The world of forex trading is a labyrinth of opportunities and risks. Amidst the ebb and flow of currency values, traders seek refuge in a sanctuary known as the cash pot.

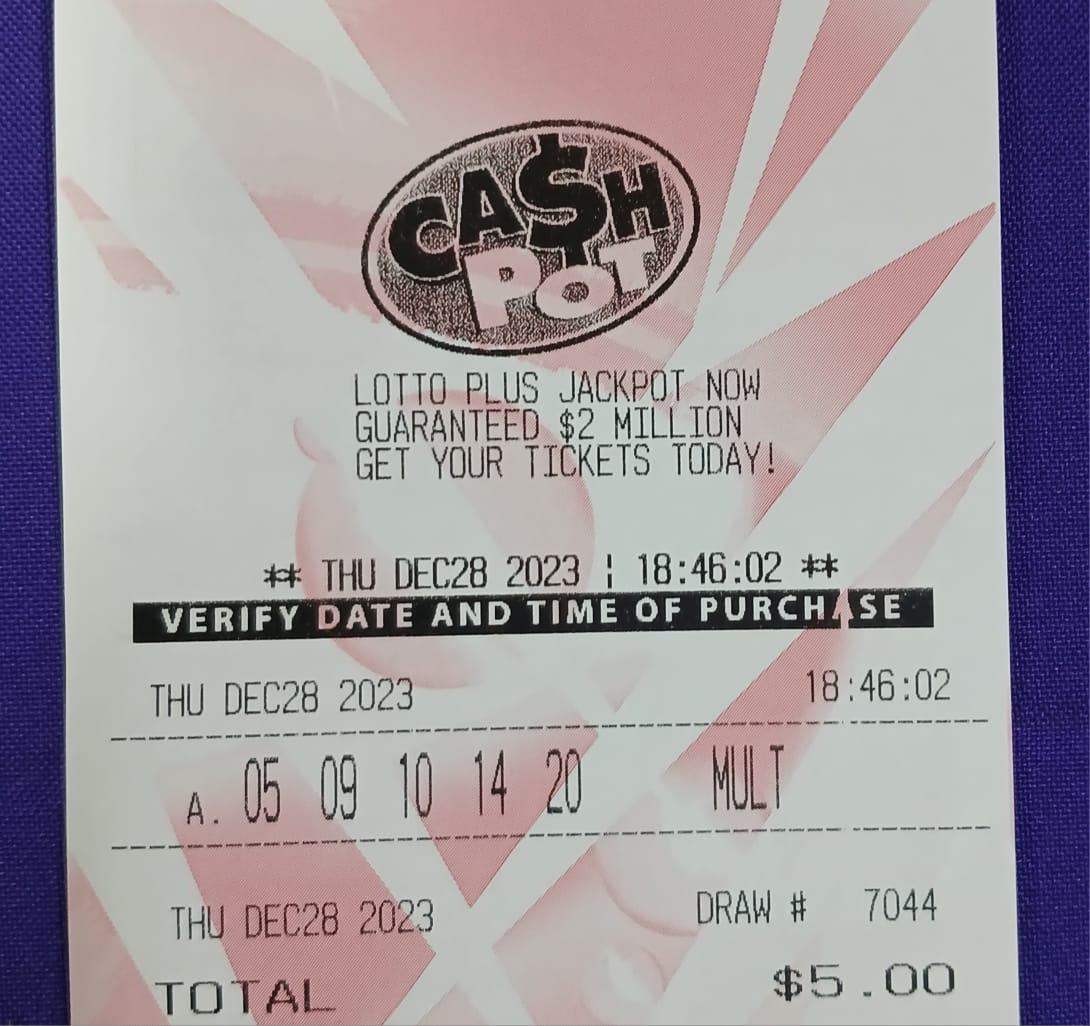

Image: www.nlcbplaywhelotto.com

This article embarks on an exploratory journey into the depths of cash pots, unraveling their intricacies and illuminating their significance in the realm of forex trading.

