Introduction: Navigating the Labyrinth of Financial Markets

The world of financial markets presents a vast and alluring terrain, beckoning investors of all levels with promises of financial freedom. Among the myriad options, stock trading and forex trading stand as two prominent choices that have captivated the imaginations of countless individuals. Each avenue entails distinct advantages and complexities, requiring traders to carefully weigh their options to determine the optimal path toward investment success. In this comprehensive guide, we will delve into the intricate realms of stock trading and forex trading, exploring their defining characteristics, potential benefits, and critical differences. By arming ourselves with a deep understanding of these markets, we can make informed decisions and embark on a financial journey destined for prosperity.

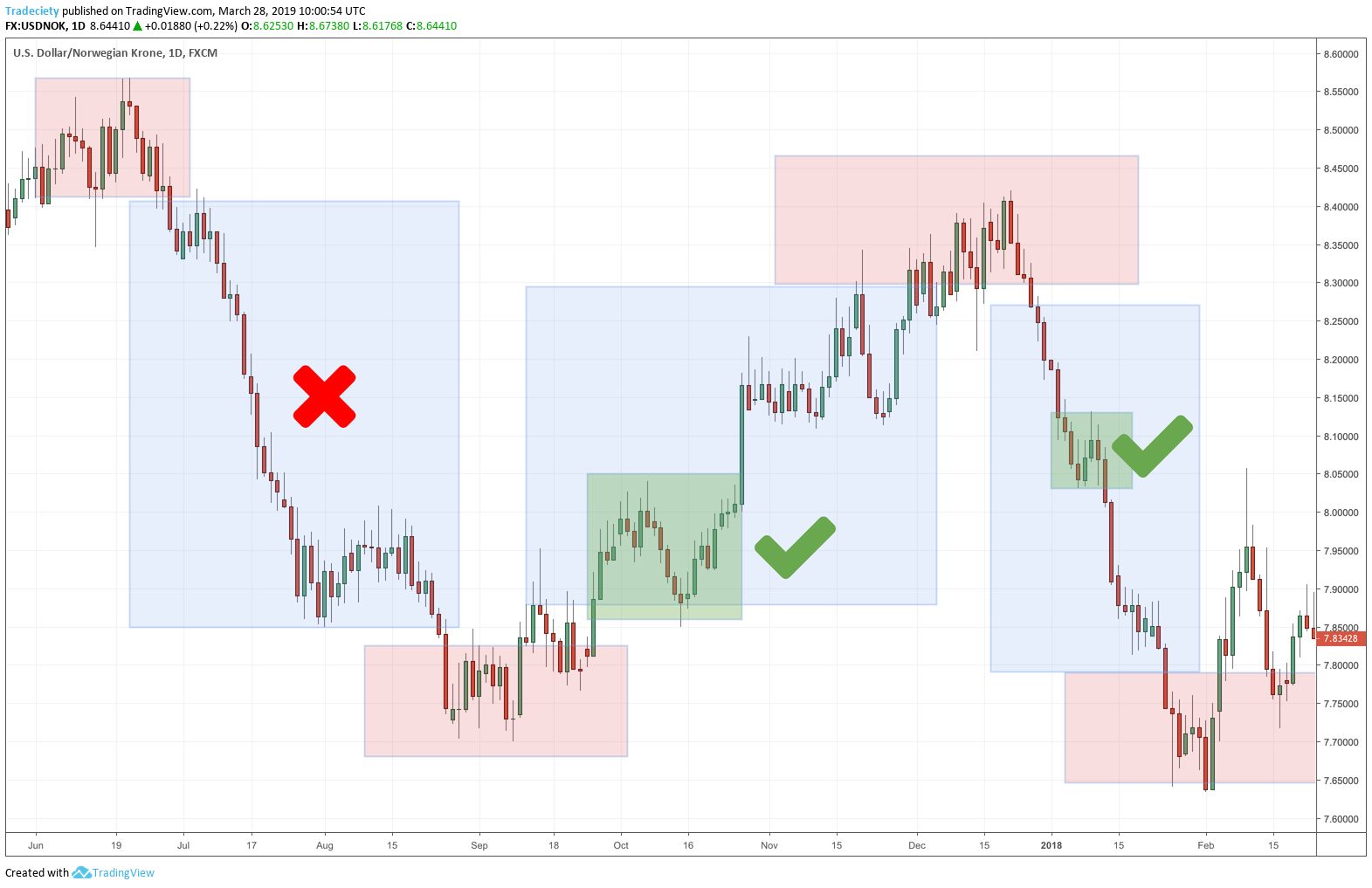

Image: tradeciety.com

Understanding Stock Trading: A Gateway to Corporate Ownership

Stock trading revolves around the buying and selling of company stocks, representing fractional ownership within publicly traded corporations. As a shareholder, you gain the right to a proportionate share of the company’s profits and assets. Stock trading provides investors with a diverse range of opportunities, allowing them to invest in specific companies or sectors tailored to their financial goals and risk tolerance. The stock market is an ever-evolving landscape, influenced by a multitude of factors such as economic conditions, corporate performance, and investor sentiment. This dynamism presents both opportunities for profit and potential risks that traders must carefully navigate.

Benefits of Stock Trading:

- Fractional Ownership: Stocks offer the unique opportunity to own a piece of successful companies, enabling investors to participate in their growth potential.

- Diversification: With access to a vast array of stocks, traders can spread their investments across different sectors and companies, reducing overall portfolio risk.

- Dividend Income: Many companies distribute a portion of their profits to shareholders in the form of dividends, providing investors with a passive income stream.

- Long-Term Growth: Stocks have historically demonstrated a trend of long-term appreciation, making them an attractive investment option for building wealth over time.

Unveiling Forex Trading: A Global Marketplace for Currencies

Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies from around the world. Unlike stock trading, where ownership is acquired in companies, forex trading focuses on speculating on the relative values of different currencies. The forex market is the largest and most liquid financial market globally, offering traders the opportunity to capitalize on short-term price fluctuations. Currency exchange rates are influenced by various economic and political factors, creating a dynamic and fast-paced trading environment.

