Imagine you’re planning a grand vacation but want to avoid the peak season rush and inflated prices. You could set a pending order with your travel agent to automatically purchase tickets when they drop below a certain price. This is essentially how pending orders work in the world of forex trading.

Image: timonandmati.com

A pending order in forex trading is an instruction you leave with your broker to execute a trade at a specified price or condition in the future. It allows you to enter or exit the market automatically, without the need for constant monitoring. This can be particularly advantageous when you can’t be glued to the charts or want to take advantage of market volatility while you sleep.

Types of Pending Orders

There are several types of pending orders, each with its unique purpose and strategy:

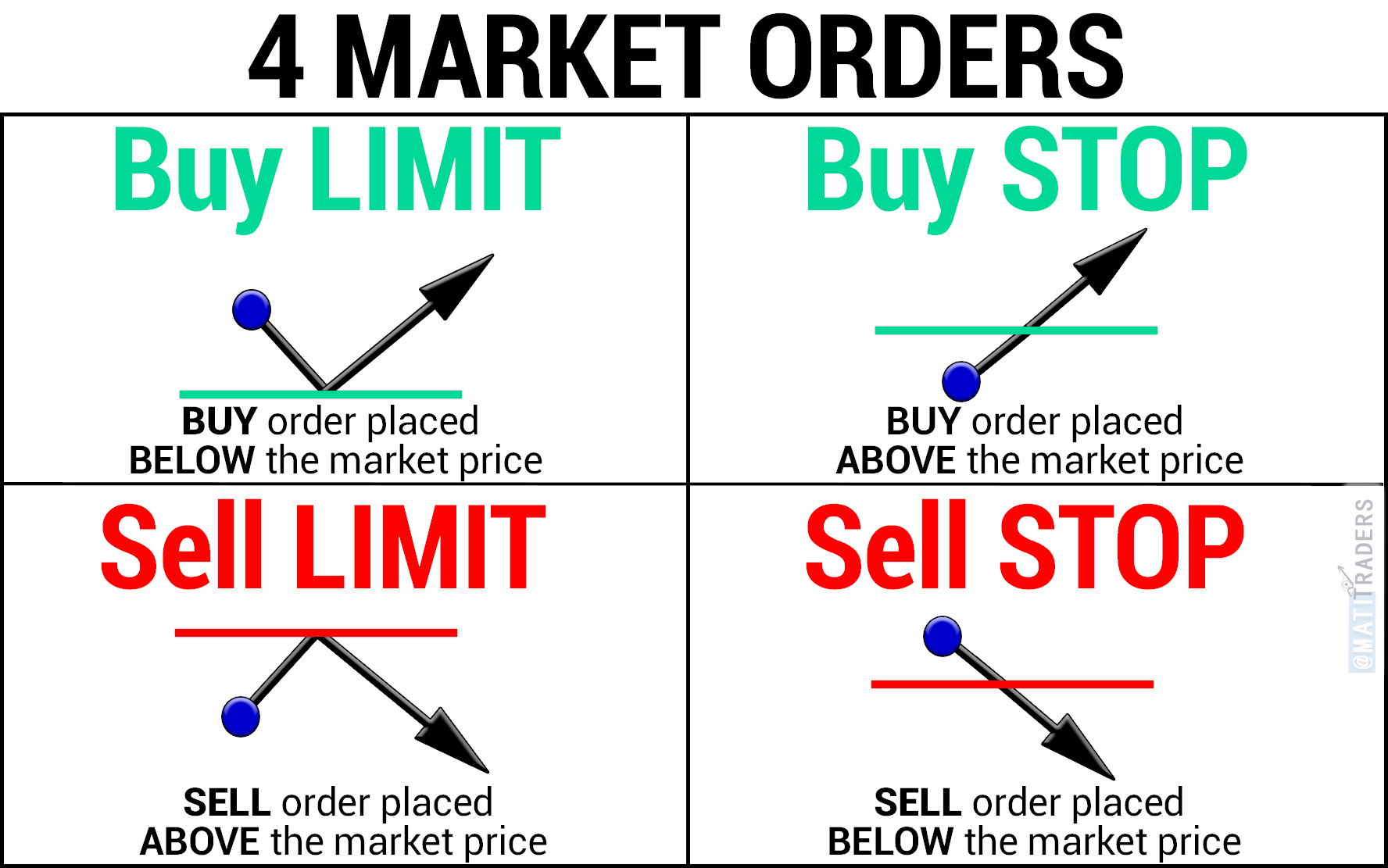

1. Buy Limit Order: Used when you expect a downtrend to reverse. It places an order to buy below the current market price, ensuring you enter the trade at a favorable price.

2. Sell Limit Order: The opposite of a buy limit order, this order is placed above the current market price and triggers a sell trade when the price rises to the set level.

3. Buy Stop Order: Designed to capitalize on an uptrend, this order is placed above the current market price and activates a buy trade if the price rises through the specified level.

4. Sell Stop Order: Executes a sell trade when the market price falls below a predetermined stop price. It’s often used to protect against potential losses in a downtrend.

5. Trailing Stop Order: A dynamic stop order that moves with the market price to lock in profits or limit losses. It adjusts its stop level based on a specified percentage or pip distance from the current price.

Benefits of Pending Orders

Employing pending orders in your forex trading strategy offers several advantages:

- Automated Execution: You can set and forget your orders, allowing the market to execute them automatically when the predefined conditions are met.

- Time Management: Free up your time by eliminating the need for constant market monitoring. Trade around your schedule without missing out on potential opportunities.

- Emotional Control: Pending orders help you avoid impulsive trading decisions driven by fear or greed. They ensure you stick to your trading plan and execute trades objectively.

- Risk Management: Stop orders can be used to limit potential losses by automatically exiting trades when the market moves against you, protecting your capital and managing risk.

Expert Tips for Using Pending Orders

1. Use Multiple Orders: Don’t rely on a single pending order. Consider using multiple orders with staggered entry or exit points to spread out your risk and increase your chances of success.

2. Identify Key Price Levels: Carefully analyze market charts to identify key support and resistance levels. These levels are often potential trigger points for pending orders.

3. Set Realistic Targets: Don’t be overambitious with your profit targets. Set realistic goals that align with market conditions and your risk tolerance.

4. Monitor Market Conditions: Pending orders are not foolproof. Monitor market movements regularly and adjust your orders as needed to reflect changing conditions.

Image: www.allfxbrokers.com

What Is Pending Order In Forex Trading

Conclusion

Mastering pending orders is an essential skill for any forex trader looking to enhance their trading strategy. By understanding the different types of orders, their benefits, and how to use them effectively, you can improve your market timing, automate your trades, and manage your risk more efficiently. Remember, the key is to trade with patience, discipline, and a comprehensive understanding of market dynamics. As you delve deeper into the world of pending orders, you’ll uncover their true power and how they can transform your forex trading experience.

Are you eager to explore the possibilities of pending orders and take your trading to the next level?