Unlock the Secrets of Monitoring Your Forex Trades Like a Pro

Imagine the thrill of witnessing your forex trades unfold before your very eyes, observing their progress in real-time. With open orders, this exhilarating experience becomes a reality. As a forex trader, mastering the art of open orders empowers you to track your trades, adjust your strategies, and maximize your profit potential.

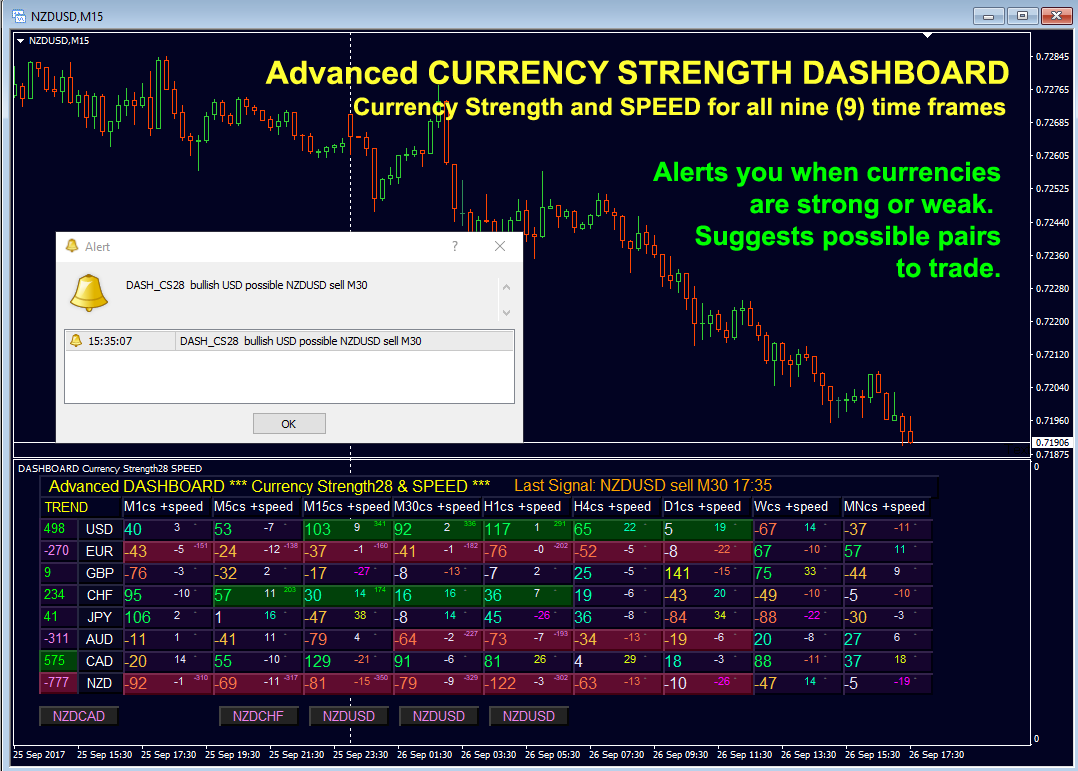

Image: www.mql5.com

A Comprehensive Guide to Open Orders in Forex

An open order refers to a pending transaction in the forex market. It represents your intention to buy or sell a currency pair at a predetermined price, which remains valid until the order is executed or canceled.

Open orders are instrumental in various aspects of forex trading:

- Automating Trade Execution: Open orders eliminate the need to manually monitor market movements and place trades at the desired price.

- Profit Maximization: By defining entry and exit points using open orders, you can capitalize on favorable price fluctuations.

- Risk Mitigation: Stop-loss orders, a type of open order, safeguards your capital by automatically closing trades when losses reach a specified threshold.

Types of Open Orders in Forex

Understanding the diverse types of open orders is crucial for tailoring your trading strategies:

- Market Order: Orders executed immediately at the prevailing market price.

- Limit Order: Orders executed only when the market price reaches or exceeds a predetermined price level.

- Stop Order: Orders that activate when the market price falls below or rises above a specified level.

- Stop-Loss Order: Orders that close trades automatically if the price moves against the trader, protecting against losses.

- Take-Profit Order: Orders that close trades automatically when the target profit level is reached, securing gains.

Placing and Managing Open Orders in Forex

Executing and managing open orders is straightforward, typically involving the following steps:

- Select the preferred currency pair and choose from the available order types.

- Define the desired price at which the order should execute.

- Set a stop-loss or take-profit level if desired, enhancing risk management and profit taking.

- Monitor the open order through your trading platform, tracking its status and making necessary adjustments.

- Smart Order Placement: Position open orders strategically based on technical analysis to increase execution probability.

- Risk Management Paramount: Use stop-loss orders diligently to protect against excessive drawdowns.

- Agility and Adaptability: Adjust open orders promptly in response to changing market conditions, maximizing flexibility.

Image: www.urbanforex.com

Expert Tips and Advice for Mastering Open Orders

Harnessing the full potential of open orders requires insights from experienced traders:

Frequently Asked Questions (FAQ)

What is the difference between a market order and a limit order?

How can stop-loss orders help me in forex trading?

Is it possible to manage open orders remotely?

Watch Open Order Forex Currency

https://youtube.com/watch?v=5jLfPlQBYuw

Conclusion

Mastering open orders empowers forex traders to automate trades, enhance profitability, and effectively manage risk. By utilizing the techniques outlined in this comprehensive guide, you can unlock their full potential and elevate your forex trading performance. Join us in the world of open orders and unlock limitless possibilities in the ever-evolving forex market.

Would you like to delve deeper into the captivating world of forex open orders?