Navigating the complexities of the forex market requires an arsenal of tools and strategies. Identifying upcoming trends is crucial for successful trading, and in 2024, certain indicators are poised to provide invaluable insights for traders.

Image: howtotradeonforex.github.io

By tapping into these indicators at Forex Factory, traders can gain an edge by anticipatiing market movements and making informed decisions.

Technical Indicators: A Window into Trends

Technical indicators analyze historical price data to identify patterns and predict future price movements. Some key indicators to watch in 2024 include:

- Moving Averages: These provide a smoothed average price over a specified period, offering insights into long-term trends.

- Relative Strength Index (RSI): This measures the magnitude of recent price changes, indicating overbought or oversold conditions.

- Bollinger Bands: These trace the market’s volatility around a moving average, providing insights into breakout opportunities.

- MACD (Moving Average Convergence Divergence): This compares the difference between two exponentially moving averages, identifying changes in momentum.

- Ichimoku Cloud: This combines multiple indicators to create a comprehensive view of trend direction, support, and resistance levels.

Fundamental Indicators: Economic Insights

Beyond technical analysis, fundamental indicators shed light on economic conditions that influence currency values. Forex Factory provides access to real-time data on:

- Gross Domestic Product (GDP): This measures the value of all goods and services produced in a country, reflecting its economic health.

- Consumer Price Index (CPI): This gauges inflation, impacting consumer spending and currency demand.

- Interest Rates: Central banks set interest rates to manage inflation and economic growth, affecting currency values.

- Trading Volume: This indicator shows the number of currency transactions, providing insights into market sentiment and liquidity.

- Political and Economic Events: Forex Factory tracks major events that can significantly impact currency values.

Tips and Expert Advice: Enhancing Your Trading

Along with understanding trend prediction indicators, here are some tips for effective trading in 2024:

- Monitor Multiple Indicators: Avoid relying solely on a single indicator. Use a diverse range to gain a comprehensive view.

- Consider Different Timeframes: Analyze indicators across various timeframes to identify short-term and long-term trends.

- Set Realistic Expectations: Indicators provide probabilities, not certainties. Manage your expectations and don’t expect perfect accuracy.

- Use Risk Management Strategies: Protect your capital with stop-loss orders and appropriate position sizing.

- Stay Informed: Stay abreast of economic news, geopolitical events, and market updates that can impact currencies.

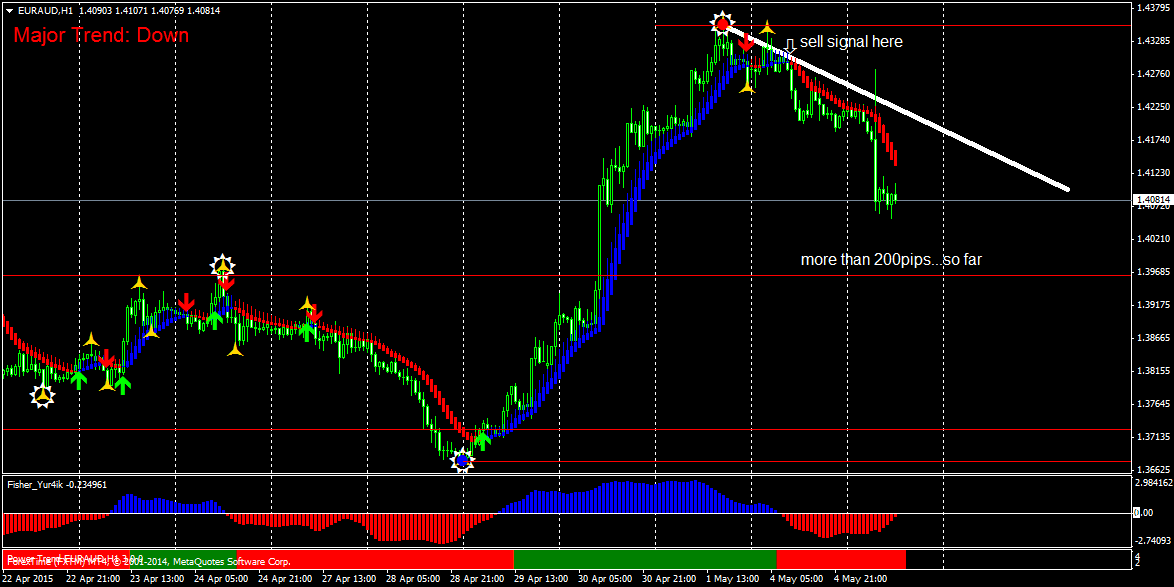

Image: algotradingsystem.logdown.com

Frequently Asked Questions: Clarifying Common Doubts

Q: Can trend indicators predict the future with certainty?

A: Trend indicators provide probabilities, not guarantees. Market conditions are dynamic, and unexpected events can impact prices.

Q: How do I choose the right trend indicator for me?

A: Different indicators suit different trading styles and timeframes. Experiment with various indicators and identify those that best align with your strategy.

Q: Can I rely on technical indicators alone for successful trading?

A: While technical indicators are valuable, they should be complemented with fundamental analysis to gain a comprehensive understanding of the market.

Trend Prediction Indicators In 2024 At Forex Factory

https://youtube.com/watch?v=zV1EksThtYo

Conclusion

By leveraging trend prediction indicators at Forex Factory and following sound trading practices, traders can harness the power of market analysis to make informed decisions and navigate the forex markets in 2024. Remember, the key lies in continuous learning, adaptability, and managing risk effectively.

Are you ready to delve into the world of trend prediction indicators and enhance your forex trading experience?