Have you ever wondered how much profit you could potentially make on a Forex trade? I remember when I first started trading, I was so confused by all the numbers and terms. I had no idea how to calculate my potential profits, or even how much I needed to risk. But then I discovered the magic of Forex pip profit calculators. These simple tools can help you take the guesswork out of your trading and make informed decisions.

Image: otrabalhosocomecou.macae.rj.gov.br

This comprehensive guide will delve into the world of Forex pip profit calculators, teaching you everything you need to know to master their usage and boost your trading strategy. From understanding the basics of pips and profit calculations to exploring various calculator types and using them effectively, this guide will empower you to confidently navigate the Forex market and maximize your potential earnings.

Understanding Forex Pips, The Building Blocks of Profit

What are Pips and Why Are They Crucial?

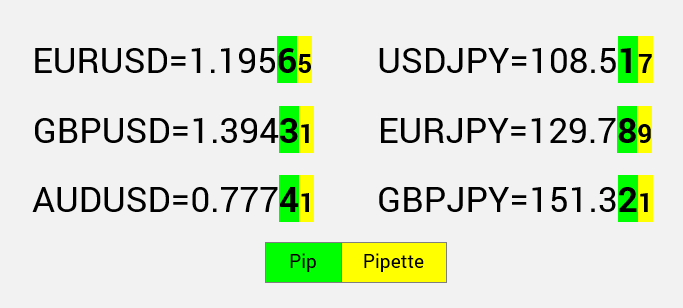

“Pip” stands for “point in percentage,” and it’s the smallest unit of change in a currency pair’s exchange rate. It’s the fundamental unit of measurement used to express the profit or loss generated by a Forex trade. Think of it like the smallest increment on a ruler, measuring the difference in price between two currencies.

To illustrate, consider the EUR/USD (Euro against US Dollar) currency pair. If the exchange rate moves from 1.1000 to 1.1001, that tiny shift in price represents a one-pip movement. While each pip may seem insignificant, when you’re trading large amounts of currency, these small differences can quickly add up, leading to substantial profits or losses.

Calculating Your Profit: The Power of Pip Value

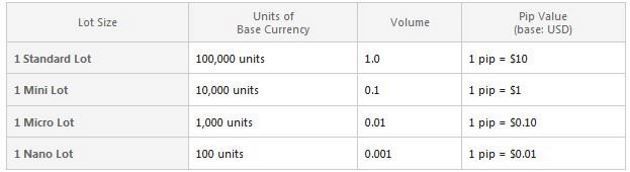

The value of a pip varies depending on the specific currency pair, the size of your trade (lot size), and the broker’s margin requirements. The key to unlocking your trading potential lies in understanding how to calculate the pip value for your specific trading scenario.

For example, if you buy 1 standard lot of EUR/USD at 1.1000 and then sell it at 1.1010, you have made a 10-pip profit. But how much money does that translate to? The pip value depends on the account currency, lot size, and current exchange rates. For instance, if your account currency is USD and the pip value is $10 per pip, your 10-pip profit would yield $100 in profit.

Image: www.vidial-ngo.com

Image: www.vidial-ngo.comNavigating the World of Forex Pip Profit Calculators

Understanding Different Calculator Types

The Forex market offers a wide range of calculators for various purposes. The most common types include:

- Basic Pip Profit Calculators: These calculators provide a straightforward estimate of your potential profit based on entering your trade details such as currency pair, lot size, and entry/exit prices. They are perfect for quick estimations.

- Advanced Pip Profit Calculators: These calculators offer a more in-depth analysis by incorporating factors like leverage, margin requirements, swap rates, and commissions to provide a precise calculation of your potential profit.

- Stop-Loss and Take-Profit Calculators: These tools help you set realistic and effective stop-loss and take-profit levels for your trades, ensuring you manage your risk and protect your profits.

- Pip Calculator Spread Analyzers: These specialized calculators assess the impact of the spread (the difference between the bid and ask price) on your profit potential, allowing you to choose currency pairs with lower spreads for more profitable trading.

Using Pip Calculators Effectively

Using a pip calculator is relatively simple. Most calculators have user-friendly interfaces that require you to input basic information about your trade, such as:

- Currency pair (e.g., EUR/USD, GBP/USD)

- Lot size (e.g., mini lot, standard lot)

- Entry price

- Exit price

- Account currency (e.g., USD, EUR)

Once you’ve entered these details, the calculator will automatically calculate your potential profit or loss, expressed in your preferred currency.

Tips and Expert Advice for Maximizing Pip Profit

While a pip profit calculator is a valuable tool, it’s essential to remember that it’s only one piece of the puzzle. Here are some expert tips to maximize your trading success:

- Understand the Market Dynamics: Before you even think about calculating pips, you need to understand the forces driving the Forex market. Research the economic indicators, political events, and news that can influence currency prices.

- Master Risk Management: It’s crucial to manage your risk effectively to protect your capital. Determine your risk tolerance and set realistic stop-loss orders to limit potential losses on each trade.

- Choose the Right Broker: The broker you select significantly impacts your trading experience. Look for reputable brokers with competitive spreads, reliable platforms, and excellent customer support.

- Leverage Your Knowledge: Forex trading requires continuous learning and adaptation. Stay updated on industry news, attend webinars, and read financial publications to refine your trading strategies.

- Embrace Patience and Discipline: Consistent profitability in Forex trading is a marathon, not a sprint. Avoid chasing profits and stick to your predetermined trading plan. It’s essential to be patient, disciplined, and manage your emotions.

By understanding the market dynamics, effectively managing risk, choosing the right broker, and constantly expanding your knowledge, you can transform your trading journey and achieve consistent profitability.

Frequently Asked Questions (FAQ)

Q: What is the difference between pips and points?

Points and pips are similar concepts but can have different meanings depending on the market. In Forex, pip refers to the smallest change in a currency pair’s exchange rate, while points are used in other markets, such as gold, silver, and oil.

Q: How do I calculate the pip value for a specific currency pair?

The pip value depends on the specific currency pair, lot size, and the current exchange rate. Many online tools and calculators can help you determine the pip value for your chosen currency pair.

Q: Do all Forex brokers offer pip profit calculators?

Not all Forex brokers offer built-in pip profit calculators. Some brokers may provide this feature through their trading platforms, while others may recommend using third-party calculators.

Q: Is it necessary to use a pip profit calculator for successful Forex trading?

While it’s not strictly required, a pip profit calculator can be a valuable tool for understanding your potential profit or loss and managing your risk effectively.

Q: Are there any free pip profit calculators available?

Yes, there are plenty of free pip profit calculators available online. Many reputable Forex websites and brokers offer free calculators with various features and functionalities.

Forex Pip Profit Calculator

Conclusion

Mastering the art of Forex trading involves understanding pips, leveraging pip profit calculators, and managing risk effectively. This guide equips you with the knowledge and tools to navigate the world of Forex trading with confidence. By understanding pip calculations, utilizing relevant calculators, and implementing effective strategies, you can capitalize on the opportunities offered by the Forex market.

Are you ready to take your Forex trading to the next level with the help of pip profit calculators? Let us know in the comments below!