Demystifying Forex Trading Platforms: A Gateway to Global Markets

The world of finance is vast and complex, with countless avenues to explore. One such domain that captivates traders worldwide is forex trading, the exchange of currencies on a global scale. At the heart of this exciting journey lies the crucial element of a forex trading platform. These digital gateways provide a user-friendly interface for accessing market data, executing trades, and managing your portfolio. But with so many platforms vying for your attention, how do you navigate this landscape and find the perfect match for your trading goals?

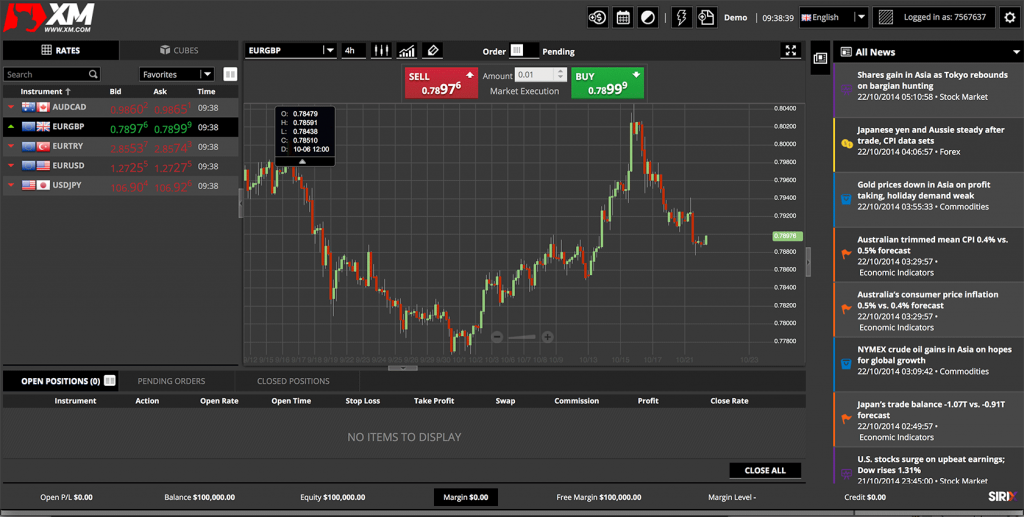

Image: www.btcc.com

This comprehensive guide delves into the intricacies of forex trading platforms, offering insights into their features, functionalities, and the factors you should consider before making a selection. Whether you’re a seasoned trader or just starting your financial journey, understanding the nuances of these platforms is essential for success in the forex market.

Unveiling the World of Forex Trading Platforms

Defining Forex Trading Platforms: Your Digital Trading Hub

Forex trading platforms serve as the bridge between traders and the global currency market. They provide a structured environment for executing trades, analyzing market trends, and managing your financial positions. Think of them as your command center, equipped with all the tools you need to navigate the volatile world of currency exchange.

A Historical Journey: From Traditional Brokers to Digital Revolution

The evolution of forex trading platforms has been a fascinating journey. Before the advent of online trading, traders relied on traditional brokers who executed orders manually via phone. The introduction of online platforms revolutionized the industry, allowing instant access to markets and real-time price information. This digital transformation further led to the development of advanced platforms packed with sophisticated features like automated trading, charting tools, and economic calendars.

Image: www.youtube.com

Key Components of a Comprehensive Forex Trading Platform

A robust forex trading platform should offer a diverse set of functionalities to cater to the needs of various traders. These key components include:

- Order Execution: The platform’s ability to process your trades efficiently and accurately is paramount. Look for platforms with reliable order execution engines and a clear understanding of slippages and spreads.

- Trading Instruments: A variety of currency pairs, metals, commodities, and indices should be available to broaden your trading opportunities.

- Charting and Technical Analysis Tools: Advanced charting packages with customizable indicators and drawing tools empower you to analyze market trends and identify trading opportunities.

- Market News and Economic Calendar: Stay ahead of the curve with real-time market news and economic data releases that can influence currency movements.

- Educational Resources: Platforms that offer articles, tutorials, and webinars help both beginners and experienced traders enhance their skills and knowledge.

- Customer Support: Prompt and responsive support is invaluable for resolving queries and navigating any challenges you encounter.

