Have you ever wondered how seasoned traders seem to anticipate market swings with uncanny accuracy? The answer might lie in a fascinating mathematical sequence known as the Fibonacci sequence. This sequence, with its intriguing patterns, forms the foundation of Fibonacci retracement, a powerful tool used by traders to identify potential support and resistance levels in financial markets.

Image: www.warriortrading.com

Fibonacci retracement is a technical analysis technique that uses specific mathematical ratios derived from the Fibonacci sequence to predict price reversals. These ratios, which represent levels of potential support and resistance, offer traders valuable insights into market sentiment and potential price targets. But how does this ancient mathematical sequence connect with the dynamic world of finance?

The Foundation: The Fibonacci Sequence

A Journey Through Time: Unveiling the Fibonacci Sequence

The Fibonacci sequence, named after the Italian mathematician Leonardo Pisano, known as Fibonacci, is a series of numbers beginning with 0 and 1, where each subsequent number is the sum of the two preceding ones. This sequence, represented as 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, and so on, appears in surprisingly diverse aspects of nature, from the arrangement of leaves on a stem to the spiral patterns of a seashell.

The Golden Ratio: A Key to Understanding Fibonacci

One of the most intriguing aspects of the Fibonacci sequence is its link to the golden ratio, often denoted by the Greek letter phi (φ). The golden ratio, approximately 1.618, is derived from dividing any number in the Fibonacci sequence by its preceding number. As the sequence progresses, this ratio approaches the golden ratio. This remarkable relationship hints at the inherent order and harmony present in both nature and financial markets.

