Introduction:

Image: forums.babypips.com

Navigating the dynamic world of forex trading requires traders to anticipate market movements with precision. Identifying strong and weak market conditions is crucial for making informed trading decisions and maximizing returns. The strong market vs. weak market alert forex indicator serves as an invaluable tool in this regard, providing traders with real-time insights into market strength and weakness. This article delves into the concept, functionality, and advantages of using this indicator to stay ahead in the forex market.

Understanding Strong and Weak Markets

In forex trading, a strong market refers to a market condition characterized by a clear trend, either bullish or bearish. The price action exhibits a sustained momentum, and traders can confidently ride the trend for potential gains. Conversely, a weak market lacks a clear directional bias, and the price action fluctuates indecisively within a range. In such markets, traders face challenges finding profitable trading opportunities.

Function and Mechanics of the Strong Market vs. Weak Market Alert Indicator

The strong market vs. weak market alert forex indicator is a technical indicator designed to assist traders in identifying and classifying market conditions as strong or weak. It operates based on historical price data and various technical analysis techniques to assess market momentum, volatility, and trend strength. When the indicator generates a strong market alert, it signals a market with a clear trend and increased volatility, providing traders with the confidence to take trend-following trades. Conversely, a weak market alert indicates a lack of market direction and volatility, suggesting caution and avoidance of aggressive trading strategies.

Advantages of Using the Strong Market vs. Weak Market Alert Indicator

Traders utilizing the strong market vs. weak market alert forex indicator gain several advantages:

-

Informed Trading Decisions: The indicator provides real-time alerts about prevailing market conditions, empowering traders to make informed decisions based on market strength and weakness.

-

Increased Trade Success Rate: By identifying strong market conditions, traders can capitalize on trending markets and increase their chances of successful trades.

-

Risk Management: The indicator helps traders avoid weak market conditions, where profitability is challenging, and the risk of losses increases.

-

Improved Market Timing: The alert feature provides timely notifications, allowing traders to enter and exit trades at optimal market conditions.

-

Trend Confirmation: The indicator confirms existing market trends or provides early warnings of impending trend changes, helping traders to stay ahead of the market.

Image: topfxmanagers.com

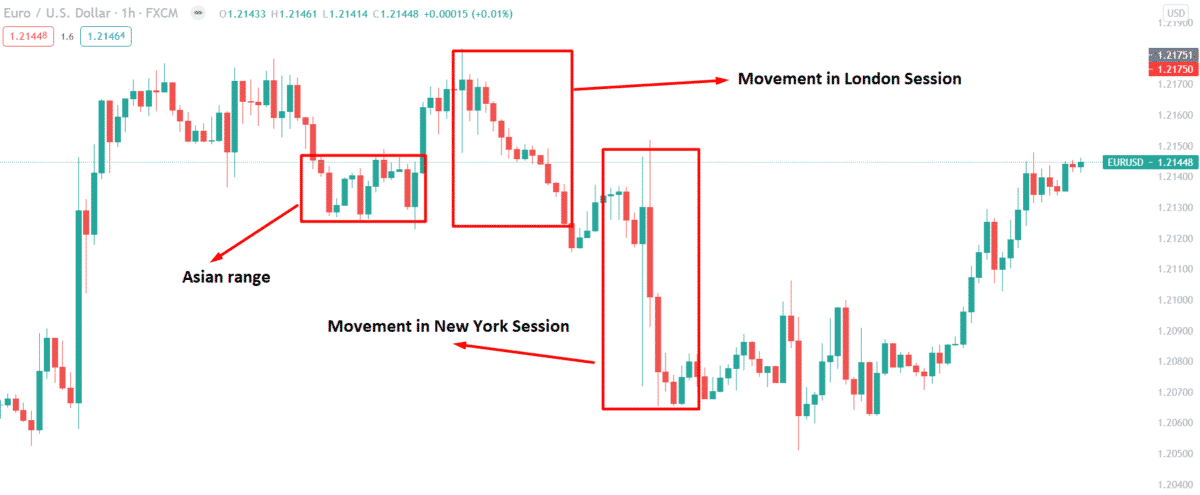

Examples of Trading with a Strong Market vs. Weak Market Alert Indicator

Consider the following real-world examples:

-

Strong Market: The indicator generates a strong market alert when the price action shows a clear uptrend or downtrend, accompanied by high volatility. Traders can then enter buy or sell positions following the trend with higher confidence.

-

Weak Market: The indicator issues a weak market alert when the price action consolidates within a range with indecisive movement. Traders should exercise caution, avoid initiating new positions, or consider exiting existing trades to minimize losses.

Recent Trends and Advancements in Strong Market vs. Weak Market Alert Indicators

As the forex market evolves, traders have access to increasingly sophisticated strong market vs. weak market alert indicators. Recent innovations include:

-

Real-Time Data Analysis: Advanced indicators incorporate real-time data to provide up-to-date insights into market conditions.

-

Multiple Timeframe Analysis: Traders can now apply the indicator across multiple timeframes, enabling them to capture long-term trends and short-term market fluctuations.

-

Customization: Some indicators allow for customization, offering traders the flexibility to tailor the alert parameters to suit their trading style and risk tolerance.

Strong Market Vs Weak Market Alert Forex Indicator

Conclusion: Empowering Traders with Timely Market Insights

The strong market vs. weak market alert forex indicator is an invaluable tool that empowers traders in navigating the dynamic and volatile world of forex trading. By providing real-time insights into market conditions, the indicator helps traders identify strong market trends, avoid weak markets, and make informed trading decisions to enhance their profit potential. As the forex market continues to evolve, traders can expect even more sophisticated and refined strong market vs. weak market alert indicators to emerge.