Imagine yourself standing at the precipice of a vast, undulating landscape. Beneath you, the currents of global finance flow and ebb, driven by the ever-changing tides of demand and supply. This landscape is the forex market, a labyrinth of interconnected currencies where fortunes can be made and lost in the blink of an eye. But what if you had a powerful tool to help you navigate this complex terrain? What if you could gain insights into the future direction of major currencies? Welcome to the world of futures forex indices.

Image: www.tradingreviewers.com

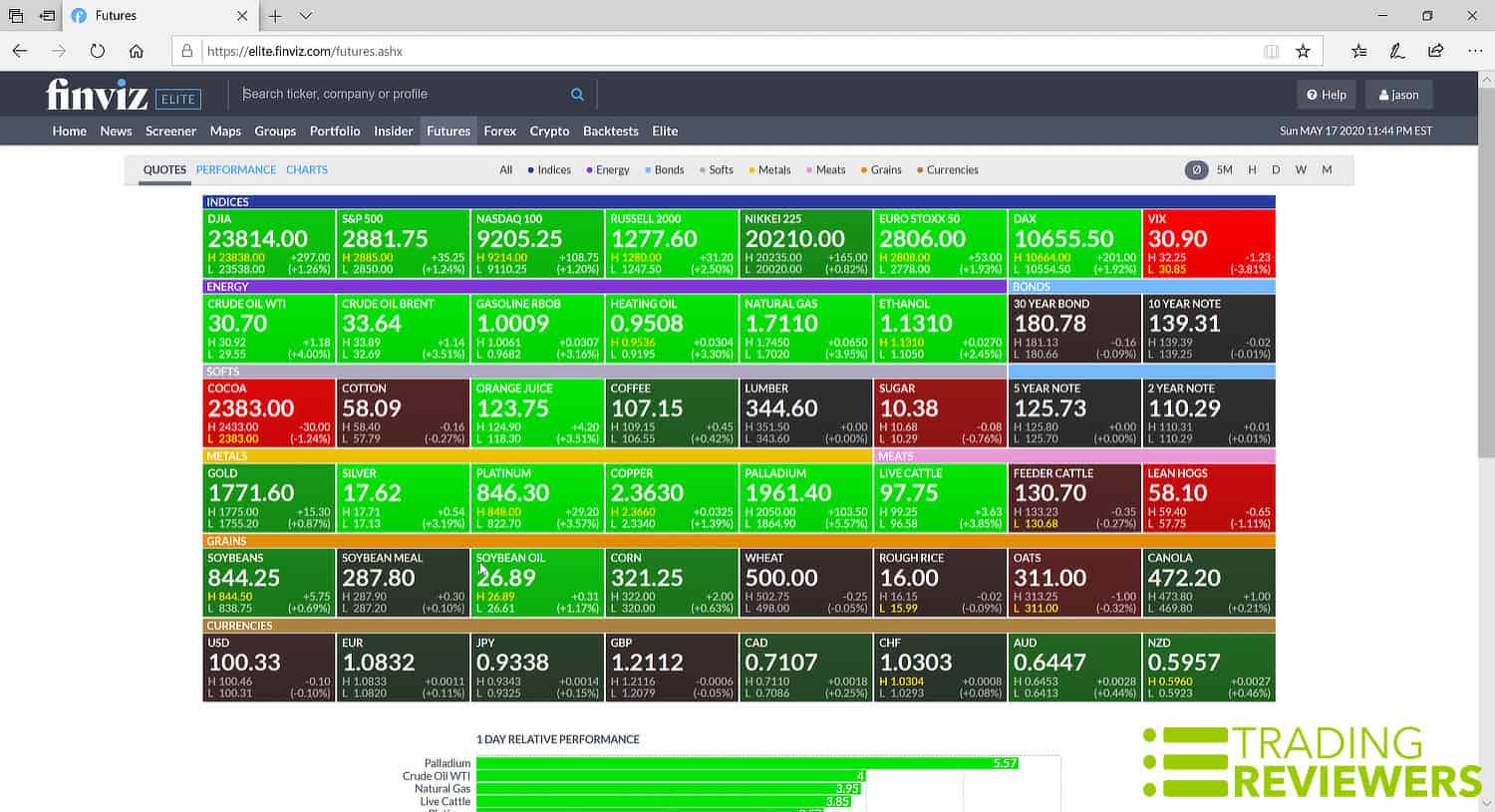

These indices, not merely abstract numbers, are the key to unlocking the dynamic forces that shape global currency markets. They offer a glimpse into the collective wisdom of investors, revealing their expectations for future currency movements. In essence, they are a powerful tool for understanding where the market is headed. But before diving into the practical applications of futures forex indices, let’s understand their genesis and the fundamental principles that underpin their construction.

Demystifying the Futures Forex Indices: A Deep Dive into the Global Currency Market

At their core, futures forex indices are calculated based on the collective wisdom of a vast pool of market participants. These participants, ranging from individual traders to institutional investors, “vote” on their expectations for future currency movements by trading forex futures contracts. The indices take this collective sentiment and distill it into a single, compelling indicator.

A Look Behind the Veil: Imagine a scenario where the Japanese yen is expected to strengthen against the US dollar. This sentiment would be reflected in the futures market through an increase in demand for yen futures contracts. As demand grows, the price of yen futures rises, ultimately becoming a reflection of the market’s collective expectations.

The Diverse Faces of Futures Forex Indices: These indices come in various forms, each tailored to specific currency pairs or broader global currency dynamics. For example, the Euro Stoxx 50 Index tracks the performance of the top 50 companies listed on the Euro Stoxx 50 exchange. This index is often used as a barometer for the overall health of the Eurozone economy and can be used as a proxy for euro exchange rate forecasting.