Navigating the Landscape: Choosing the Right Forex Trading Platform

With a plethora of forex trading platforms available, selecting the one that aligns with your needs and trading style is crucial. Key factors to consider include:

1. Trading Experience Level:

- Beginners: Simplicity and user-friendliness should be priorities. Platforms with intuitive interfaces, comprehensive tutorials, and demo accounts are ideal for learning the ropes.

- Experienced Traders: Advanced features like automated trading, custom indicators, and robust charting tools are essential for maximizing profits.

2. Trading Style:

- Scalpers: Platforms with lightning-fast order execution and minimal latency are crucial for quick in-and-out trades.

- Day Traders: Real-time price updates, advanced charting tools, and economic calendar features are essential for short-term trading decisions.

- Swing Traders: Platforms with flexible order types and risk management tools aid in managing positions over longer time frames.

3. Platform Fees and Commissions:

Understand the cost structure associated with each platform. Compare deposit fees, trading commissions, inactivity fees, and withdrawal fees to find a platform that offers competitive pricing.

4. Security and Regulation:

Prioritize platforms that prioritize security measures and are regulated by reputable financial authorities. Look for features like two-factor authentication, encryption, and secure data storage.

5. Customer Support and Resources:

Evaluate the quality of customer support offered by each platform. Availability through phone, email, live chat, and FAQs can make all the difference when you need assistance.

Emerging Trends and Innovations in Forex Trading Platforms

The landscape of forex trading platforms is constantly evolving. Here are some prominent trends shaping the future of the industry:

1. Artificial Intelligence (AI) and Machine Learning:

AI-powered platforms can analyze vast amounts of data to identify patterns, predict price movements, and optimize trading strategies. They offer personalized insights, automated trading tools, and risk management features.

2. Mobile Trading Applications:

The rise of mobile trading apps has made forex accessible from anywhere, anytime. These apps offer seamless integration with desktop platforms and provide access to essential trading tools on the go.

3. Social Trading and Copy Trading:

Platforms that allow you to follow and copy the trades of successful traders can be a valuable resource for learning and growing your trading skills.

Expert Insights and Tips for Navigating Forex Trading Platforms

Based on my experience, here are some key tips for maximizing your use of forex trading platforms:

1. Start with a Demo Account:

Familiarize yourself with the platform’s interface, features, and trading mechanics without risking real capital. Demo accounts offer a risk-free environment to hone your trading strategies.

2. Prioritize Security and Regulation:

Never compromise on the security of your funds. Choose platforms regulated by reputable financial authorities and utilize strong passwords and two-factor authentication.

3. Utilize Research and Educational Resources:

Take advantage of the educational resources offered by the platform, including articles, videos, and webinars. Continuously expanding your knowledge is crucial for success in the forex market.

4. Stay Informed and Adapt:

The forex market is constantly evolving. Stay up-to-date on industry trends, technological advancements, and regulatory changes to ensure you are always adapting and optimizing your trading approach.

Frequently Asked Questions (FAQs)

Q: What are the best forex trading platforms for beginners?

A: For beginners, platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and eToro are popular choices due to their user-friendly interfaces, comprehensive tutorials, and demo accounts.

Q: What are the main differences between MT4 and MT5?

A: MT4 is a robust platform known for its simplicity, reliability, and extensive customization options. MT5 offers more instruments, advanced trading features, and economic calendar tools.

Q: Are forex trading platforms safe?

A: While forex trading platforms are generally safe, choosing regulated platforms with robust security measures is vital. Research the regulatory authority and inquire about encryption, two-factor authentication, and data security practices.

Q: How can I find the best platform for my trading style?

A: Analyze your trading frequency, risk tolerance, and technical preferences. Consider the features offered by each platform, such as charting tools, order types, and automated trading capabilities.

Q: What are some popular forex trading platforms with high-quality customer support?

A: Platforms like Forex.com, FXCM, and Oanda are known for their dedicated customer support teams available through phone, email, live chat, and FAQs.

Forex Trading Platforms

In Conclusion

Choosing the right forex trading platform is a critical step in your trading journey. Whether you’re a beginner or a seasoned trader, understanding the key features, functionalities, and industry trends can help you make an informed decision. Remember to prioritize safety, ease of use, and the availability of educational resources.

Are you ready to embark on your forex trading adventure? Explore our website for more insightful articles and resources.