The Allure of Forex Trading: Embracing Patience and Calculated Moves

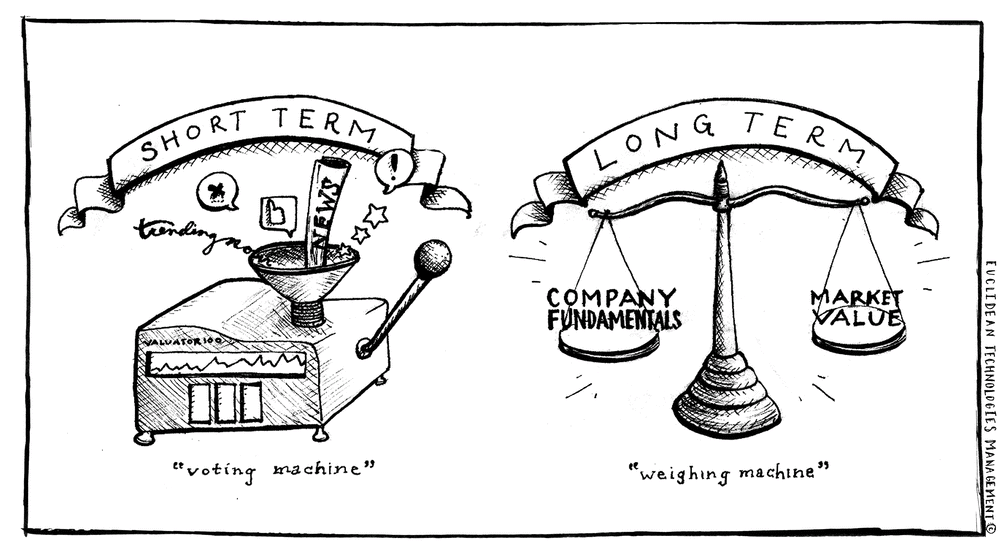

In the realm of finance, where instant gratification often takes center stage, long-term forex trading stands out as a beacon of steadfastness and calculated moves. Unlike its short-term counterpart, long-term forex trading eschews the thrill of quick profits in favor of a methodical, strategic approach that seeks to harness the market’s inherent patterns over extended periods.

Image: www.forex.academy

This patient, disciplined approach requires traders to don the hats of both analysts and strategists, meticulously studying market trends, economic data, and geopolitical events to make informed decisions. It’s a journey that demands a keen eye for detail, unwavering patience, and an ability to withstand the inevitable ups and downs of the market.

Laying the Foundation: Unraveling the Essence of Long-Term Forex Trading

At its core, long-term forex trading revolves around identifying and capitalizing on long-term market trends. Unlike short-term traders who seek to exploit intraday price fluctuations, long-term traders focus on the broader, underlying forces that shape currency movements over weeks, months, and even years.

To achieve this, long-term traders employ a wide range of tools and techniques, including technical analysis, fundamental analysis, and economic forecasting. They study historical price charts, identify support and resistance levels, and analyze economic indicators to predict the direction of currency pairs in the long run.

Catching the Current: Embracing the Nuances of Trend Trading

Trend trading, a cornerstone of long-term forex trading, involves riding the waves of long-term price trends. By identifying the overall direction of a currency pair, traders can position themselves to capitalize on its momentum, entering trades in line with the prevailing trend.

To master trend trading, traders must cultivate the ability to discern true trends from fleeting market noise. This requires an understanding of trendlines, moving averages, and other technical indicators that help identify the path of least resistance in the market.

Navigating the Market’s Ebb and Flow: The Art of Swing Trading

While trend trading focuses on long-term trends, swing trading occupies a middle ground between short-term and long-term trading. Swing traders seek to profit from the cyclical swings that occur within broader market trends, capitalizing on price fluctuations that typically span several days or weeks.

Swing traders employ a range of technical indicators, such as Fibonacci retracements, Bollinger Bands, and moving averages, to identify potential turning points in the market. They then enter trades in anticipation of a reversal or continuation of the current swing, aiming to ride the momentum of the price swings.

Image: preferforex.com

Unveiling the Secrets: Tips and Expert Advice for Long-Term Forex Success

To thrive in the long-term forex trading arena, aspiring traders can benefit from the wisdom and experience of seasoned professionals. Here are some invaluable tips to guide you on your journey:

Embrace Patience: Long-term forex trading requires patience and discipline. Don’t chase quick profits or succumb to emotional trading. Trust in your analysis and let your trades play out over time.

Manage Risk Wisely: Risk management is paramount in long-term forex trading. Always trade with a well-defined risk-to-reward ratio and employ stop-loss orders to protect your capital.

FAQs: Demystifying the World of Long-Term Forex Trading

Q: Is long-term forex trading suitable for beginners?

A: While long-term forex trading offers the potential for consistent profits, it requires patience, market knowledge, and risk management skills. Beginners may consider starting with shorter-term trading or practicing on a demo account before venturing into long-term trades.

Q: What are the benefits of long-term forex trading over short-term trading?

A: Long-term forex trading offers the potential for more stable returns, reduced trading costs, and a smoother trading experience compared to short-term trading, which is often characterized by higher volatility and emotional trading.

Long Term Forex Trading Strategy

Call to Action: Embark on Your Long-Term Forex Trading Journey

Long-term forex trading presents a compelling opportunity for those seeking to harness the power of the currency markets. By embracing a patient, analytical approach, traders can unlock the potential for consistent profits while mitigating the risks associated with short-term trading.

Are you ready to embark on this rewarding journey? Dive into the world of long-term forex trading today and experience the thrill of riding the market’s currents.