**

Image: blog.myfxbook.com

In the dynamic world of currency exchange, the spread has emerged as a pivotal concept that can significantly impact traders’ profits and losses. This article delves into the spread, exploring its recent surge in forex markets and its implications for traders.

Introduction to the Spread

The spread refers to the difference between the bid price and the ask price of a currency pair. Simply put, the bid price is the price at which a broker is willing to buy a currency, while the ask price is the price at which they are willing to sell. This spread represents the broker’s profit margin and covers their operational costs.

Traditionally, the spread was negligible for major currency pairs, allowing traders to reap maximum gains from exchange rate fluctuations. However, in recent years, a confluence of factors has led to a significant widening of spreads in the forex market.

Factors Driving the Spread Increase

The recent surge in spreads can be attributed to several key factors:

-

Interest Rate Volatility: Fluctuating interest rates can create uncertainty in currency markets, making it more challenging for brokers to accurately price currencies. This uncertainty is reflected in wider spreads.

-

Increased Regulatory Oversight: Stringent regulations have forced brokers to increase their capital reserves and adopt more stringent risk management practices. These measures add to the brokers’ operational costs, which are passed on to traders in the form of wider spreads.

-

Technological Advancements: The proliferation of high-frequency trading (HFT) algorithms and automated trading systems has increased the demand for liquidity, which drives up spreads. HFTs execute lightning-fast trades, competing with manual traders in real time.

Implications for Traders

The widening spread has profound implications for forex traders:

-

Reduced Profitability: Wider spreads reduce the potential profit margin for traders by eating into their gains.

-

Increased Transaction Costs: Each spread represents an additional cost that traders must factor into their trading decisions.

-

Difficulty in Market Entry: New traders may find it more difficult to enter the market due to the higher transaction costs associated with wider spreads.

Mitigation Strategies

Despite the challenges posed by wider spreads, traders can implement certain strategies to mitigate their impact:

-

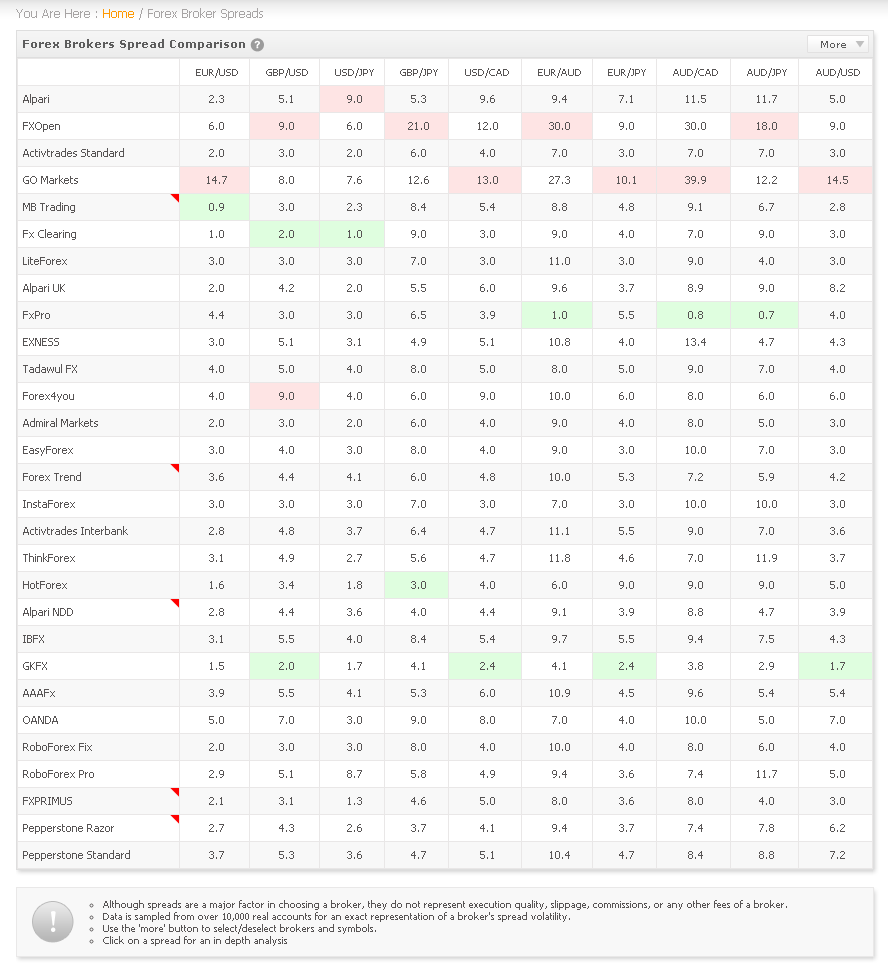

Choose Lower-Spread Brokers: Traders should research and select brokers that offer narrow spreads for their preferred currency pairs.

-

Optimize Trade Entry and Exit Points: Identify market conditions with narrower spreads and execute trades accordingly.

-

Use Limit Orders: Limit orders allow traders to specify the maximum spread they are willing to accept, reducing potential losses if the spread widens unexpectedly.

-

Explore Alternative Trading Instruments: Consider using contracts for difference (CFDs) or other financial instruments that may offer lower spreads.

Conclusion

The widening spread in the forex market is a significant trend that has altered the trading landscape for both experienced and aspiring traders. Understanding the factors driving this surge and implementing the appropriate mitigation strategies is crucial for traders to navigate the market effectively. By embracing these strategies, traders can minimize the impact of wider spreads and continue to pursue profitable trading opportunities.

Image: topforexbrokers.com

The Spread Have Increased In Forex