In the realm of forex trading, success is not solely determined by technical prowess or market analysis. The psychological aspect plays a pivotal role in shaping traders’ decisions and ultimately influencing their bottom line. Understanding and mastering the psychological level under forex trading can empower traders with an edge that often separates winners from losers.

Image: allaboutforexs.blogspot.com

What is the Psychological Level in Forex Trading?

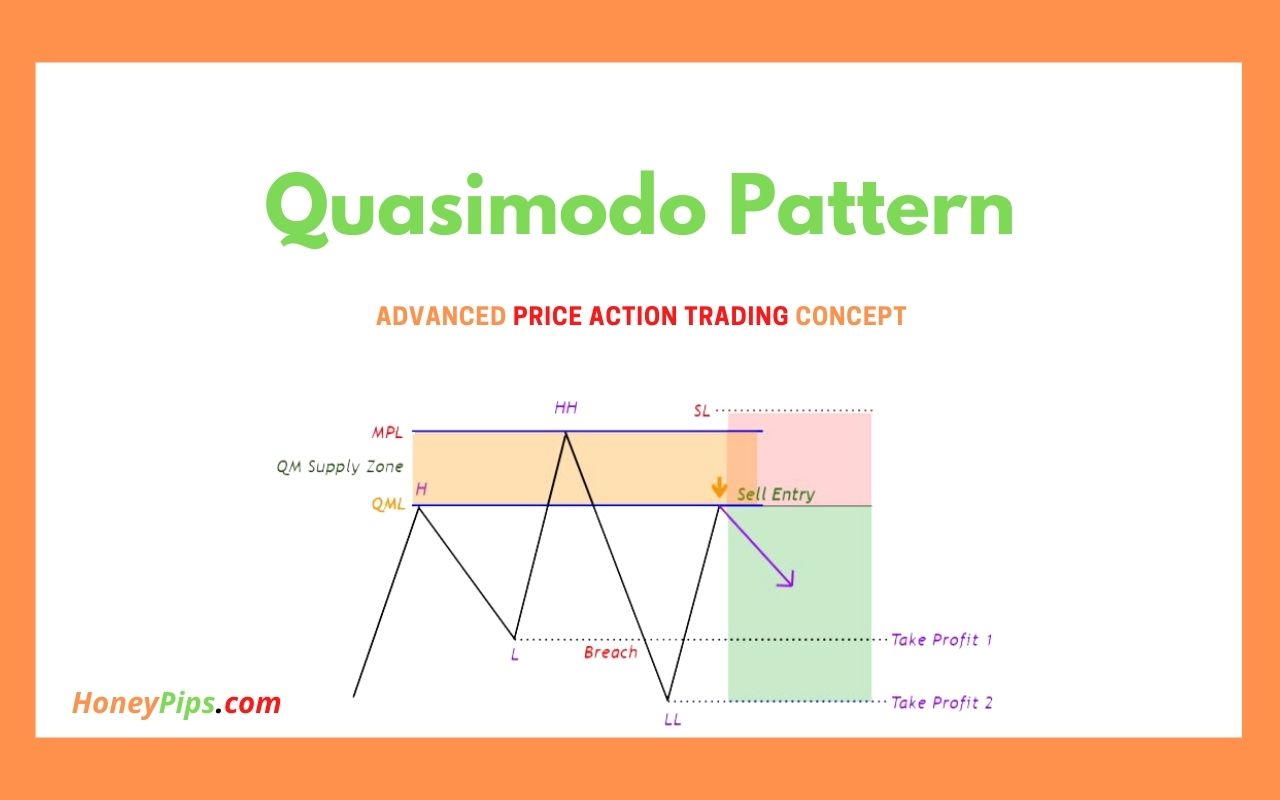

The psychological level refers to the crucial points in the price chart that evoke strong emotional responses from traders. These levels often coincide with round numbers, such as 1.0000 or 100.000, and trigger psychological biases and irrational behavior. The presence of psychological levels can amplify market volatility and create opportunities for astute traders.

Impact of Psychological Levels on Trader Psychology

Psychological levels influence trader psychology in several ways:

- Fear and Greed: Round numbers can instill fear or greed in traders, leading them to sell or buy hastily, driven by emotions rather than sound judgment.

- Anchoring Bias: Traders may become fixated on psychological levels, assuming they are significant support or resistance zones. This bias can prevent them from adapting to changing market conditions.

- FOMO and Hindsight Bias: The fear of missing out (FOMO) can compel traders to enter or exit trades at the wrong time, chasing psychological levels instead of using objective analysis. Hindsight bias can also cloud traders’ judgment, making them believe trades were predictable in retrospect.

