Ever wondered what makes a stock skyrocket one day and plummet the next? Or why a company with seemingly brilliant ideas struggles to attract investors? The answer lies in the intricate interplay of forces that drive share price, a constantly shifting landscape influenced by everything from company performance to global events.

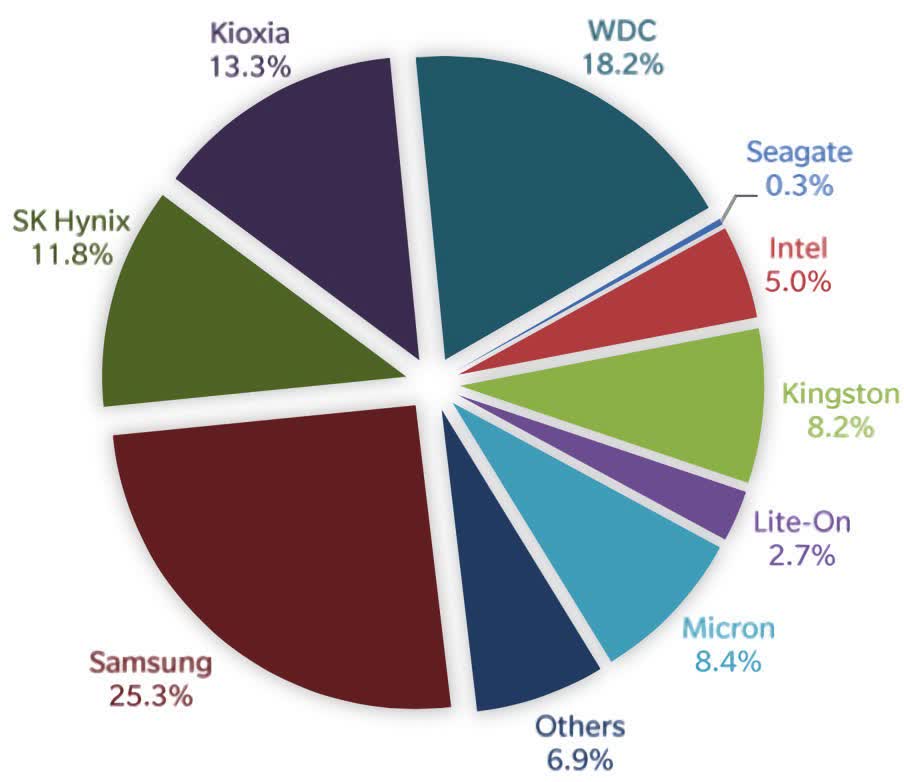

Image: mybroadband.co.za

Understanding the factors that affect share price is not just for seasoned investors. Whether you’re a casual observer of the stock market or someone looking to invest for the future, comprehending these drivers offers invaluable insights into the world of finance and can help you navigate the often turbulent waters of the market.

The Fundamentals: What Makes a Company Valuable

At its core, a share price reflects the market’s perception of a company’s value. This value is determined by a blend of fundamental factors:

Earnings and Profitability:

A company’s profitability is a key driver of share price. Investors want to see companies generating consistent profits, demonstrating their ability to turn revenue into earnings. Growing earnings typically indicate good management, strong demand for products or services, and a healthy financial position – all of which signal good prospects for future growth.

Revenue Growth:

While profitability is essential, investors also look for companies that can consistently increase their revenue. A company generating higher revenue often means it’s capturing a larger market share, expanding into new markets, or successfully introducing new products or services. This growth signals potential for future earnings expansion.

Image: www.techspot.com

Financial Strength:

Beyond profitability, a company’s overall financial health is crucial. Investors want to see companies with strong cash flow, manageable debt levels, and a healthy balance sheet. This financial stability indicates a company’s resilience during economic downturns and the ability to weather unforeseen challenges.

