Have you ever stared at a chart, your heart pounding with anticipation, and wondered how much to invest in a promising stock or cryptocurrency? The fear of losing everything can be paralyzing, especially for those new to the world of trading. But what if there was a way to calculate your risk and maximize your potential profit, all while keeping your financial security intact?

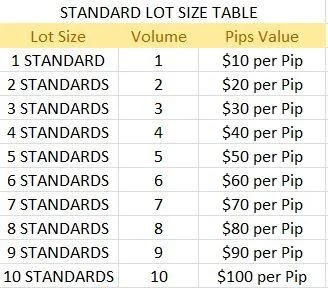

Image: training.csaforex.com

This is where position size calculators come in, offering a lifeline to navigate the tempestuous seas of the market. These powerful tools, coupled with a deep understanding of market indices, are your secret weapons to making informed, calculated decisions, and potentially taking your trading game to the next level.

Understanding the Foundation: Position Size Calculators and Market Indices

Position size calculators are essentially financial tools that help determine the appropriate amount of capital to allocate to a single trade, based on your risk tolerance and the specific asset’s volatility. Imagine it as a compass guiding you through the treacherous waters of the market, ensuring you don’t overextend yourself and navigate safely towards your goals.

Market indices, on the other hand, are statistical measures of the performance of a specific group of assets, providing a comprehensive snapshot of a particular sector or the overall market. Examples include the S&P 500, NASDAQ, and the Dow Jones Industrial Average, each reflecting the performance of different segments of the stock market.

The intersection of these two concepts creates a powerful synergy. Imagine you’re looking to invest in a promising tech stock, but the recent market volatility has you hesitant. With a position size calculator, you can factor in your risk tolerance, the stock’s historical volatility, and the overall market sentiment, reflected by indices like the NASDAQ. This analysis leads to a calculated position size that aligns with your risk and profit expectations, providing a safe and informed entry point into the market.

Delving Deeper: The Benefits of Utilizing a Position Size Calculator and Market Indices

The combination of position size calculators and market indices offers a range of benefits for traders of all levels, from beginners cautiously exploring the market to seasoned veterans seeking to refine their strategy:

- Risk Management: The cornerstone of any successful trading strategy lies in managing risk. Position size calculators empower you to quantify your risk tolerance, translating it into concrete position sizes, preventing you from overextending yourself and potentially facing devastating losses.

- Improved Decision-Making: By factoring in the historical volatility of an asset, combined with the broader market trends reflected by indices, position size calculators provide a more holistic view, leading to more informed and calculated trading decisions.

- Optimized Profit Potential: By taking calculated risks, traders can potentially maximize their profit potential without jeopardizing their capital.

- Increased Confidence & Control: Understandably, uncertainty can be a major deterrent for many aspiring traders. By having a clear understanding of their position size and the broader market sentiment, traders gain a sense of confidence and control over their investments.

Unveiling the Power of Calculators: Practical Applications

Now, let’s move from theory to practice. How can you leverage this powerful combination in your trading journey? Here are some practical applications:

- Day Trading: For day traders who thrive on short-term opportunities, understanding market volatility, reflected by indices like the VIX (Volatility Index), becomes crucial. Position size calculators can help them determine the ideal position size for each day trade, based on their risk appetite and the market’s current temperament.

- Long-Term Investing: Even for long-term investors seeking consistent growth, position size calculators can be incredibly valuable. By factoring in the historical volatility of stocks and market indices, they can determine appropriate allocation levels, ensuring a healthy balance between risk and reward.

- Options Trading: Options trading is often associated with higher risk, but with proper tools, it can be a powerful strategy. Position size calculators help define appropriate position sizes based on the underlying asset’s volatility, strike price, and option’s time decay, providing crucial insights for effective risk management.

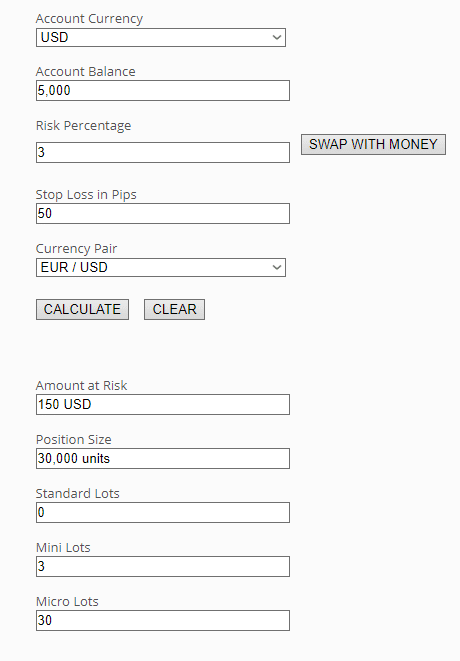

Image: www.keenbase-trading.com

Expert Insights and Actionable Strategies

While these calculators can be powerful tools, it’s essential to understand that they are just that – tools. They offer guidance, but ultimate responsibility for making informed decisions lies with you. Here are some expert insights to consider:

- Start Small and Scale Up: Always, always start with a small position size to test the waters. As you gain experience and confidence, you can gradually increase your position size.

- Embrace Frequent Monitoring: The market is a dynamic beast. Keep a close eye on your positions and use your calculator to adjust your position size as market conditions, reflected in indices, change.

- Diversify: Never put all your eggs in one basket. Diversifying across multiple assets, sectors, and indices significantly reduces overall risk and potentially enhances returns over time.

Position Size Calculator Indices

The Path Forward: Mastering Your Market Presence

As you embark on your trading journey, remember that the tools you choose can make all the difference. By embracing position size calculators and harnessing the power of market indices, you equip yourself with the knowledge and tools to navigate the market efficiently, potentially maximizing profits and minimizing losses.

Don’t be afraid to explore further, learn from experienced traders, and experiment with different strategies and tools. Remember, the market is vast and evolving, but with the right approach and the right tools, you can chart your course towards financial success.