Have you ever wondered how currencies fluctuate around the world, shaping the global economy? Or perhaps you’ve daydreamed about harnessing the power of these fluctuations to build wealth. The world of forex trading, where currencies are bought and sold like any other commodity, offers that very opportunity. But before you jump into the exciting, yet complex financial jungle, it’s crucial to find the right guide – a trusted forex broker.

Image: www.tradingwithrayner.com

This guide will equip you with the knowledge to confidently navigate the forex market. We’ll unpack the fundamentals of forex trading, delve into the intricacies of choosing a broker, and guide you through the crucial factors to consider when selecting your trading partner.

What is Forex Trading?

Forex, short for foreign exchange, is the world’s largest financial market, surpassing even the stock market. It’s a decentralized marketplace, meaning it doesn’t have a physical location. Instead, transactions happen electronically through a network of banks, institutions, and individual traders like yourself. The core concept is simple: you buy one currency and sell another, hoping to profit from the difference in their values.

Imagine you’re traveling to Japan. Before you go, you exchange your local currency, say US dollars, for Japanese yen. You want the yen to be stronger against the dollar so you can buy more yen with your dollars. If the value of the yen rises against the dollar, you gain. If it drops, you lose. That’s essentially how forex trading works.

Why Choose a Forex Broker?

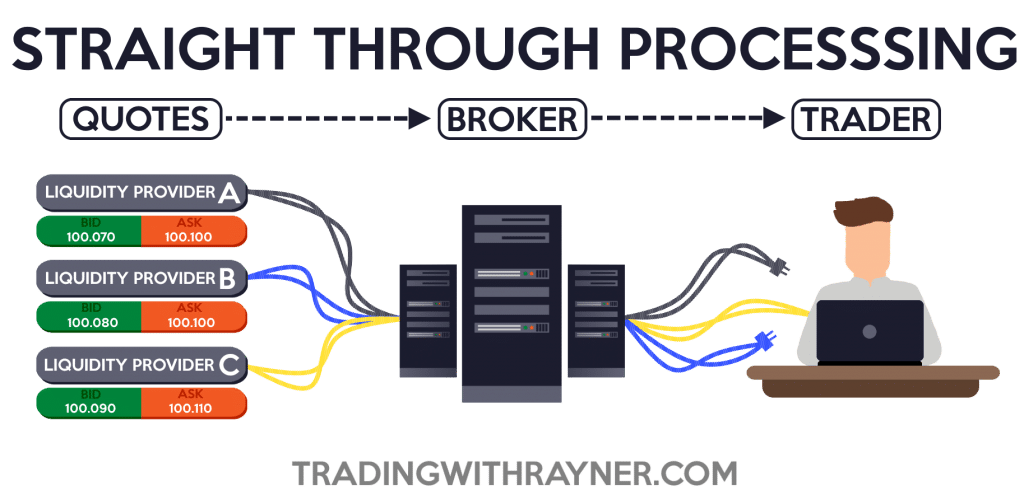

Trading on the forex market directly is often not an option for individual traders. That’s where forex brokers come in. They act as intermediaries, giving you access to the global forex market through their trading platforms. They provide tools for executing trades, managing your account, and accessing market analysis.

Key Factors to Consider When Choosing a Forex Broker

Choosing the right broker is crucial, as it directly impacts your trading experience and success. Here’s a checklist of essential factors to consider:

1. Regulation and Security:

- A regulated broker is a sign of legitimacy and trustworthiness. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK and the National Futures Association (NFA) in the US ensure brokers adhere to specific standards and protect customer funds.

- Check if your broker is regulated and look for the regulatory body’s license number on their website.

2. Trading Platforms:

- A user-friendly platform is essential for efficient and effective trading. Look for intuitive design, real-time quotes, chart tools, and order management features.

- Try out different platforms through demo accounts to find one that suits your trading style and technical skills.

3. Trading Instruments & Market Access:

- A good broker offers a diverse range of trading instruments, not just currency pairs. Consider trading options like commodities, indices, and CFDs to diversify your portfolio.

- Ensure they provide access to major forex markets with tight spreads and competitive execution speeds.

4. Spreads and Commissions:

- Spreads represent the difference between the buy and sell price of a currency pair. Lower spreads mean you pay less to enter and exit trades, increasing your potential profits.

- Be aware of commission structures, as they can vary greatly between brokers.

5. Account Types and Minimum Deposits:

- Different brokers offer varying account types with various features and minimum deposit requirements. Choose an account type that aligns with your trading goals and capital.

- Start with a smaller account to test the platform and gain experience before committing significant funds.

6. Customer Support and Education:

- A reliable broker provides readily available and responsive customer support, especially if you’re new to trading.

- Check out their educational resources like webinars, tutorials, and market analysis to enhance your trading skills.

7. Mobile Trading and Accessibility:

- Nowadays, mobile accessibility is a must. The best brokers provide dedicated mobile trading apps with features comparable to their desktop counterparts.

- Check the app’s ratings and reviews on popular app stores.

8. Demo Accounts and Security Features:

- Many brokers offer free demo accounts to familiarize yourself with their platforms and practice your trading strategies without risking real money.

- Look for robust security features like two-factor authentication and encryption to protect your sensitive data.

Image: howtotradeonforex.github.io

Expert Tips for Choosing Your Forex Broker

Here are some expert insights to help you make an informed decision:

- Do your research: Don’t rush into signing up with the first broker you encounter. Take your time to compare different options, read reviews, and check their reputation.

- Consult with financial advisors: Seek professional guidance from experienced financial advisors specializing in forex trading. They can help you assess your risk tolerance and suggest brokers tailored to your needs.

- Start small: Begin with a demo account or a smaller live account to hone your skills and understand the intricacies of forex trading before committing substantial capital.

Broker Forex Trading

Wrapping Up: Your Journey to Forex Success

Choosing the best forex broker is a crucial step in your trading journey. By carefully considering the factors mentioned above and seeking expert advice, you can find a reliable partner to navigate the exciting, yet challenging world of forex trading. Remember, thorough research, an understanding of your risk appetite, and continuous learning are essential to success in any financial market.

Start your forex trading journey today by exploring reputable brokers and utilizing the resources at your disposal. The world of forex trading is waiting, and with the right broker by your side, you can experience the thrill of capitalizing on global currency fluctuations.