Introduction

The foreign exchange (forex) market, a vast and ever-fluctuating realm, presents both opportunities and uncertainties for traders. Its stability is a Holy Grail of sorts, a tantalizing goal that has eluded investors for decades. In this article, we embark on a journey to explore the factors shaping forex market stability, unraveling the mysteries that determine when this elusive equilibrium might be found.

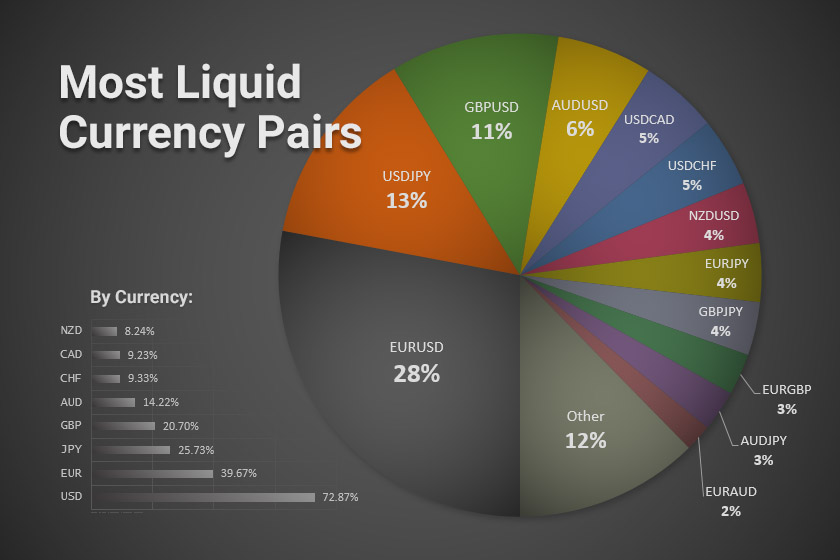

Image: fxssi.com

Factors Influencing Forex Market Stability

The forex market is a complex tapestry woven by a myriad of interconnected factors, both domestic and international. Economic growth, interest rates, political events, natural disasters, and even pandemics can sway the market’s delicate balance. Understanding these forces is crucial for discerning when stability might prevail.

Economic Indicators

Key economic metrics, such as GDP growth, employment rates, and inflation data, provide insights into the underlying health of an economy. Positive economic indicators generally bolster a currency’s value, creating market stability. Conversely, negative data can trigger sell-offs, leading to currency depreciation and market volatility.

Interest Rate Policies

Central banks play a pivotal role in stabilizing the forex market through interest rate policies. By raising or lowering interest rates, central banks can influence investment flows, capital appreciation, and currency exchange rates. Stable interest rates foster stability, while sudden or dramatic shifts can roil the market.

Image: telegra.ph

Political Events

Political stability is a bedrock of economic well-being. Unrest, elections, and changes in government can send ripple effects through the forex market, creating uncertainty and volatility. Conversely, stable political environments breed confidence and contribute to market equilibrium.

Natural Disasters and Global Events

Natural disasters, pandemics, and other global events can have profound impacts on the forex market. These events often trigger safe-haven trades as investors seek refuge in stable currencies, leading to spikes in demand and potential market volatility.

When Stability Returns

With so many factors at play, it can be challenging to pinpoint the exact moment when forex market stability will return. However, by monitoring key indicators and understanding underlying trends, traders can gain insights into the market’s potential trajectory.

Economic Recovery and Growth

Economic recovery and sustained growth are strong indicators of future forex stability. When economies grow steadily, investors tend to take on more risk, seeking higher returns. This increased demand can stabilize exchange rates and create a virtuous cycle of economic development.

Stable Interest Rate Environment

Stable interest rates provide a solid foundation for currency stability. When central banks adopt a cautious approach to monetary policy, sudden fluctuations in exchange rates are less likely. Long-term stability in interest rates promotes long-term stability in the forex market.

Political Stability and Global Harmony

Political stability and global harmony foster confidence among investors. When geopolitical events are minimal and the threat of conflict is low, risk appetite increases, and investors seek out higher returns in foreign currency markets. This increased liquidity and demand help stabilize exchange rates.

Risk Appetite and Recovery from External Shocks

Risk appetite is a crucial barometer of forex market stability. When investors are optimistic about the future, they tend to invest more aggressively, diversifying their portfolios across currencies. This increased demand can cushion exchange rates from external shocks, promoting market equilibrium.

When Will The Forex Market Gets Stable

Conclusion

The forex market is a dynamic entity, constantly fluctuating in response to a diverse array of influences. While predicting its exact movements is an elusive quest, understanding the underlying factors shaping stability can provide valuable insights for traders. By monitoring economic indicators, interest rate policies, geopolitical events, and global trends, we can better anticipate when the forex market might find its elusive equilibrium and reap its boundless opportunities.