In the realm of global finance, forex reserves stand as a cornerstone of economic stability and global trade. These reserves represent a nation’s foreign exchange assets held by its central bank. They serve as a safeguard against potential economic disruptions and play a crucial role in maintaining currency stability and facilitating international transactions.

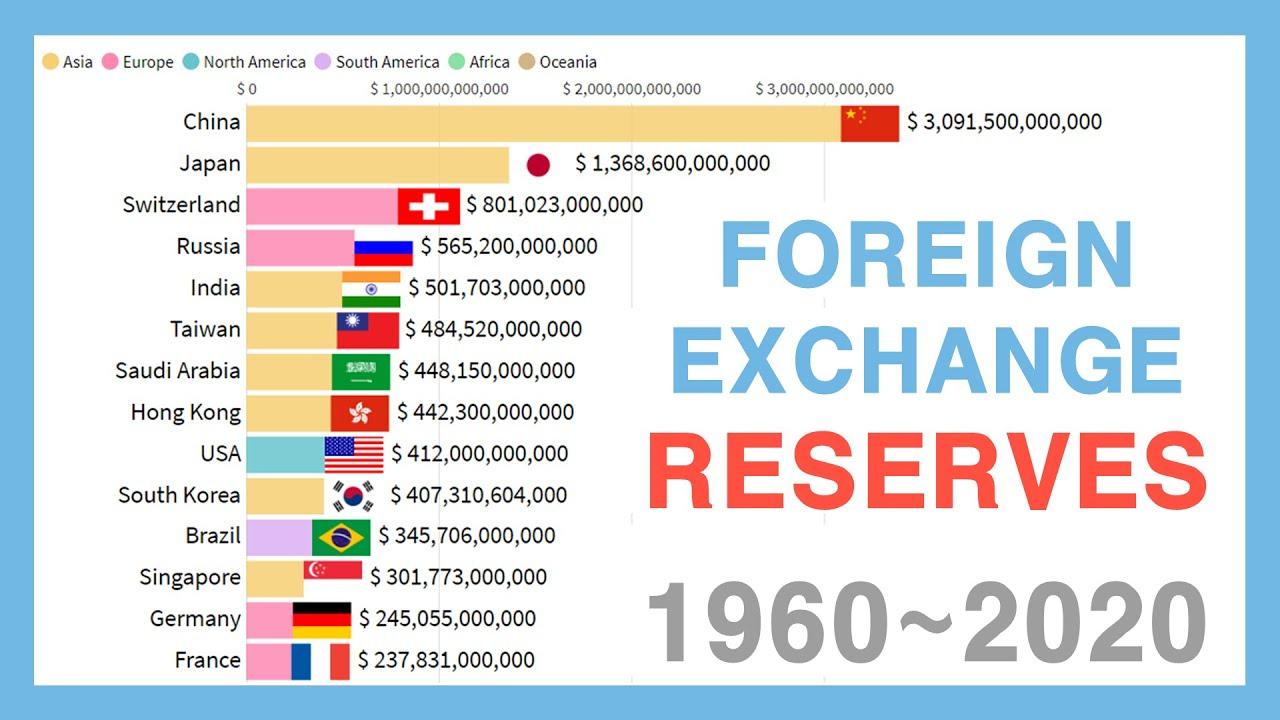

Image: forextraders.guide

Delving deeper into the composition of forex reserves reveals a fascinating array of financial instruments. These reserves are primarily comprised of the following components:

Gold: For centuries, gold has held a unique allure as a safe haven asset. Central banks around the world maintain substantial gold reserves to hedge against inflation and geopolitical risks.

Foreign Currencies: A significant portion of forex reserves is held in foreign currencies, primarily the US dollar. These reserves provide central banks with the liquidity to intervene in the foreign exchange market and stabilize the value of their domestic currency.

Special Drawing Rights (SDRs): Created by the International Monetary Fund (IMF), SDRs are an international reserve asset that supplements foreign exchange reserves. SDRs can be used to settle international obligations and provide additional liquidity during times of crisis.

Reserve Position in the IMF: Central banks can also hold a reserve position in the IMF as part of their forex reserves. This reserve position represents claims on the IMF’s financial resources and can be used to draw on additional funds if needed.

Other Foreign Assets: Forex reserves may also include a variety of other foreign assets, such as bonds, equity securities, and real estate. These assets provide diversification and alternative sources of return for central banks.

The composition of a country’s forex reserves is influenced by several factors, including its trade patterns, economic outlook, and geopolitical environment. Countries with large trade surpluses tend to accumulate more foreign currency reserves, while countries that import more than they export may hold smaller reserves. Political stability, low inflation, and sound economic policies can also boost a country’s forex reserves.

Managing forex reserves requires a delicate balance between liquidity, return, and risk. Central banks must strike a careful equilibrium to ensure that they have sufficient liquidity to meet their obligations while also preserving the value of their reserves. Balancing these objectives is essential for maintaining economic stability and fostering international trade.

Understanding the components of forex reserves empowers individuals with a deeper comprehension of global financial dynamics. It unveils the intricacies of currency management, risk mitigation, and the interconnectedness of global economies. As the world navigates an ever-changing financial landscape, a thorough grasp of forex reserves proves invaluable in shaping informed opinions and engaging in meaningful discussions on international finance.

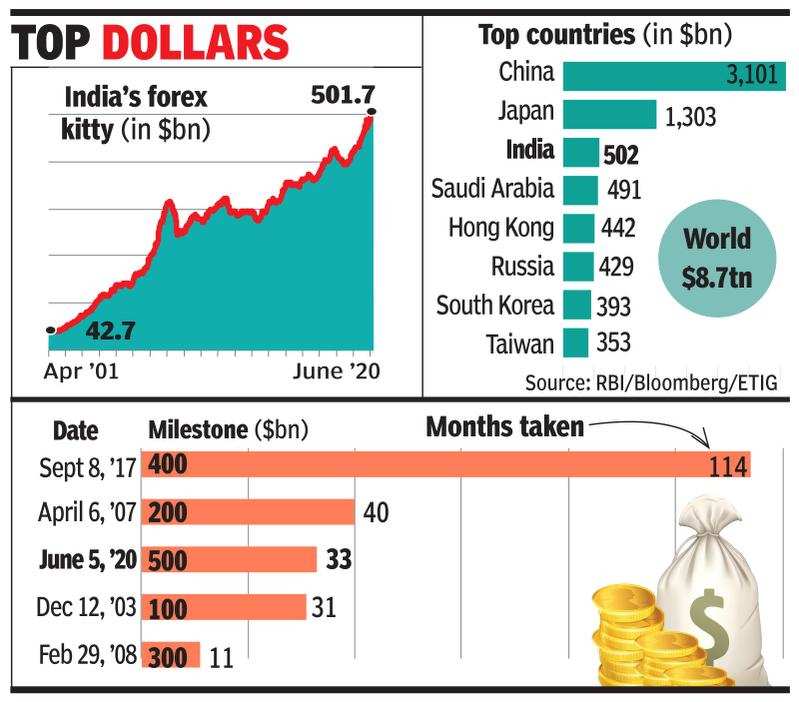

Image: timesofindia.indiatimes.com

What Are The Components Of Forex Reserves