In the dynamic world of forex trading, understanding how to transpose a bid ask rate is crucial for informed decision-making. Whether you’re a seasoned trader or just starting your journey, this guide will provide you with a comprehensive understanding of this essential concept.

Image: www.chegg.com

What is a Forex Bid Ask Rate?

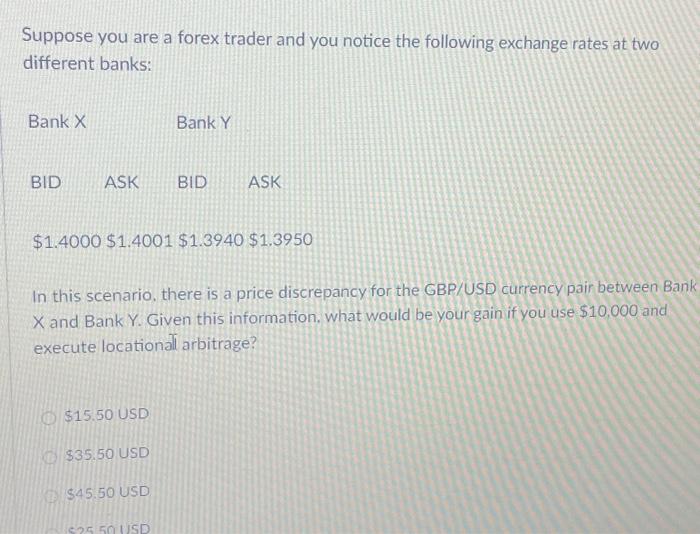

A forex bid ask rate represents the price at which a currency pair can be bought (bid) or sold (ask) in the market. The bid price is the highest price at which a trader is willing to buy a currency, while the ask price is the lowest price at which a trader is willing to sell it.

The Spread

The difference between the bid and ask price is known as the spread. It represents the broker’s profit and is typically expressed in pips, where one pip is 0.0001 for most currency pairs. Selecting a broker with a competitive spread can significantly impact your profitability.

Transposing a Forex Bid Ask Rate

To transpose a bid ask rate, simply swap the bid and ask prices. For example, if the bid price for EUR/USD is 1.2345 and the ask price is 1.2350, the transposed rate would be 1.2350 bid and 1.2345 ask.

Image: dailypriceaction.com

Why Transpose?

Transposing a bid ask rate is essential when you want to compare rates from different brokers or analyze price charts. By transposing the rates, you can ensure that you’re comparing apples to apples and making informed trading decisions.

Expert Advice and Tips

Here are some tips from experienced traders to help you navigate the forex market effectively:

- Shop around for competitive spreads: Compare rates from multiple brokers to secure favorable spreads.

- Understand bid-ask spreads: Recognize that spreads can vary, depending on the currency pair and market conditions.

- Use a trading platform with real-time quotes: Access up-to-the-minute rates for accurate trading decisions.

- Leverage tools like backtesting: Utilize software to analyze and optimize trading strategies based on historical data.

- Adopt sound risk management: Implement stop-loss and take-profit orders to minimize potential losses and maximize gains.

Frequently Asked Questions

**Q: Why do bid and ask prices change frequently?**

**A:** Bid and ask prices fluctuate constantly due to market supply and demand, economic news, and geopolitical events.

**Q: Which factors influence the spread?**

**A:** The spread depends on the liquidity of the currency pair, broker fees, and market volatility.

**Q: Is it possible to negotiate the spread with brokers?**

**A:** In some cases, brokers may offer reduced spreads to high-volume traders or clients with a large account balance.

Transpose A Forex Bid Ask Rate

Conclusion

Mastering the art of transposing a forex bid ask rate is a fundamental skill for successful trading. By leveraging the insights and tips outlined in this guide, you can confidently make informed trading decisions and potentially improve your profitability. Remember, the key to success lies in embracing knowledge, staying informed, and continuously refining your strategies.

If you enjoyed this article and found value in the information provided, please share it with others who may benefit from it. Your support enables us to continue delivering high-quality content for the benefit of the trading community.