Introduction

Foreign exchange (forex) plays a crucial role in India’s economy, fueling growth, stability, and international trade. The annual report on forex inflows provides valuable insights into the flow of foreign currency into the country, reflecting its economic health and global position. This article offers a comprehensive overview of India’s forex inflows, analyzing trends, drivers, challenges, and their impact on the Indian economy.

Image: www.thehindubusinessline.com

Key Findings of the Annual Report

The annual forex report released by the Reserve Bank of India (RBI) highlights several key findings:

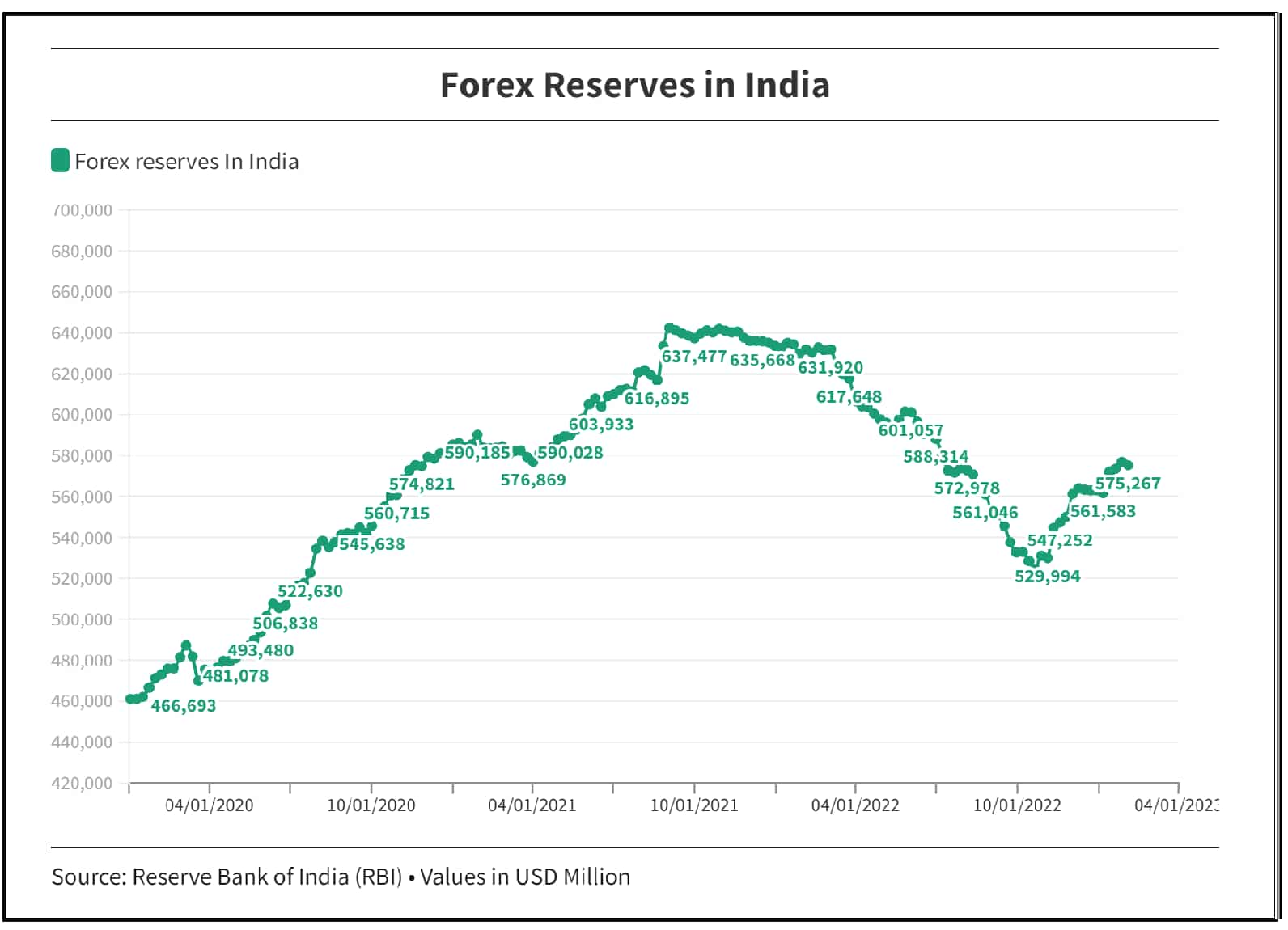

- India’s forex reserves surged to a record high of $623.8 billion in March 2023.

