Introduction:

Image: www.beyond2015.org

Navigating the turbulent waters of the foreign exchange (forex) market demands a keen eye for identifying trends that drive price movements. Understanding these trends empowers traders with the foresight to make informed decisions and maximize their trading potential. In this comprehensive guide, we will delve into the intricacies of price trend determination, equipping you with the essential techniques to decode market behavior and optimize your forex trading strategies.

Forecasting price trends in forex is akin to unearthing hidden treasure—a skill that transforms traders from passive market observers into active market players. By mastering these techniques, you can unlock the secrets to predicting future price movements, gaining a significant advantage over your peers. Let’s embark on this journey of discovery, armed with the knowledge that will elevate your forex trading endeavors to new heights.

Section 1: Technical Analysis – The Art of Unveiling Market Rhythms

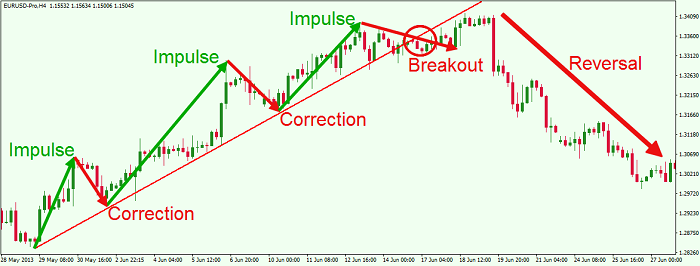

The foundation of price trend determination lies in technical analysis, the study of historical price data to uncover patterns and relationships that provide insights into future price movements. This method relies on the assumption that these patterns tend to repeat over time, allowing traders to identify potential trading opportunities.

Section 2: Trend Following Indicators – Illuminating the Path Ahead

Trend following indicators are invaluable tools for identifying and capturing ongoing trends. These indicators measure trend strength and momentum, providing traders with a clear understanding of the market’s overall direction. Popular trend following indicators include moving averages, Bollinger Bands, and the Ichimoku Cloud.

Section 3: Volume Analysis – Unveiling the Hidden Force

Volume analysis plays a crucial role in understanding the true intentions of the market. It measures the number of transactions occurring at each price level, offering valuable insights into the strength of buying and selling pressure. High volume during an uptrend signals strong buying interest, while high volume during a downtrend indicates intense selling pressure.

Section 4: Support and Resistance Levels – Defining Market Boundaries

Support and resistance levels are pivotal areas on a price chart where the price has historically reversed or paused its movement. These levels act as crucial boundaries within which the price oscillates, providing traders with valuable information about potential areas of price reversal or breakout.

Section 5: Chart Patterns – Identifying Predefined Market Behavior

Chart patterns are recognizable formations on a price chart that suggest the prevailing direction of the market. By identifying these patterns, traders can anticipate potential trend reversals or continuations. Common chart patterns include flags, triangles, and head-and-shoulders.

Section 6: Candlestick Analysis – Reading the Story behind the Bars

Candlestick analysis is a powerful technique that visually represents price action through candlestick patterns. These patterns provide valuable insights into market sentiment, momentum, and potential trend reversals. By understanding candlestick patterns, traders can better gauge the underlying forces driving the market.

Section 7: Sentiment Indicators – Tapping into the Market Pulse

Sentiment indicators measure the overall sentiment of market participants, whether they are bullish or bearish. These indicators are helpful in identifying potential trend reversals or confirming existing trends. Popular sentiment indicators include the Commitment of Traders (COT) report and the Relative Strength Index (RSI).

Section 8: Fundamental Analysis – Uncovering the Underlying Forces

While technical analysis focuses on historical price data, fundamental analysis examines macroeconomic factors that can impact currency values and price trends. These factors include interest rates, economic growth, inflation, and political events. By considering the underlying fundamentals, traders can better gauge the long-term direction of the market.

Conclusion:

Mastering the techniques for determining price trends in forex is a journey that empowers traders to navigate the complexities of the market with greater precision and conviction. By integrating technical, fundamental, and sentiment analysis into your trading repertoire, you can gain a deeper understanding of market dynamics and make more informed trading decisions. Remember, the pursuit of knowledge in forex trading is an ongoing endeavor, and the more you immerse yourself in the art of price trend determination, the closer you will come to unlocking the secrets of market success

Image: www.dreamstime.com

Techniques For Determining The Trend Of Price In Forex