Harnessing the Psychological Level for Profits

Savvy traders can leverage their understanding of psychological levels to enhance their profitability:

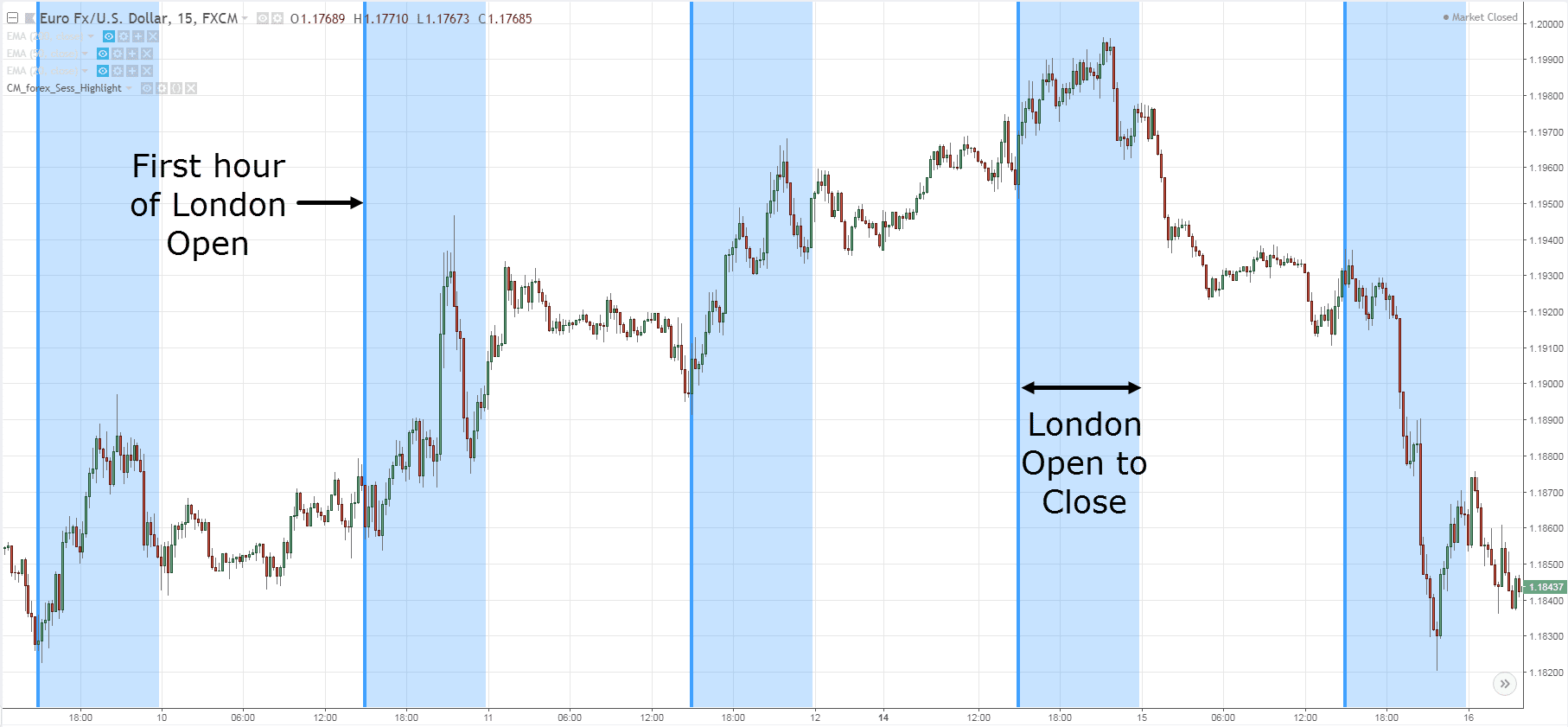

- Identify and Anticipate: It is essential to identify and anticipate psychological levels on the price chart. By marking them ahead of time, traders can plan their trades accordingly.

- Trade with the Trend: Often, psychological levels coincide with the broader market trend. Trading in line with the trend while respecting psychological levels can increase the probability of success.

- Manage Risk: Psychological levels present excellent opportunities to place stop-loss orders. Traders can set their stop-losses just above or below these levels to limit potential losses.

- Control Emotions: Traders must strive to control their emotions and avoid letting fear or greed influence their trading decisions. Sticking to a well-defined trading plan is crucial.

Image: renaycordell.blogspot.com

What Is Cycological Level Under Forex Trading

Conclusion

Understanding and mastering the psychological level in forex trading is paramount for long-term success. By acknowledging the influence of round numbers on trader psychology and developing strategies to mitigate the associated biases, traders can gain a competitive advantage. However, it is important to remember that psychology is only one aspect of trading. A comprehensive approach that combines technical analysis, sound risk management, and emotional control is essential for consistent profitability. Embracing the psychological level is not a magical formula but rather a valuable tool that can help traders navigate the complexities of the forex market with greater confidence and effectiveness.