As an avid forex trader, I’ve experienced the exhilarating highs and frustrating lows that come with navigating the dynamic currency market. One of the most crucial factors that can impact trading success is understanding the strength and weakness of currencies. That’s where a forex currency strength meter comes in.

Image: bestforexeaonthemarket.blogspot.com

Forex Currency Strength Meter: A Tool to Track Market Dynamics

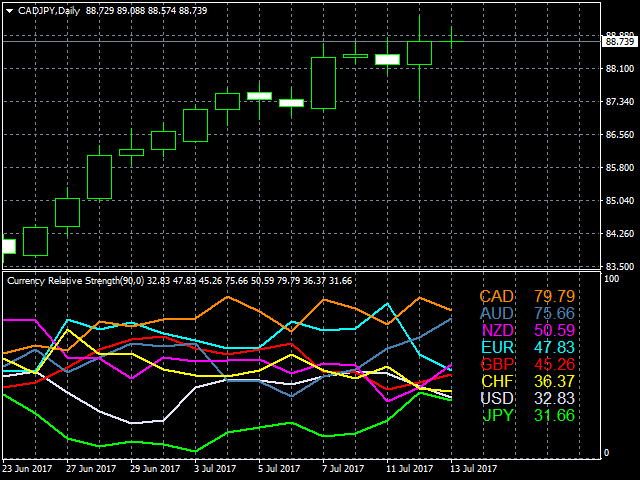

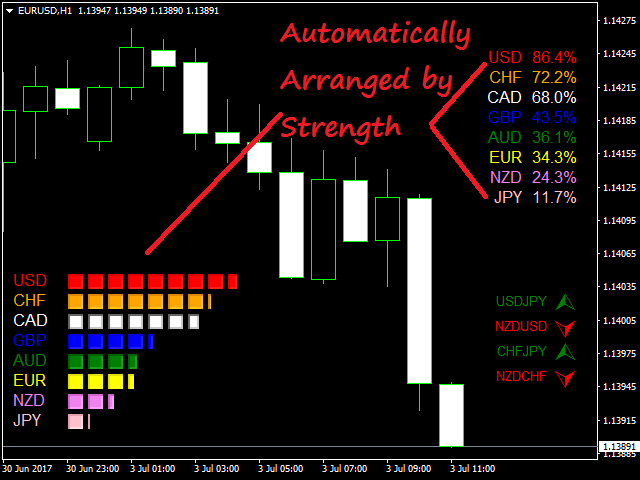

A forex currency strength meter is an invaluable tool that provides traders with a real-time snapshot of the relative strength or weakness of currencies compared to one another. This information is essential for making informed trading decisions and minimizing potential losses.

These meters typically calculate the strength or weakness of a currency based on a combination of economic indicators, market sentiment, and technical analysis. By taking into account various data points, these tools provide traders with comprehensive insights into currency movements.

Comprehensive Guide to Forex Currency Strength Meters

To understand the significance of forex currency strength meters, we need to delve into their definition, history, and meaning.

Definition and Significance

Forex currency strength meters are automated systems that assess the relative strength or weakness of currencies in the foreign exchange market. They provide traders with a visual representation of currency fluctuations, enabling them to identify potential trading opportunities.

Image: forextradingyields.blogspot.com

Historical Evolution and Impact

The concept of currency strength meters has been around for decades. However, the advent of advanced computing technologies has led to the development of sophisticated tools that offer real-time and accurate currency analysis.

Meaning for Forex Traders

Forex currency strength meters hold immense value for traders. By understanding the strength or weakness of currencies, traders can make informed decisions based on the dynamics of the market. This information empowers them to capitalize on potential opportunities and manage risks effectively.

Latest Trends and Emerging Insights

The forex market is constantly evolving, and so too are the tools and techniques used by traders. Here are some of the latest trends in forex currency strength meters:

- Advanced Artificial Intelligence (AI): AI-powered tools are transforming currency strength meters by automating data analysis and providing predictive insights.

- Real-Time Sentiment Analysis: These tools incorporate sentiment analysis from social media, news feeds, and other sources to gauge market sentiment and identify potential trends.

- Cross-Platform Availability: Currency strength meters are now accessible on various platforms, including web, mobile, and desktop applications, enhancing their convenience and usability.

Tips and Expert Advice for Forex Currency Strength Meters

Leverage these tips to maximize the benefits of forex currency strength meters:

- Consider Multiple Factors: Remember that currency strength meters are only one part of your trading strategy. Consider other factors such as economic indicators, news events, and technical analysis.

- Use with Caution: While these meters provide valuable insights, they are not foolproof. Treat them as a guide rather than a definitive indicator of market direction.

- Monitor Currency Correlations: Pay attention to the correlations between different currencies. A strong correlation can indicate a trend or influence the performance of other currencies.

Frequently Asked Questions (FAQs)

Q: How do forex currency strength meters work?

A: These meters analyze various economic data, including interest rates, inflation, gross domestic product (GDP), and other indicators to assess the strength or weakness of currencies.

Q: Are forex currency strength meters accurate?

A: While they provide valuable insights, these meters are not 100% accurate. They rely on algorithmic analysis and can be influenced by market volatility and unforeseen events.

Q: How can I use forex currency strength meters effectively?

A: Use these meters as a tool for research and analysis, but not as a sole source of trading decisions. Combine their insights with your knowledge of the market and other trading strategies.

Forex Currency Strength Meter Download

Conclusion

Forex currency strength meters are indispensable tools for traders looking to gain an edge in the market. By understanding the relative strength or weakness of currencies, traders can make informed decisions that align with market dynamics. While these meters provide valuable insights, it’s important to use them with caution and incorporate a comprehensive trading strategy for optimal results.

If you’re interested in learning more about forex currency strength meters or other tools to enhance your trading experience, feel free to reach out for further guidance and support. Empower yourself with the knowledge and resources needed to navigate the forex market confidently.