The Enigma of Currency Supremacy: Unveiling the Dominant Forces in the Forex Arena

In the dynamic and ever-evolving world of forex trading, the question of currency supremacy remains a topic of ceaseless debate and intrigue. Numerous currencies vie for dominance in the market, but identifying the one that will ascend to greater heights can be a daunting task. This comprehensive analysis endeavors to delve deeply into the factors and trends that shape currency values, providing invaluable insights for traders seeking to navigate the complexities of the forex market.

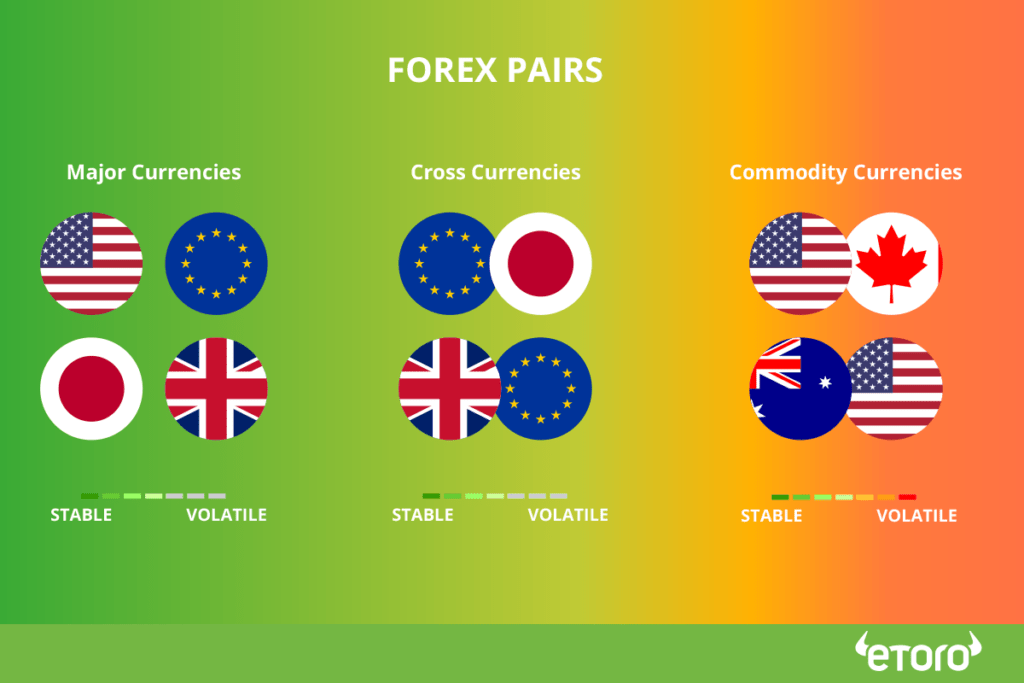

Image: www.etoro.com

Currency dominance is not merely a matter of speculation but a complex interplay of economic fundamentals, political stability, and market sentiment. By examining historical data, analyzing current events, and consulting expert perspectives, we aim to illuminate the potential trajectories of major currencies and forecast their potential for growth in the years to come.

Understanding the Determinants of Currency Value

Economic Strength: A Bedrock of Currency Might

A nation’s economic strength serves as a cornerstone of its currency’s value. Robust economic growth, low inflation, and a stable financial system foster confidence among investors, attracting capital inflows and boosting the currency’s value. Conversely, economic weakness, high inflation, and financial instability can erode investor sentiment, leading to currency depreciation.

Political Stability: A Catalyst for Economic Prosperity

Political stability is another pivotal factor that influences currency value. Stable governments can implement sound economic policies and maintain investor confidence, while political turmoil and uncertainty can unsettle markets and trigger capital flight, negatively impacting the currency.

Image: fxreviews.best

Market Sentiment: The Elusive Driver of Currency Fluctuations

Market sentiment plays a significant role in shaping currency values. Positive sentiment towards a particular currency can lead to increased demand and appreciation, while negative sentiment can fuel speculative selling and depreciation. News events, economic data, and geopolitical developments can all influence market sentiment and drive currency movements.

Decoding the Forex Market’s Latest Trends and Developments

Central Bank Actions: Influencers of Currency Direction

Central banks play a crucial role in determining currency values through monetary policy decisions. Interest rate hikes tend to strengthen a currency by attracting foreign capital, while interest rate cuts can weaken it by encouraging capital outflows.

Global Economic Outlook: Impacts on Currency Dynamics

The global economic outlook can significantly impact currency values. Strong global growth typically benefits riskier currencies, while economic downturns tend to drive investors towards safe-haven currencies such as the US dollar.

Technological Advancements: Reshaping the Forex Landscape

Technological advancements, such as algorithmic trading and high-frequency trading, have transformed the forex market. These advancements can amplify currency fluctuations and exacerbate volatility, making it essential for traders to stay abreast of the latest technological developments.

Expert Insights and Tips for Informed Forex Trading

Forecast Models: Predictive Tools for Currency Trends

Advanced forecast models, utilizing machine learning and statistical techniques, can help traders identify potential currency trends and make informed trading decisions. However, it is crucial to remember that these models are not foolproof and should be used in conjunction with other analysis techniques.

Technical Analysis: Deciphering Currency Charts

Technical analysis involves studying historical currency price data to identify patterns and predict future price movements. While technical analysis can be a valuable tool, it should be used cautiously and in conjunction with other analysis methods to minimize risk.

Risk Management: Essential for Trading Success

Risk management is paramount in forex trading. Traders should determine their risk tolerance and develop strategies to mitigate potential losses. Utilizing stop-loss orders, position sizing, and hedging techniques can help traders manage risk and preserve capital.

Continuous Learning: The Path to Trading Excellence

The forex market is constantly evolving, and traders must commit to ongoing learning to stay ahead of the curve. Reading books, attending webinars, and connecting with experienced traders can expand one’s knowledge and enhance trading skills.

Frequently Asked Questions: Empowering Currency Traders

Q: Which factors should I consider when evaluating currency strength?

A: Economic indicators, political stability, and market sentiment are all important factors to consider. Economic indicators can provide insights into a nation’s economic health, while political stability and market sentiment can influence investor confidence and capital flows.

Q: How do central bank actions affect currency values?

A: Central banks can influence currency values by adjusting interest rates. Raising interest rates strengthens the currency, while lowering interest rates weakens it. Central banks also intervene in the forex market by buying and selling currencies to stabilize values or achieve specific economic objectives.

Q: How can I effectively manage risk in forex trading?

A: Determine your risk tolerance, use stop-loss orders, size your positions appropriately, and consider hedging techniques. Managing risk helps mitigate potential losses and preserve capital.

Which Currency Is Going To Higher In Forex Market

Conclusion: Embarking on the Journey of Currency Dominance

The question of currency supremacy in the forex market is a multifaceted one, with numerous factors and trends influencing currency values. By understanding the determinants of currency value, staying abreast of market developments, and utilizing expert advice, traders can navigate the currency market with greater confidence and potential success. The world of forex trading offers endless opportunities, but it is essential to approach it with a well-informed and disciplined mindset.

Are you captivated by the intricacies of currency markets and the quest for currency supremacy? Share your thoughts and insights in the comments below, and let us delve deeper into this fascinating realm together.