Introduction:

Image: www.forexcracked.com

Imagine conquering the financial markets like a seasoned trader, predicting price movements with unmatched accuracy. This dream is within reach with the potent combination of Fibonacci retracement and technical analysis. Embrace this transformative toolset and embark on a journey towards financial empowerment.

What is Fibonacci Retracement?

Fibonacci retracement, inspired by the mathematical Fibonacci sequence found in nature, identifies potential support and resistance levels in financial charts. It assumes that price retraces to specific percentages of previous price swings, creating reliable entry and exit points for traders.

Technical Analysis: A Window into Market Psychology

Technical analysis unlocks the secrets of trading by studying past price data and market indicators. It reveals trends, patterns, and anomalies, empowering traders to gauge market sentiment and make informed decisions. By interpreting charts, volume data, and moving averages, you’ll uncover hidden opportunities and minimize risk.

Fibonacci and Technical Analysis in Practice:

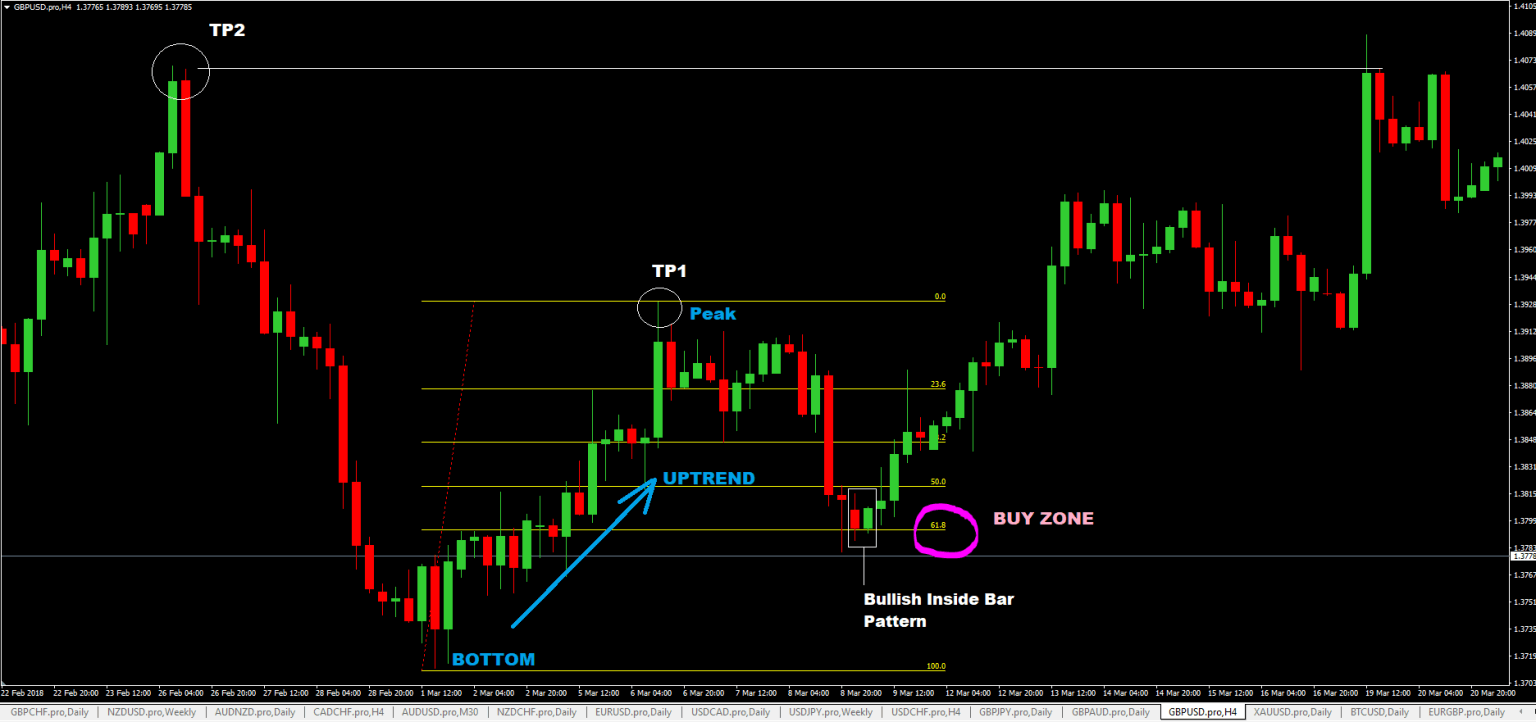

- Identify Trendlines: Draw trendlines along price highs and lows to determine the market’s overall direction. Fibonacci retracements can then pinpoint key areas where corrections may occur, aiding in trend trading strategies.

- Pinpoint Support and Resistance: Fibonacci levels mark potential areas where price may bounce off support or encounter resistance. This knowledge empowers traders to adjust their positions and manage risk effectively.

- Confirm Trading Signals: Technical indicators, such as moving averages or momentum oscillators, provide additional confirmation for Fibonacci retracement levels. When multiple signals align, the chances of a profitable trade increase significantly.

- Optimize Entry and Exit Points: Fibonacci retracements enable traders to identify optimal entry and exit points within a price swing. By entering near support levels and exiting near resistance levels, traders can maximize profits and reduce losses.

- Enhance Risk Management: Fibonacci retracements can help traders establish stop-loss orders at precise levels. By limiting potential losses, traders can protect their capital and maintain a disciplined trading approach.

Expert Insights:

“Fibonacci retracement and technical analysis are essential tools in my trading arsenal. They provide a systematic approach to market analysis, enabling me to identify profitable trading opportunities with greater confidence.” – John Carter, Author of “Mastering the Trade”

“Leveraging Fibonacci levels and technical indicators empowers traders to trade with both precision and intuition. By understanding market dynamics and price patterns, traders can navigate volatility with a focused strategy.” – Kathy Lien, Co-Founder of TradingView

Actionable Tips:

- Study Historical Charts: Examine past market movements to identify recurring Fibonacci retracement levels. This will enhance your understanding of how markets behave and improve your predictive ability.

- Test on a Demo Account: Before risking real funds, practice trading strategies using Fibonacci retracement and technical analysis on a demo account. This allows you to fine-tune your approach without financial consequences.

- Manage Risk Responsibly: Always determine your risk tolerance and stick to a predefined trading plan. Fibonacci retracements and technical analysis can aid in risk management, but it’s crucial to be disciplined and responsible.

- Stay Updated: Financial markets are constantly evolving. Regularly follow news and industry updates to stay abreast of emerging trends and adjust your trading strategy accordingly.

Conclusion:

Embracing Fibonacci retracement and technical analysis in stock forex trading is not merely a trading technique but a pathway to financial empowerment. By harnessing the power of these tools, you gain the ability to navigate market volatility with confidence, identify profitable opportunities, and achieve your financial aspirations. Remember, knowledge is power, and the journey toward financial freedom begins with mastering the art of technical analysis.

Image: investorji.in

Stock Forex Trading With Fibonacci And Technical Analysis