The Enigmatic Cash Pot: A Definition

In its essence, a cash pot is a pool of funds held in a trader’s account, consisting of the trader’s own capital as well as any profits accrued from successful trades. It represents the trader’s financial reservoir, from which they draw upon to initiate and maintain positions in the forex market.

The cash pot serves as a critical lifeline, providing traders with the flexibility to seize trading opportunities while safeguarding against the perils of excessive leverage. By prudently managing their cash pot, traders can navigate market fluctuations with increased confidence and resilience.

A Comprehensive Overview of the Cash Pot

The cash pot is more than just a financial buffer; it is an indispensable tool in the arsenal of every successful forex trader. Its significance extends far beyond its primary function of funding trades.

1. Risk Management: The cash pot acts as a shield against excessive risk-taking. By maintaining a healthy balance in their cash pot, traders can limit their potential losses in adverse market conditions. The cash pot provides a financial cushion, preventing traders from incurring catastrophic losses that could jeopardize their financial well-being.

2. Margin and Leverage: The cash pot plays a crucial role in determining a trader’s available margin and leverage. Margin refers to the amount of funds a trader can borrow from their broker to amplify their trading position. Leverage is the ratio of a trader’s borrowed funds to their own capital. By maintaining a substantial cash pot, traders can access higher levels of margin and leverage, enabling them to trade larger positions with increased potential returns.

3. Trading Discipline: The cash pot fosters discipline in trading practices. By setting aside a designated amount of funds for trading, traders are more inclined to adhere to their trading plan and avoid impulsive or emotional decisions. The cash pot serves as a constant reminder of the financial risks involved, promoting a cautious and calculated approach to trading.

Unveiling the Latest Trends

The realm of forex trading is constantly evolving, and the cash pot is no exception to this dynamic landscape. Recent trends and developments have shaped the significance of cash pots in unprecedented ways.

1. Technology Advancements: Technological advancements have revolutionized the way traders interact with their cash pots. Online trading platforms now offer sophisticated tools that allow traders to monitor and manage their cash pots in real-time. These tools provide traders with valuable insights into their cash flow, enabling them to make informed decisions and adjust their trading strategies accordingly.

2. Growth of Algorithmic Trading: The advent of algorithmic trading has also impacted the role of cash pots. Algorithmic trading involves using automated systems to execute trades based on predefined rules and parameters. As algorithmic trading becomes more prevalent, traders need to ensure their cash pots are adequately sized to support the increased trading activity generated by these systems.

Image: playwheresults.com

Expert Tips and Advice for Cash Pot Management

Experienced forex traders have accumulated a wealth of wisdom regarding cash pot management. By gleaning from their insights, aspiring traders can enhance their trading strategies and navigate market challenges more effectively.

1. Set Realistic Trading Goals: Traders should establish realistic trading goals and allocate a proportionate amount of funds to their cash pot. Overly ambitious targets can lead to excessive risk-taking and jeopardize the stability of the cash pot. By setting attainable goals, traders can maintain a disciplined approach to trading and avoid the pitfalls of excessive leverage.

2. Utilize Risk Management Strategies: Effective risk management is paramount in forex trading, and the cash pot plays a pivotal role in implementing such strategies. Traders should adopt stop-loss orders and position sizing techniques to minimize potential losses and protect their cash pot from depletion. These measures help traders safeguard their capital and preserve their ability to continue trading.

What Is Cash Pot In Forex

https://youtube.com/watch?v=8poT42RJ0cE

FAQs: Demystifying Common Queries

This section addresses frequently asked questions regarding cash pots, providing clear and concise answers to empower traders with a comprehensive understanding of this pivotal element in forex trading.

Q: What is the recommended size of a cash pot?

A: The optimal size of a cash pot varies depending on the trader’s risk tolerance, trading style, and available capital. Generally, it is advisable to allocate a significant portion of the trader’s