Unlocking Forex Mastery: A Comprehensive Guide to Volume and Volatility Indicators

Image: emugepavo.web.fc2.com

In the exhilarating world of forex trading, understanding volume and volatility indicators can be the key to unlocking greater profits and mitigating risks. These powerful tools provide traders with critical insights into market momentum and sentiment, empowering them to make informed decisions and maximize their potential.

Definition of Volume and Volatility Indicators

Volume indicators measure the number of transactions taking place in a specific currency pair over a given period. They unveil the market’s activity level, indicating the magnitude of buying and selling activity, thus offering traders a glimpse into the market’s underlying strength and momentum.

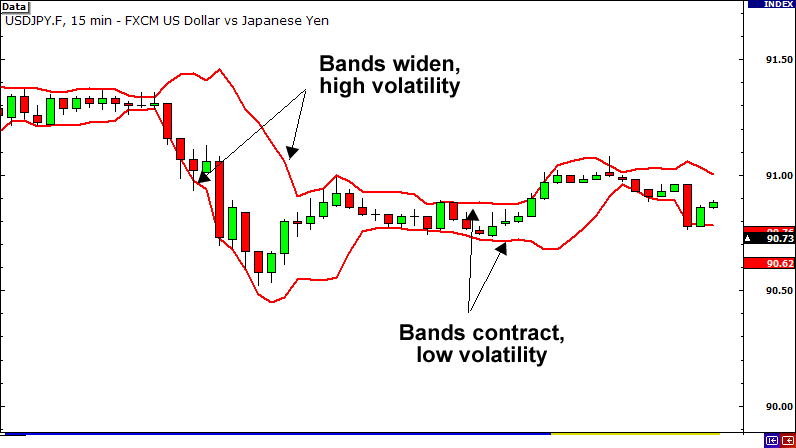

Volatility indicators, on the other hand, gauge the extent to which currency prices fluctuate. They measure the magnitude of price swings and help traders identify potential opportunities or potential risks when market volatility is either increasing or decreasing.

Historical Evolution and Practical Applications

Volume and volatility indicators have a rich history in the financial industry. The renowned Technical Analysis of Stock Trends by Richard W. Schabacker published in 1932, highlighted the pivotal role of volume and volatility in successful trading. Modern charting platforms and sophisticated algorithms have further refined these indicators, making them indispensable for forex traders today.

Unveiling the Power of Volume Indicators

- Identifying Market Strength and Momentum: High volume indicates strong interest from participants, which can lead to stronger price movements.

- Monitoring Accumulation and Distribution: Volume analysis helps identify periods of accumulation (buying) or distribution (selling) by large players.

- Confirming Price Trends: Volume can validate price trends. Higher volume in the direction of the trend indicates increased conviction and potential for continuation.

Harnessing the Insights of Volatility Indicators

- Gauging Market Stability: Low volatility often signals a lull in market activity, while high volatility indicates increased uncertainty and potential trading opportunities.

- Identifying Trading Range Boundaries: Volatility indicators help traders determine support and resistance levels where market action tends to be concentrated.

- Managing Risk: Volatility assessments enable traders to adjust their risk appetite and position sizing appropriately.

Tapping into Expert Insights and Actionable Tips

- Legendary Trader John Bollinger: Emphasizes the importance of combining volume and volatility analysis to identify potential trend reversals.

- Bestselling Author Kathy Lien: Advocates for using volume to assess the conviction behind price movements and for identifying strong support and resistance levels.

- Renowned Analyst James Stanley: Offers a unique perspective on the relationship between price and volume, highlighting the concept of “volume expansion” as a key indicator of potential price changes.

Conclusion: Empowering Forex Traders

By mastering the nuances of volume and volatility indicators, forex traders equip themselves with a potent weapon in their arsenal. These tools offer invaluable insights into market dynamics, enabling traders to make informed decisions, capitalize on prevailing trends, and manage risks effectively. Harness the power of these indicators today and unleash your trading potential.

Image: www.blogforex.org

Volume And Volatility Indicators Forex

https://youtube.com/watch?v=2nLHTKu_EVI