Unlocking the Potential of Two Market Giants

Embarking on the journey of investing in financial instruments unveils a vast panorama of possibilities. The realms of commodities and foreign exchange (forex) stand as two towering pillars within this expansive landscape, each boasting unique characteristics and advantages. Whether you seek the allure of tangible assets or the dynamic interplay of global currencies, understanding the nuanced distinctions between these two instruments is paramount to maximizing your profits.

Image: www.financemagnates.com

A Deeper Dive into Commodities: Beyond the Basics

Commodities, the quintessential raw materials that fuel the global economy, encompass a diverse array of products, from the precious metals of gold and silver to the agricultural backbone of wheat and soybeans. Investing in commodities offers the allure of tangible assets, often perceived as a hedge against inflation.

- Tangible Asset Protection: Commodities represent physical goods, providing a tangible store of value that can safeguard your portfolio against inflationary pressures.

- Market Diversification: Incorporating commodities into your investment strategy adds a layer of diversification, reducing portfolio volatility and enhancing overall returns.

- Hedge against Currency Fluctuations: Commodities have historically exhibited an inverse correlation with paper assets, offering a cushion against currency devaluations.

Exploring the Forex Arena: Currencies in Constant Flux

Forex, the global marketplace for currency exchange, enables traders to speculate on the relative values of currencies from around the world. The sheer volume and liquidity of the forex market make it an attractive destination for investors seeking short-term profits.

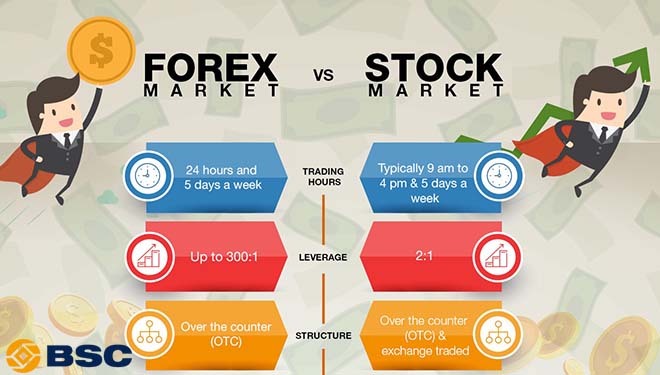

- Limitless Trading Opportunities: Forex operates around the clock, 24 hours a day, 5 days a week, providing ample opportunities for trading regardless of your time zone.

- High Liquidity and Volume: The massive size of the forex market ensures constant liquidity, reducing the risk of slippage and ensuring seamless execution of orders.

- Leverage Advantage: Brokers offer leverage, allowing traders to control a larger position than their account balance, potentially amplifying profits but also magnifying potential losses.

The Interplay of Commodities and Forex: A Dynamic Duo

Commodities and forex, though distinct in their nature, share an intricate relationship that can prove advantageous to astute investors.

- Macroeconomic Factors: Global economic trends and geopolitical events often impact both commodities and forex markets, providing opportunities for coordinated trading strategies.

- Hedging Strategies: Combinations of commodity and currency trades can be employed to offset risks and enhance returns.

- Currency Exposure: Commodities denominated in foreign currencies expose traders to currency risk. Forex trading can be leveraged to mitigate this exposure, ensuring profits are protected against unfavorable exchange rate fluctuations.

Image: xaydungso.vn

Expert Advice for Navigating the Markets: Wisdom from the Wise

Embrace Comprehensive Research: Meticulously research commodities and currencies before investing. Consider historical price trends, supply and demand dynamics, and geopolitical factors to make informed decisions.

Know Your Risk Tolerance: Forex trading involves inherent risks, particularly when utilizing leverage. Determine your risk tolerance and invest only an amount you are comfortable losing.

FAQs: Unraveling Common Queries

Q: Are commodities a safer investment than forex?

A: While commodities offer tangible asset protection, both commodities and forex markets carry inherent risks. The level of safety depends on your investment strategy and risk management approach.

Q: Which is more profitable: commodities or forex?

A: Profitability depends on various factors, including market conditions, trading strategy, and risk tolerance. Neither commodities nor forex consistently outperform the other.

Q: Can I trade commodities and forex simultaneously?

A: Yes, it is possible to trade both commodities and forex simultaneously. However, it requires expertise and a comprehensive understanding of both markets to optimize returns and mitigate risks.

Trading Commodities Vs Forex Reddit

Invitation to Action

Whether you are a seasoned investor or just starting your financial journey, understanding the intricacies of trading commodities and forex is essential to maximize your returns. Research thoroughly, manage risk wisely, and consider the expert advice provided. Embark on a profitable path by exploring the world of commodities and forex trading today!