- The largest contributors to forex inflows were foreign direct investment (FDI), portfolio investment, and remittances from overseas Indians.

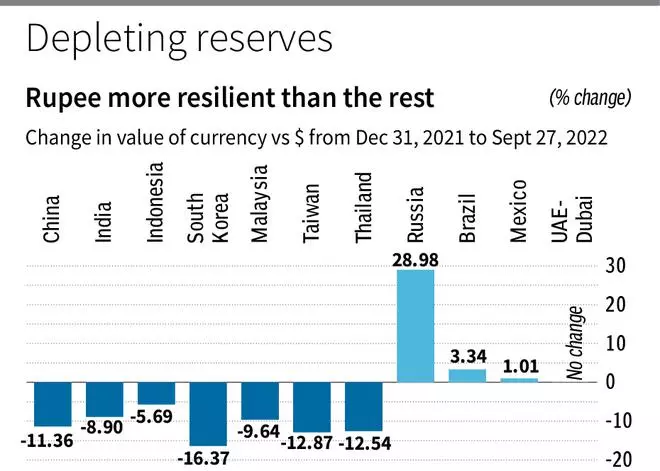

- India’s current account deficit narrowed, indicating a more balanced external trade position.

- The rupee depreciated slightly against the US dollar, reflecting global currency fluctuations.

Drivers of Forex Inflows

Various factors have contributed to India’s robust forex inflows:

- FDI: FDI inflows have been driven by the government’s initiatives to improve the business environment, such as the “Make in India” campaign. Key sectors attracting FDI include infrastructure, manufacturing, and technology.

- Portfolio Investment: India’s stock and bond markets have attracted foreign investors due to their strong fundamentals, high returns, and stable regulatory environment.

- Remittances: Remittances from Indian expats have been a steady source of forex inflows, totaling approximately $87 billion in 2022.

Challenges and Mitigation Strategies

Despite the overall positive inflow trend, the Indian economy faces certain challenges that affect forex inflows:

- Global Economic Headwinds: External factors such as the ongoing Russia-Ukraine conflict and the global economic slowdown can impact investor sentiment and reduce foreign inflows.

- Trade Deficits: India’s trade deficit can lead to pressure on the rupee and reduce forex reserves. The government has implemented measures to promote exports and reduce imports to mitigate this impact.

- Currency Fluctuations: The volatility of the rupee against major currencies can affect foreign investors’ confidence. The RBI intervenes in the forex market to manage excessive volatility and maintain exchange rate stability.

Image: www.zeebiz.com

Impact on the Indian Economy

Robust forex inflows have several significant implications for the Indian economy:

- Economic Growth: Forex inflows provide foreign capital for investment in infrastructure, industries, and other sectors, contributing to economic growth.

- Currency Stability: Ample forex reserves help maintain the stability of the rupee and prevent sharp fluctuations, protecting the economy from external shocks.

- Foreign Debt Management: Forex inflows reduce the need for external borrowing and help manage India’s foreign debt.

- International Trade: Forex reserves provide a buffer for import payments and facilitate international trade.

Volume Of Foreign Money Forex Coming To India Annual Report

Conclusion

The annual report on India’s forex inflows provides a comprehensive analysis of the vital role foreign exchange plays in the country’s economic growth, stability, and international trade. Understanding the drivers, challenges, and impact of forex inflows is essential for policymakers, businesses, and individuals alike. By addressing challenges and capitalizing on opportunities, India can continue to attract foreign currency and harness its transformative potential for the benefit of its economy and citizens.