In the ever-evolving world of financial trading, technical analysis has emerged as an indispensable tool for investors seeking to navigate the intricacies of the Forex market.

Image: howtotrade.com

A Journey into Technical Analysis

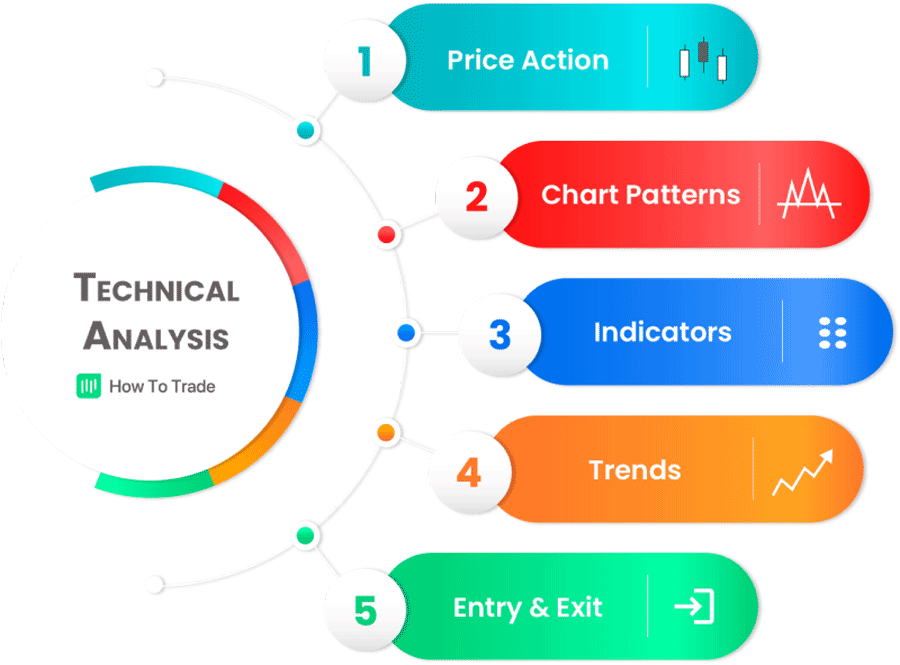

Technical analysis is a discipline that seeks to predict future price movements by examining historical data, price patterns, and statistical indicators. Traders employ a wide range of technical analysis tools, including:

- Chart patterns

- Trendlines

- Moving averages

- Oscillators

- Support and resistance levels

By analyzing these factors, technical analysts aim to identify market trends, predict price reversals, and make informed trading decisions.

Benefits of Technical Analysis

Technical analysis offers several benefits to Forex traders, including:

- Improved trade timing

- Enhanced risk management

- Increased profitability

- Objective and data-driven approach

A Showcase of Technical Analysis Projects

To illustrate the practical applications of technical analysis in Forex trading, let’s delve into a series of successful projects undertaken by industry professionals:

Image: es.noxinfluencer.com

Moving Averages: Forecasting Market Trends

A team of traders utilized moving averages, which are calculated by averaging price data over a specified period, to identify potential price reversals. By combining multiple moving averages (e.g., 50-period, 100-period), they were able to capture both short-term and long-term price trends, enabling them to identify entry and exit points.

Candlestick Patterns: Recognizing Market Sentiment

Another project focused on the analysis of candlestick patterns, which are graphical representations of price movements over a specific period. By studying candlestick patterns, traders can gain insights into market sentiment and identify potential trading opportunities. The project utilized historical data to identify the most profitable candlestick patterns, allowing traders to develop a rule-based trading system.

Support and Resistance: Defining Market Boundaries

A third project explored the concept of support and resistance levels, which are price levels that have historically acted as barriers to price movement. By identifying these levels, traders were able to anticipate potential price reversals and determine when to enter or exit trades. The project also examined the effectiveness of retracement strategies to optimize trade execution.

Latest Trends and Developments in Technical Analysis

Technical analysis is constantly evolving, with new techniques and strategies emerging regularly. Some of the latest trends include:

- Artificial Intelligence (AI) and Machine Learning (ML): These technologies are being applied to develop automated trading systems that can analyze vast amounts of data and make trading decisions.

- Behavioral Finance: Insights from behavioral finance are being incorporated into technical analysis to understand how psychological factors influence market behavior.

- Social Sentiment Analysis: Analysis of social media sentiment is being used to gauge market sentiment and identify potential trading opportunities.

Tips for Successful Technical Analysis

Based on my experience as a blogger, here are some tips for successful technical analysis in Forex trading:

- Master the basics: Develop a solid understanding of chart patterns, indicators, and other technical analysis tools.

- Combine multiple indicators: Use a range of technical indicators to confirm signals and improve trading accuracy.

- Manage risk: Always consider risk management when making trading decisions.

- Stay up-to-date: Keep abreast of the latest trends and developments in technical analysis.

- Practice and backtest: Gain experience and refine strategies through practice and backtesting historical data.

Remember, technical analysis is not a perfect science, and there is no guarantee of success. However, by employing sound principles, staying informed, and continuously improving, traders can increase their chances of making profitable trades in the Forex market.

Frequently Asked Questions

Q: Can anyone learn technical analysis?

Yes, technical analysis is accessible to anyone willing to invest time and effort.

Q: Is technical analysis sufficient for profitable trading?

Technical analysis is a valuable tool, but it should be combined with other factors, such as fundamental analysis and risk management.

Q: How much historical data is necessary for technical analysis?

The amount of historical data required depends on the timeframe and the trading strategy employed.

Q: What are the most important technical indicators?

There is no definitive answer to this question, as different traders have different preferences. Some popular indicators include moving averages, RSI, MACD, and Bollinger Bands.

A Report Based Projects On Technical Analysis In Forex Market

Conclusion

Technical analysis has proven to be a powerful tool for Forex traders seeking to navigate market complexities. By embracing the principles and insights detailed in this report, traders can enhance their decision-making, maximize their profits, and stay abreast of the ever-evolving financial landscape.

Are you interested in exploring technical analysis further? Share your thoughts and experiences in the comments section below.