.

-

Enhanced Transparency:

STP accounts provide a transparent view of the order execution process. Traders can trace the journey of their orders from initiation to fulfillment, eliminating any uncertainties or concerns about price manipulation.

-

Access to Interbank Rates:

By connecting directly to liquidity providers, STP accounts offer competitive spreads and access to interbank rates. This translates into improved profitability and a more favorable trading environment.

Drawbacks of STP Forex Accounts:

-

Higher Commissions:

STP accounts typically charge higher commissions compared to non-STP accounts. These fees compensate liquidity providers for their services, ensuring seamless order execution.

-

Lower Leverage:

Some STP brokers may offer lower leverage options due to the increased risk associated with instant execution. Traders who rely on high leverage may need to adjust their strategies accordingly.

How to Choose an STP Forex Broker:

Selecting the right STP forex broker is crucial for a smooth and profitable trading experience. Here are key factors to consider:

-

Regulation and Reputation:

Opt for brokers that are regulated by reputable authorities and have a proven track record of reliability and customer support.

-

Liquidity and Spreads:

Evaluate the broker’s liquidity providers to ensure they offer competitive spreads and sufficient liquidity during high-volume trading sessions.

-

Commission Structure:

Compare the commission fees charged by different brokers and choose the one that aligns with your trading style and budget.

-

Trading Platform:

Select a broker that offers a user-friendly trading platform with advanced charting tools, customization options, and automated features.

What Is Stp Account Forex

Conclusion:

STP forex accounts are an invaluable tool for seasoned traders seeking speed, transparency, and direct access to the interbank market. While they come with slightly higher commission fees, the benefits far outweigh the drawbacks. By partnering with a reputable STP broker and carefully considering your trading needs, you can harness the power of straight-through processing to elevate your forex trading endeavors to new heights.