Supply and Demand in Forex Trading: A Comprehensive Guide to Reading the Market

Image: learnpriceaction.com

Introduction:

In the realm of currency trading, understanding supply and demand is paramount. It’s the lifeblood that drives price movements, enabling you to discern the ebb and flow of the market with precision. This guide will delve into the intricacies of supply and demand, empowering you to decode market patterns, anticipate price action, and seize trading opportunities.

The Basics of Supply and Demand:

Imagine a marketplace where buyers (demand) and sellers (supply) interact. When demand exceeds supply, prices tend to rise. Conversely, when supply surpasses demand, prices generally fall. This fundamental principle dictates the behavior of the currency exchange market.

How to Identify Supply and Demand Zones:

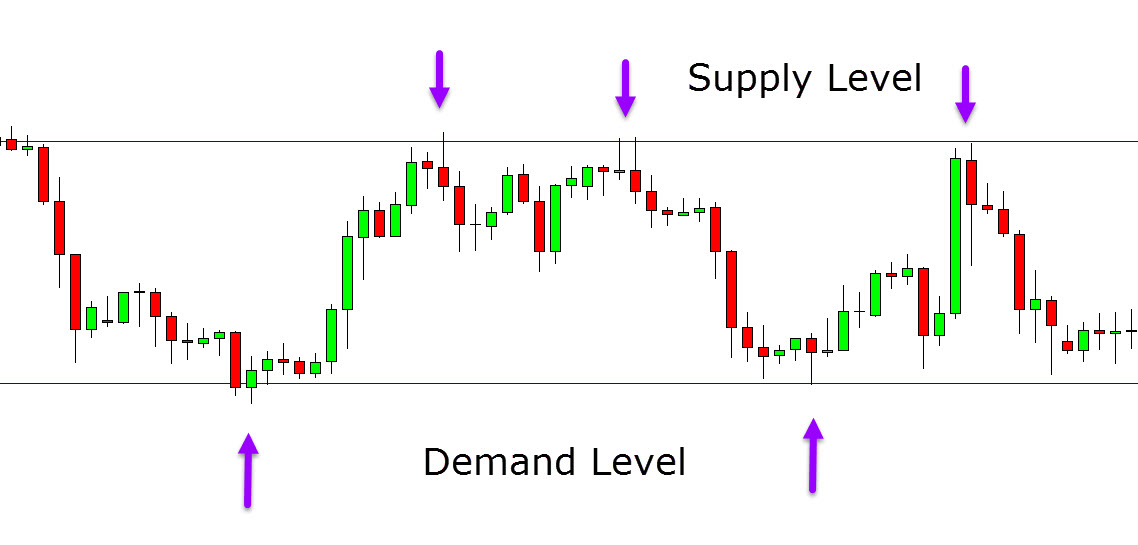

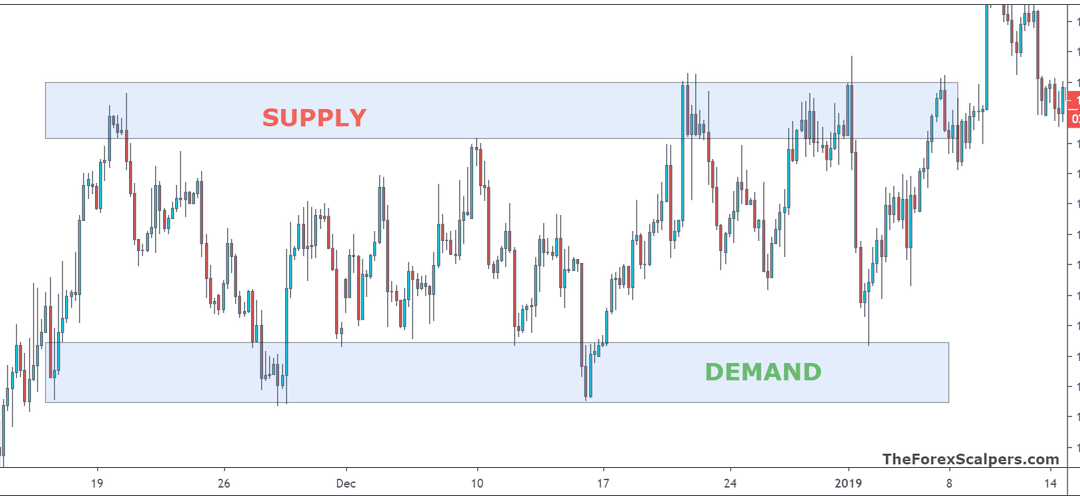

Technical analysis plays a crucial role in identifying supply and demand zones. Traders often observe price action on charts to locate areas where buying or selling pressure has been intense.

Supply zones, or resistance levels, indicate where the market has repeatedly failed to move higher. Demand zones, or support levels, represent areas where the market has consistently found buyers. Understanding these levels provides insights into potential price reversals and trading opportunities.

Reading Candlestick Patterns:

Candlestick patterns are graphical representations of price action. They provide visual cues that can suggest the presence of supply and demand forces. For example, a bullish engulfing pattern suggests a surge in demand, while a bearish engulfing pattern indicates increased supply.

Expert Insights and Actionable Tips:

- Trend Following: When identifying supply and demand zones, consider the prevailing market trend. If the overall trend is up, supply zones become areas to watch for potential shorting opportunities. In a downtrend, demand zones present potential long positions.

- Risk Management: Always implement proper risk management strategies to mitigate potential losses. Use stop-loss orders to limit your downside exposure and take-profit orders to lock in gains.

- Beware of False Breakouts: Sometimes, price action may break through supply or demand levels only to reverse course. False breakouts can be frustrating but can be reduced by using confirmation techniques, such as waiting for a retest of the broken level.

Conclusion:

Mastering the concept of supply and demand is essential for successful forex trading. By understanding how buying and selling pressures interact, traders can make informed decisions, anticipate market movements, and identify lucrative trading opportunities. This guide has laid the foundation for your journey towards becoming a savvy forex trader. Remember, knowledge is power, and the market rewards those who arm themselves with it. So, delve into the world of supply and demand, refine your analytical skills, and unlock the secrets of profitable forex trading.

Image: theforexscalpers.com

Supply And Demand Forex Tutorial Pdf