Market Sentiment and Investor Confidence

While fundamentals are the bedrock, the market’s perception of a company can significantly impact its share price. This perception is shaped by various factors, collectively known as market sentiment:

Investor Confidence:

Overall investor confidence in the economy, specific industries, and individual companies plays a huge role. When sentiment is high, investors are more likely to buy stocks, driving prices up. Conversely, negative sentiment can lead to selling pressure and lower prices.

News and Events:

Major news events, regulatory changes, and industry developments can significantly impact investor confidence. Positive news like product launches, successful mergers, or favorable regulatory changes can boost a company’s share price. Conversely, negative news such as regulatory probes, legal issues, or disappointing earnings reports can lead to declines.

Analyst Recommendations:

Financial analysts closely follow companies and issue ratings and price targets. These recommendations can influence investor sentiment. A positive recommendation from a respected analyst can boost a stock’s price, while a negative one can lead to investor selling.

Technical Factors: The Art of Charting

Technical analysis focuses on price patterns and trading volume to identify potential trends in share prices. This approach looks at historical data and patterns to predict future movement, often using charts and indicators:

Moving Averages:

Moving averages are a popular technical indicator that smooths out price fluctuations, making it easier to spot trends. The most common moving averages are 50-day and 200-day averages. When the price crosses above a moving average, it suggests a bullish trend, while crossing below indicates a bearish trend.

Relative Strength Index (RSI):

The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A reading above 70 suggests overbought conditions, where a price correction might be imminent. Conversely, a reading below 30 signals overselling, indicating a potential price rebound.

Trend Lines:

Trend lines are lines connecting price peaks and troughs to identify the overall direction of a stock’s price. A bullish trend line connects higher lows, while a bearish trend line connects lower highs. Breakouts from trend lines can signal a change in the prevailing trend.

External Influences: Beyond the Company

While company-specific factors are essential, external influences can play a significant role in shaping the market and, consequently, individual share prices:

Economic Conditions:

The overall economic health of the country and the global economy can impact stock prices. Strong economic growth often leads to higher investor confidence and increased stock prices. Conversely, economic downturns or recessions can lead to lower investor confidence and decreased stock prices.

Interest Rates:

Interest rates have a significant impact on the cost of borrowing and the attractiveness of investments. Higher interest rates can make borrowing more expensive for companies, which can negatively impact profitability and growth. Lower interest rates can stimulate borrowing and investment, leading to potentially higher share prices.

Geopolitical Events:

Global events like wars, political instability, or trade disputes can create uncertainty in the market and impact investor sentiment. Such events can lead to market volatility and unpredictable stock price movements.

Inflation:

High inflation erodes purchasing power and can lead to rising interest rates, impacting both company profits and investor confidence. Companies facing rising costs and reduced consumer spending might see their share prices decline.

The Power of Supply and Demand

At its core, the stock market operates on the basic principles of supply and demand. When demand for a stock exceeds the supply, the price rises. Conversely, when supply surpasses demand, the price falls. Several factors contribute to this dynamic:

Investor Sentiment:

Positive investor sentiment fuels demand for a stock, driving up the price. Conversely, negative sentiment can lead to selling pressure, increasing supply and decreasing price.

Trading Activity:

High trading volume often indicates significant investor interest, which can push prices higher. Conversely, low volume suggests less interest and potentially weaker price movements.

Short Selling:

Short-sellers borrow shares and sell them in the market, hoping to buy them back at a lower price later. If short-selling activity is prevalent, it can create additional selling pressure and decrease stock prices.

What Drives Share Price

Navigating the Market with Knowledge

Understanding the forces that drive share price is essential for anyone navigating the stock market. Whether you’re a long-term investor or a short-term trader, comprehending these factors can help you make informed decisions and maximize your investment potential. By paying attention to company fundamentals, market sentiment, technical analysis, and external influences, you can gain valuable insights into the market and make more confident investment choices.

Remember, the stock market is a complex and ever-changing environment. Staying informed and constantly adapting your strategies based on evolving market conditions is crucial for success. Keep exploring, learning, and investing wisely!