Image: thelawstudent.blog

Introduction

Traversing the labyrinthine world of forex trading, understanding the enigmatic concept of unrealized profit and loss (PnL) is paramount to navigating the treacherous terrain. This intangible yet formidable force can dramatically influence your trading strategy, shaping your financial destiny. Join us as we embark on an illuminating odyssey, unraveling the intricacies of unrealized PnL calculation in forex.

Unveiling the essence, unrealized PnL epitomizes the theoretical gains or losses embedded within open positions, reflective of current market prices. Unlike realized PnL, which materializes upon closing these positions, unrealized PnL remains a fluid entity, constantly fluctuating in accordance with market movements.

Unveiling the Calculation Methodology

Mastering the art of unrealized PnL calculation empowers traders with an unparalleled edge, enabling them to gauge their performance and make informed trading decisions. To decipher this enigmatic concept, we delve into the depths of its mathematical heart.

Calculating Unrealized PnL:

Unrealized PnL =Current Bid Price (or Ask Price) – Entry Price * Position Size

Wherein:

- Current Bid Price: Prevailing market price for buying a given currency pair

- Current Ask Price: Prevailing market price for selling a given currency pair

- Entry Price: Price at which the trade was initiated

- Position Size: Volume of a specific currency pair you’re trading

Comprehending the Essence of Unrealized Profit and Loss

Unveiling the significance of unrealized PnL, we discover its pivotal role in risk management, performance evaluation, and strategic decision-making. Harnessed effectively, this powerful metric transforms into an invaluable ally, guiding you toward trading success.

Role in Risk Management:

Unrealized PnL provides a real-time insight into your level of exposure to potential losses, guarding you against catastrophic drawdowns. By monitoring its ebbs and flows, you’re empowered to implement proactive risk management strategies, safeguarding your trading capital.

Performance Evaluation:

As a performance barometer, unrealized PnL allows you to gauge the trajectory of your trading journey. It’s a real-time reflection of your profitability, highlighting areas for improvement while validating your trading prowess.

Influencing Strategic Decisions:

Unrealized PnL holds sway over the strategic decisions you make as a forex trader. Leveraging its guidance, you’re capable of altering your position sizing, adjusting risk parameters, and optimizing entry or exit strategies, progressively honing your trading acumen.

Conclusion

Unveiling the depths of unrealized PnL calculation in forex empowers you to unlock a world of opportunity. Whether you’re a novice or an experienced trader, embracing this knowledge is pivotal to exploiting the full potential of the forex market. As you embrace the insights provided within this guide, you’ll emerge as a master of the trading realm, poised to reap the rewards of informed decision-making.

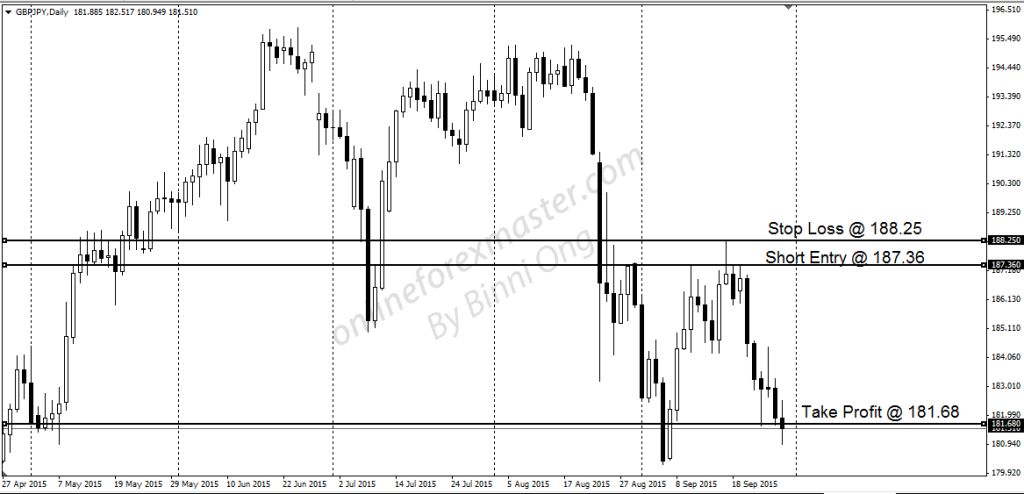

Image: onlineforexmaster.com

Unrealized Profit And Loss Calculation In Forex

https://youtube.com/watch?v=FzT3UcShlOQ