Tracking the Trends: These indices provide valuable insights into the current market sentiment, revealing potential trends and patterns in currency movements. They are not a crystal ball, but they can be a valuable tool for informing trading strategies. In addition to understanding current market sentiment, these indices can help traders identify potential turning points in the market. For instance, if a futures forex index indicates a significant shift in market sentiment, a trader might adjust their positions accordingly to capitalize on the emerging trend.

The Power of Futures Forex Indices in the Hands of Traders: Strategies for Success

Strategic Insights for Informed Trading: For seasoned traders, futures forex indices can be invaluable tools. They provide an objective measure of market sentiment and can be incorporated into comprehensive trading strategies.

Harnessing the Power of Diversification: Integrating futures forex indices into a portfolio allows for diversification, reducing the risks associated with solely focusing on spot forex trading.

The Art of Hedging: For those holding positions in certain currencies, futures forex indices can be used as a hedging tool.

Navigating Risk: While futures forex indices can offer valuable insights, it is essential to remember that they are not foolproof. Market sentiment can change quickly and unexpectedly, and external events can influence currency movements in unpredictable ways.

Risk Management for Beginners: For individuals venturing into the world of forex trading, futures forex indices can serve as a valuable gateway drug. They provide a less volatile entry point than spot forex trading, allowing beginners to gain experience and build confidence.

Image: howtotradeonforex.github.io

Futures Forex Indices

https://youtube.com/watch?v=xdt2zNV6ytE

The Path Forward: Embracing the Future of Global Currency Trading

The world of futures forex indices is constantly evolving, driven by technological innovations and the ever-changing dynamics of global finance. As a trader, it is critical to stay informed and adapt your strategies accordingly. In today’s interconnected world, the ability to understand and utilize futures forex indices is crucial for navigating the volatile landscape of global currency markets.

This guide has provided a glimpse into the vast and powerful world of futures forex indices. Their potential applications are numerous, and their use is only expected to increase as the global economy becomes increasingly intertwined. The next step in your journey lies in exploring further resources, conducting in-depth research, and making informed decisions based on the insights provided by these dynamic indices.