Introduction

Image: www.forex.academy

Imagine stepping onto a trading floor, the heart of the global foreign exchange market. Amidst the cacophony of voices and the flicker of screens, a fundamental question looms: What does it mean to go long or short in forex? In this comprehensive guide, we will delve into the complexities of these trading strategies, unraveling their nuances and empowering you to make informed decisions in the dynamic forex arena.

Understanding Long and Short Positions

In forex trading, “long” and “short” refer to the direction in which a trader places a bet on the value of a currency pair. A long position is a bet that the base currency will rise in value relative to the quote currency. Conversely, a short position is a bet that the base currency will depreciate.

How It Works

Let’s simplify it with an example. Suppose you believe that the Euro (EUR) will strengthen against the US Dollar (USD). To take advantage of this prediction, you could open a long position in EUR/USD. If your prediction holds true, the value of EUR will increase relative to USD, and you will profit from the difference.

On the other hand, if you anticipate that USD will rise against EUR, you could open a short position in EUR/USD. As USD gains strength against EUR, the value of your short position would increase, generating profits.

Long and Short Strategies

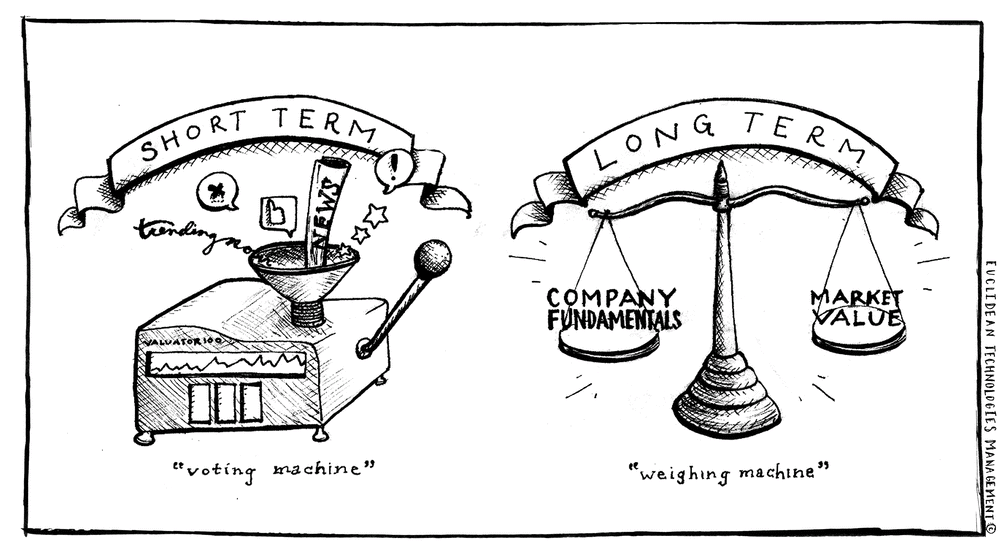

Traders employ a wide range of strategies to determine when to go long or short. Some focus on technical analysis, studying price charts and historical data to identify trends and patterns. Others rely on fundamental analysis, considering economic news, political events, and geopolitical tensions that can influence currency values.

Risks and Rewards

As with any investment, forex trading involves both risks and rewards. Long positions come with the potential for profit if the base currency appreciates, while short positions offer potential gains if the base currency depreciates. However, if the market moves against you, you can incur losses.

Expert Insights

Seasoned forex traders emphasize the importance of understanding your risk tolerance before venturing into the market. It is crucial to have a robust trading plan and stick to it. Additionally, they advise managing emotions and not letting biases cloud your judgment.

Conclusion

Navigating the forex market can be a complex endeavor, but understanding the fundamentals of long and short positions is a cornerstone for successful trading. By thoroughly researching, implementing risk mitigation strategies, and seeking guidance from experts, you can harness the potential of these strategies and make informed decisions to enhance your trading outcomes.

Image: trade-in.forex

What Is Long And Short In Trading In Forex