Image: www.tradingpedia.com

Fibonacci Retracement: A Tool for Predicting Market Movements

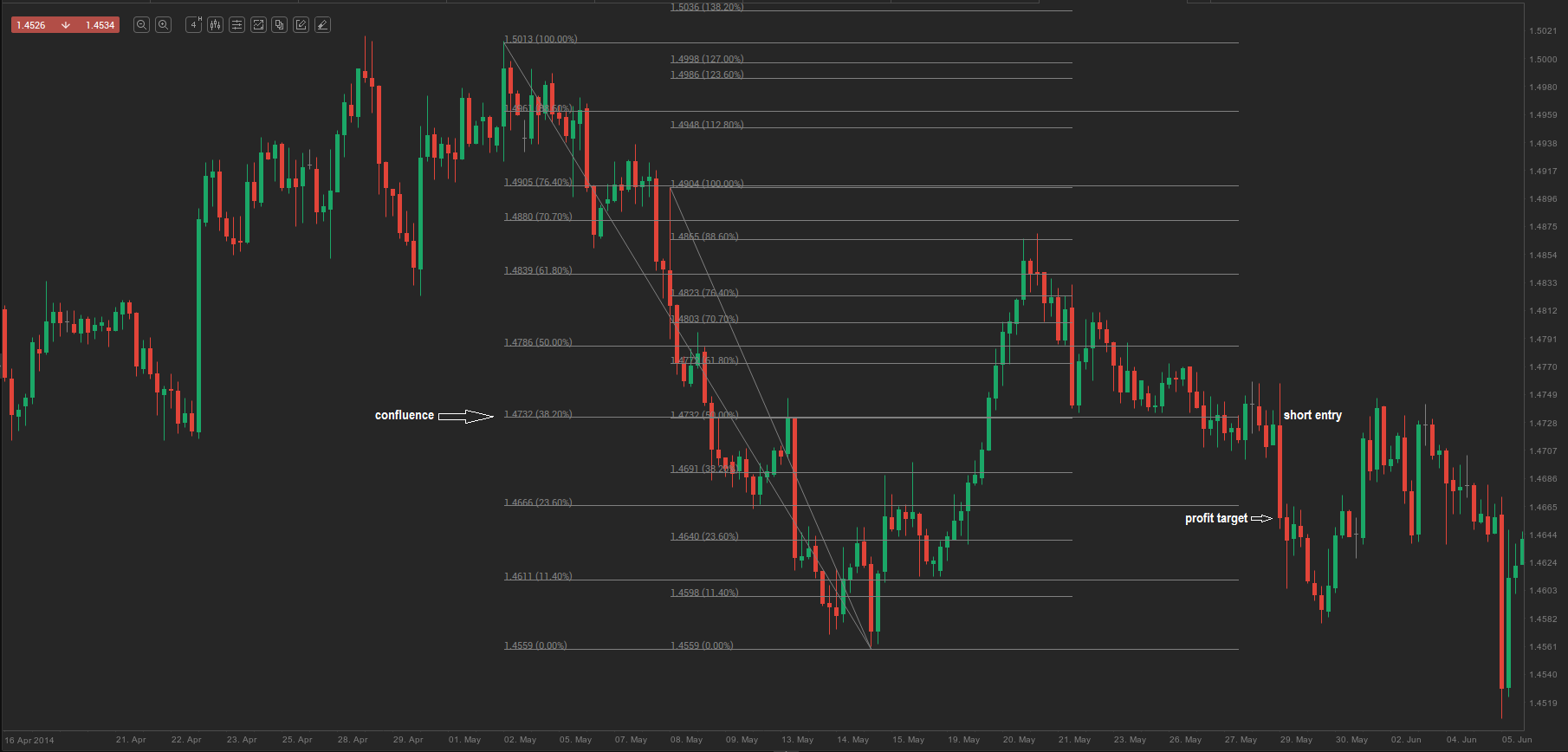

Fibonacci retracement, based on these ratios, helps traders understand the potential price reversals by identifying crucial support and resistance levels. These levels are derived by dividing the price difference between a recent high (or low) and a recent low (or high) by the Fibonacci ratios. The most commonly used Fibonacci retracement levels are:

- 23.6%: This level often represents a minor retracement, signifying a potential pause in the prevailing trend.

- 38.2%: A more significant retracement, suggesting a temporary correction in the market.

- 50%: This retracement level represents a midpoint between the high and low, often indicative of a change in momentum.

- 61.8%: Commonly referred to as the golden ratio, this level is a crucial point of potential support or resistance.

- 100%: This level represents the complete retracement of the price movement, signifying a potential reversal of the trend.

Visualizing the Fibonacci Retracement

Fibonacci retracement levels are usually depicted on price charts as horizontal lines, providing a visual representation of potential levels of support and resistance. Traders can use these levels to identify potential entry and exit points, targeting specific price levels for their trades.

Real-World Examples: Using Fibonacci Retracement in Trading

To illustrate the application of Fibonacci retracement, let’s consider a hypothetical example. Imagine the price of a stock rises from $50 to $80. Traders can use the Fibonacci retracement tool to identify potential levels of support during a retracement. The 38.2% retracement level would be calculated as:

(80 – 50) x 0.382 = 11.46

Therefore, the 38.2% retracement level would correspond to a price of approximately $68.54 (80 – 11.46). Traders might use this level as a potential buying opportunity, anticipating that the price could bounce back from this level and continue its upward trend.

Understanding Limitations: The Importance of Context

It’s vital to remember that Fibonacci retracement, like any technical indicator, is not a guaranteed predictor of future price movements. Market conditions, economic factors, and other factors can influence price action. Fibonacci retracement levels should be used in conjunction with other technical indicators and fundamental analysis to make informed trading decisions.

The Latest Trends and Developments in Fibonacci Retracement

Fibonacci retracement continues to be widely used in the trading community, with ongoing research and development exploring its potential applications. One recent development is the integration of Fibonacci retracement with other technical indicators, such as moving averages and oscillators, to create more sophisticated trading strategies.

The growing adoption of automated trading systems has also led to the implementation of Fibonacci retracement in algorithm-based trading, enabling the rapid identification and execution of trading opportunities based on these levels. This trend suggests that the importance of Fibonacci retracement in trading will likely continue to grow in the future.

Fibonacci Retracement Numbers

Conclusion: Embracing the Power of Fibonacci Retracement

By understanding the principles of Fibonacci retracement and applying them to your trading strategy, you can gain a deeper insight into market trends, identify potential support and resistance levels, and improve your trading decisions. Remember that while Fibonacci retracement provides valuable insights, it’s crucial to use it in conjunction with other tools and a comprehensive understanding of market dynamics. This approach empowers you to make well-informed decisions and navigate the exciting world of financial markets with greater confidence.

We encourage you to explore further resources on Fibonacci retracement and experiment with its applications to refine your trading strategies. Share your experiences and insights with the wider trading community, fostering a collaborative approach to learning and growth in the fascinating realm of financial markets.