Introduction

In the realm of global financial markets, the foreign exchange market, commonly known as Forex or FX, stands tall as the largest and most liquid. Within this vibrant trading arena, currencies reign supreme as the primary instruments of exchange, facilitating international trade and financial transactions worth trillions of dollars daily. Understanding the building blocks of this complex landscape is crucial, and at the heart of Forex lie two fundamental currencies that serve as the cornerstones of the market – the US dollar and the euro.

Image: www.audacitycapital.co.uk

This article delves into these two behemoths, exploring their historical significance, economic underpinnings, and why traders favor them in their currency trading strategies. Whether you are a seasoned Forex trader or a curious novice, this comprehensive guide will illuminate these twin pillars of the currency markets.

Currency Pairs – The Dance of Devises

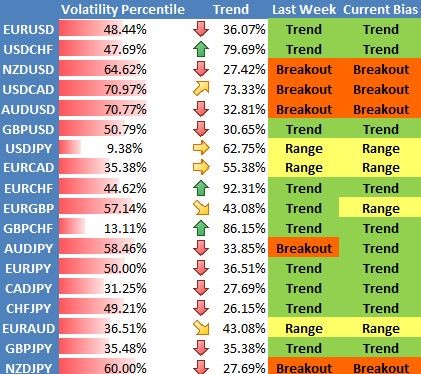

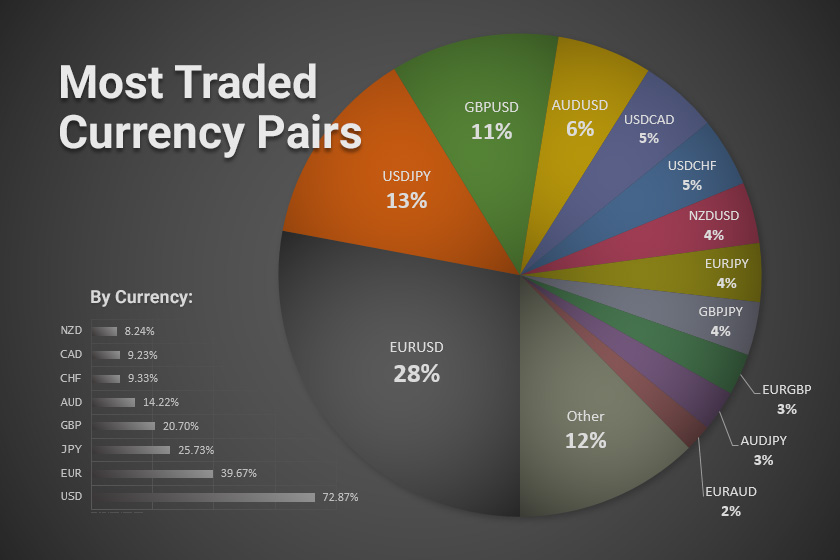

In the Forex arena, currencies are traded in pairs, representing the value of one currency relative to another. These pairings form the very essence of currency trading, with the fluctuations in exchange rates presenting both opportunities and challenges for traders.

The US dollar, denoted by the currency code USD, stands as the world’s reserve currency, widely accepted and used in international trade and financial transactions. On the other hand, the euro, bearing the code EUR, is the official currency of 19 European Union member states and the second most traded currency globally.

The pairing of USD and EUR, known as EUR/USD, is undoubtedly the most popular currency pair in Forex trading. This pairing, often referred to as the “eurodollar” or simply “euro,” captures the interplay between the world’s dominant economy, the United States, and the robust European Union. The interplay between these two influential economies has a profound impact on the value of the euro relative to the US dollar.

The Economic Heavyweights Behind the Currencies

The strength and stability of a currency are closely tied to the economic health of the country or region it represents. Both the US dollar and the euro are backed by robust economies with strong institutions.

The United States, with its massive economy, technological prowess, and geopolitical influence, underpins the US dollar’s status as the world’s reserve currency. A quarter of global GDP is attributed to the US economy, boasting a dynamic mix of industries, from technology and finance to manufacturing and agriculture. The Federal Reserve, the US central bank, plays a pivotal role in managing monetary policy and influencing interest rates, which strongly impact the value of the US dollar.

The eurozone, encompassing 19 member states, forms a formidable economic bloc. Collectively, it represents the world’s second largest economy, a hub of technological advancement, and a diverse manufacturing landscape. The European Central Bank, headquartered in Frankfurt, Germany, oversees monetary policy for the eurozone, striving to maintain price stability and foster economic growth within the member states.

Why Do Traders Love USD/EUR?

The USD/EUR currency pair is not just popular; it is the heart and soul of Forex trading, accounting for a significant chunk of daily trading volume. Several factors contribute to its exceptional appeal among traders:

- Liquidity: The USD/EUR pair boasts unparalleled liquidity, ensuring tight bid-ask spreads and rapid order execution, making it easy for traders to enter and exit trades efficiently.

- Volatility: The economic dynamics between the US and the eurozone introduce a layer of volatility to the USD/EUR pair, creating opportunities for traders to capitalize on currency fluctuations.

- Extensive Market Coverage: News, analysis, and market commentary on the USD/EUR pair are readily available, providing traders with ample resources to make informed decisions.

Image: carlfajardo.com

What Are The Two Currency In Forex Trading

In Conclusion

The US dollar and the euro are not just any currencies; they are the two anchors of the global Forex market. Their economic strength, combined with their prevalence in international trade and finance, makes them the go-to choices for currency traders. Whether you are a seasoned professional or just dipping your toes into the exciting world of Forex, understanding these two currency heavyweights is paramount for success.

As the Forex market continues to evolve, the USD and EUR are likely to remain central to currency trading. Their enduring relevance and global significance make these two currencies the perfect gateway to mastering the dynamic realm of foreign exchange.