Image: medium.com

Benefits of Forex Trading:

- Leverage: Forex trading allows traders to use leverage to increase their potential returns, but it also amplifies potential losses.

- Accessibility: The forex market is accessible 24 hours a day, 5 days a week, providing traders with the flexibility to trade at convenient times.

- Liquidity: With trillions of dollars traded daily, the forex market offers exceptional liquidity, enabling traders to enter and exit positions quickly and efficiently.

- Volatility: Currency exchange rates exhibit higher volatility compared to stocks, presenting opportunities for both profits and losses.

Delving into the Key Differences: A Comparative Analysis

To make an informed decision between stock trading and forex trading, a thorough understanding of their key differences is essential. Let’s delve into the crucial distinctions that set these markets apart:

1. Underlying Assets:

- Stock Trading: Involves the trading of company stocks, representing ownership in publicly traded corporations.

- Forex Trading: Centers on the buying and selling of currencies from around the world, speculating on their relative values.

2. Trading Platform:

- Stock Trading: Typically conducted through online brokerages or trading platforms.

- Forex Trading: Facilitated through specialized forex brokers, offering advanced trading tools and platforms.

3. Market Structure:

- Stock Trading: Stock markets operate during specific trading hours, with prices determined by supply and demand.

- Forex Trading: Forex markets operate continuously 24 hours a day, 5 days a week, with prices influenced by a broader range of factors.

4. Leverage:

- Stock Trading: Leverage is generally not permitted in stock trading, except in certain cases such as margin accounts.

- Forex Trading: Leverage is commonly used in forex trading, allowing traders to increase their potential returns but also amplifying potential losses.

5. Volatility:

- Stock Trading: Stock prices typically exhibit less volatility compared to forex rates, although significant price fluctuations can occur.

- Forex Trading: Forex rates tend to be more volatile, creating greater potential for both profits and losses.

6. Skillset Required:

- Stock Trading: Requires a fundamental understanding of company financials, market trends, and investment strategies.

- Forex Trading: Demands a deep knowledge of currency markets, macroeconomic factors, and technical analysis techniques.

Stock Trading Vs Forex Tading

7. Risk vs. Reward:

- Stock Trading: Offers a balance of risk and reward, with the potential for long-term growth but also the