A Lucrative Adventure into the Global Finance Hub

In today’s interconnected world, where economies intertwine and currencies dance in a delicate waltz, understanding foreign exchange (forex) rates has become indispensable for both financial professionals and everyday people. Among the myriad currency pairs, the USD to CNY exchange rate stands as a beacon of global significance, influencing trade flows, investment decisions, and the lives of individuals across borders.

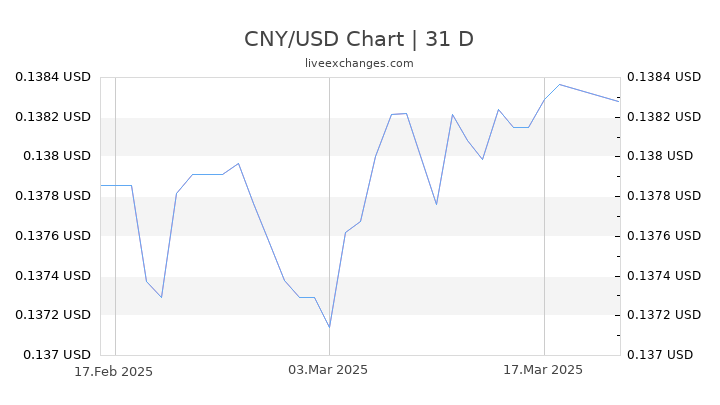

Image: www.liveexchanges.com

This comprehensive guide will illuminate the intricacies of USD to CNY forex charts, empowering you with the knowledge to navigate the dynamic currency markets. Whether you’re a seasoned investor, an aspiring entrepreneur, or simply curious about the forces that shape our financial landscapes, embark on this journey with us to unlock the secrets of forex trading.

Deciphering the USD to CNY Forex Chart

A forex chart, like a detailed map of financial terrain, provides a visual representation of the historical and present exchange rate between two currencies. In the case of the USD to CNY chart, the vertical axis represents the value of one US dollar in Chinese yuan (CNY), while the horizontal axis represents time.

Examining the chart, you’ll observe a fluctuating line that depicts the constant dance of supply and demand. When the line rises, it indicates that the US dollar is strengthening against the Chinese yuan. Conversely, when the line falls, it signifies a weakening of the US dollar relative to the Chinese yuan.

Historical Perspective and Economic Determinants

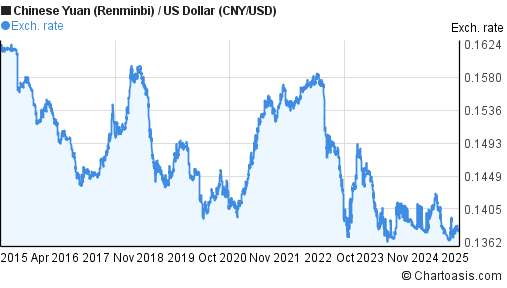

The history of USD to CNY exchange rates reveals a captivating narrative of economic shifts and geopolitical dynamics. For decades, the Chinese government maintained a fixed peg of its currency to the US dollar. However, in recent years, China has gradually liberalized its foreign exchange market, allowing the yuan to fluctuate more freely based on market forces.

Economic factors play a significant role in determining the exchange rate. For instance, a strong US economy accompanied by rising interest rates tends to strengthen the dollar relative to other currencies, including the yuan. Conversely, economic weakness in the United States or geopolitical uncertainty can lead to a weakening of the dollar.

Real-World Impact and Investment Implications

The USD to CNY exchange rate has far-reaching implications for both individuals and businesses. Importers in China become more price-sensitive when the dollar strengthens, leading to a decrease in foreign goods consumption. Conversely, a weakening dollar makes Chinese exports more competitive in global markets.

For investors, understanding USD to CNY fluctuations is crucial for maximizing returns. By analyzing chart patterns and economic indicators, traders can develop informed trading strategies that take advantage of price movements. Forex trading can offer lucrative opportunities but also carries inherent risks, so it’s essential to approach it with knowledge and caution.

Image: www.chartoasis.com

Technical Analysis: Unlocking Chart Patterns

Technical analysis is a widely used technique for deciphering forex charts and identifying trading opportunities. It involves studying historical price patterns to predict future market behavior. Some common chart patterns include:

-

Trend Lines: Lines drawn along a series of higher or lower price points, indicating a prevailing market direction.

-

Support and Resistance Levels: Price levels where the price action repeatedly bounces or stalls, signaling potential areas of buying or selling pressure.

-

Moving Averages: A line representing the average price of a currency over a specific period, often used to smooth out short-term fluctuations.

Expert Insights: Empowering Traders

Seasoned forex traders often rely on expert insights to guide their decisions. Here are a few invaluable tips from seasoned professionals:

-

Follow Economic News: Stay abreast of economic data, such as GDP, inflation, and interest rates, as these events can significantly impact exchange rates.

-

Use Multiple Technical Indicators: Don’t rely solely on one chart pattern or indicator. Employ various technical tools to triangulate your analysis for greater accuracy.

-

Risk Management is Paramount: Implement proper risk management strategies, such as stop-loss orders, to limit potential losses. Remember, forex trading involves inherent risks.

Usd To Cny Forex Chart

Conclusion: Unveiling the Power of Currency Knowledge

By understanding USD to CNY forex charts, you’ve acquired a valuable tool for navigating the dynamic currency markets. Whether you’re a casual observer, an aspiring trader, or a seasoned investor, this knowledge empowers you to make informed decisions and capitalize on financial opportunities.

Remember, the forex markets are constantly evolving, so stay curious, continue your research, and consult with experts as needed. By embracing this ever-changing landscape, you’ll find yourself well-equipped to ride the waves of global finance and unlock the potential of strategic currency trading.