In the realm of international finance, the terms “forex amount” and “INR amount” often intermingle, leaving some perplexed about their underlying differences. This article will embark on a journey to unravel this currency conundrum, empowering you with a deep understanding of the nuances between these two monetary units.

Image: mgtblog.com

The Essence of Forex: A Global Monetary Marketplace

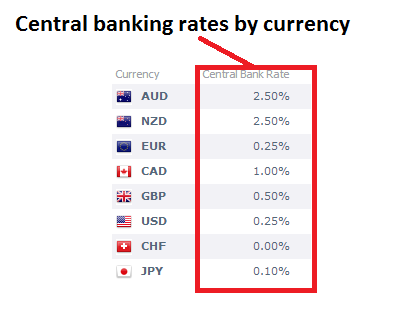

“Forex” stands for foreign exchange, an international marketplace where currencies from all corners of the globe are traded. When engaging in forex transactions, traders buy one currency and simultaneously sell another, with real-time fluctuations determining the exchange rates. The forex market is a vibrant ecosystem that facilitates global trade, investment, and travel, with a daily trading volume exceeding $5 trillion.

INR: The Lifeline of the Indian Economy

Indian Rupee (INR) is the official currency of India, the seventh-largest economy globally. Backed by the Reserve Bank of India, the INR plays a pivotal role in domestic trade and investments. It is widely recognized and accepted within the Indian borders and holds significant value in the international currency markets.

Dissecting the Differences: Forex Amount vs INR Amount

While both forex amounts and INR amounts represent monetary values, their underlying natures and implications are distinct.

Image: unickefxtrading.blogspot.com

Forex Amounts: A Transient State of Value

Forex amounts exist within the fluid confines of the forex market, perpetually subjected to fluctuations in exchange rates. Their value constantly ebbs and flows, influenced by myriad economic, political, and social factors. Thus, forex amounts are inherently transient, their worth oscillating by the minute.

INR Amounts: A Stable Benchmark of Value

Conversely, INR amounts are rooted in a more stable environment, insulated from the constant flux of the forex market. The Reserve Bank of India actively manages the INR’s value, implementing monetary policies to maintain its stability and mitigate market volatility. As a result, INR amounts offer a more predictable and stable benchmark of value for domestic transactions.

Contextualizing Forex and INR Amounts

The choice between forex amounts and INR amounts hinges on the specific context. Forex amounts are predominantly employed in international transactions, where currencies are exchanged to facilitate trade, investments, or travel. INR amounts, on the other hand, are primarily used within India’s borders, catering to domestic transactions, and safeguarding the stability of the national economy.

Forex Amount to INR Amount: Bridging the Currency Divide

Converting forex amounts to INR amounts is essential for seamless international transactions. This process involves multiplying the forex amount by the prevailing exchange rate, a value determined by the forex market’s supply and demand dynamics. Accurate exchange rate information is crucial to ensure fair and transparent conversions.

INR Amount to Forex Amount: Reversing the Currency Flow

Conversely, converting INR amounts to forex amounts is equally important, typically required when making international payments or investments. This process involves dividing the INR amount by the exchange rate, again relying on up-to-date market data. Understanding the exchange rate fluctuations can help optimize these conversions, potentially leading to favorable outcomes.

What Is The Difference Between Forex Amount And Inr Amount

Embracing the Interdependence: Forex Amounts and INR Amounts

Forex amounts and INR amounts, while distinct in nature, are inextricably intertwined, forming the backbone of the global financial system. Forex amounts facilitate cross-border transactions, fostering economic growth and global connectivity. INR amounts, on the other hand, provide a stable and reliable foundation for domestic economic activities, supporting India’s financial sovereignty.

By comprehending the differences between forex amounts and INR amounts, individuals and businesses can navigate the complexities of the financial landscape with greater confidence. Whether engaging in international trade, investing abroad, or simply understanding financial news, this knowledge empowers sound decision-making and informed financial strategies.