Managing your international finances can be a hassle, but with HDFC’s Forex Cards, you have a convenient solution. These cards offer secure and easy access to your funds when you’re traveling abroad. However, keeping track of your Forex Card’s status is essential for peace of mind. Here’s a comprehensive guide to help you check your HDFC Forex Card status.

Image: www.forex.academy

How to Check HDFC Forex Card Status

There are multiple ways to check the status of your HDFC Forex Card:

Online Banking

1. Log in to your HDFC NetBanking account.

2. Navigate to the ‘Cards’ section.

3. Select ‘Forex Cards’ and choose the relevant card.

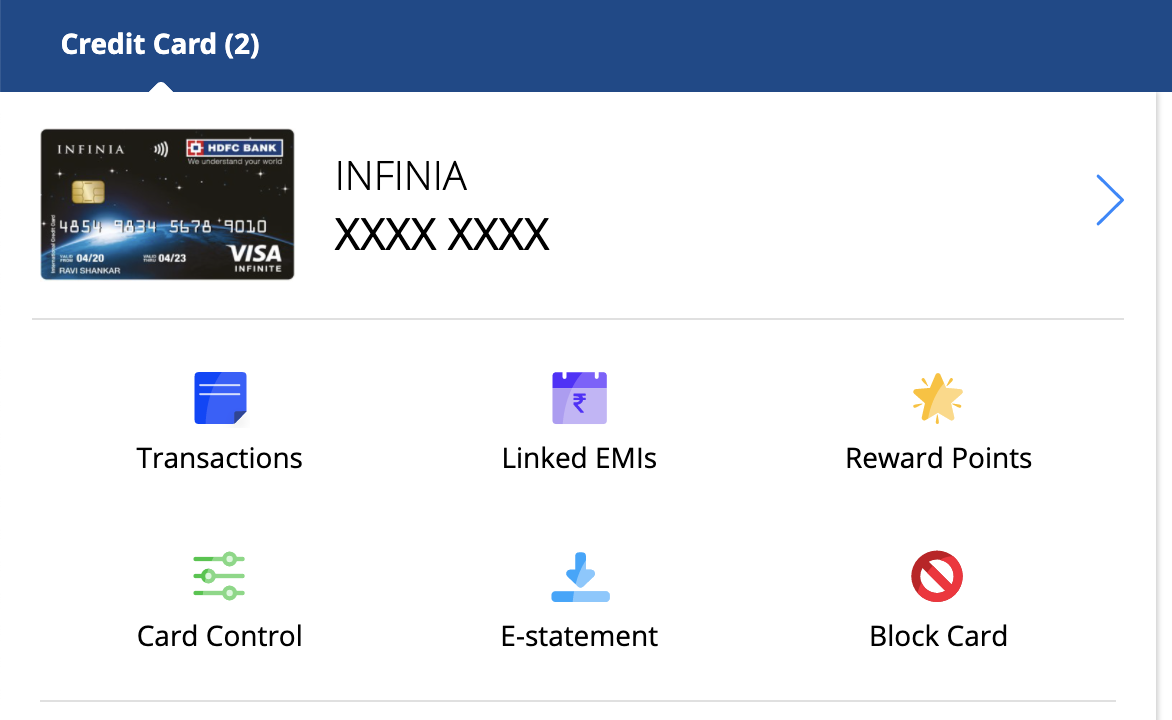

Mobile Banking

1. Open the HDFC MobileBanking app.

2. Tap on ‘Cards’.

3. Select ‘Forex Cards’ and choose the desired card.

Image: cardinsider.com

HDFC Phone Banking

1. Call the HDFC Forex Customer Care line at +91-22-67556699.

2. Provide your registered mobile number and OTP.

3. Follow the instructions to get your card status.

HDFC Forex Mobile App

1. Download the HDFC Forex App from the App Store or Google Play.

2. Log in with your registered credentials.

3. View your Forex Card balance and status.

What Information Can I Check?

When you check your HDFC Forex Card status, you can access the following information:

- Current balance

- Available balance

- Recent transactions

- Card expiry date

- Card status (active, blocked, etc.)

Tips and Expert Advice

Here are some tips and expert advice to manage your HDFC Forex Card efficiently:

Avoid ATM Withdrawals

ATM withdrawals on Forex Cards can attract high fees. Instead, prefer using your card for direct payments or online purchases.

Manage Card PIN

Keep your Forex Card PIN confidential and don’t share it with anyone. Ensure you memorize it and avoid writing it down.

Monitor Transactions

Regularly check your card statement or online account to track your transactions and identify any unauthorized activity.

Frequently Asked Questions

(Q) How long does it take to activate an HDFC Forex Card?

(A) The activation process usually takes 24-48 hours.

(Q) Can I use my Forex Card in all countries?

(A) Yes, HDFC Forex Cards are accepted globally.

(Q) What happens if I lose my Forex Card?

(A) Report the loss immediately to HDFC and block the card. You can request a replacement card.

Status Of My Hdfc Forex Card

Conclusion

Checking your HDFC Forex Card status is crucial for managing your finances efficiently while traveling abroad. By following the methods outlined above, you can stay on top of your card’s activity, track its status, and avoid any potential issues. As always, if you have any further questions, please don’t hesitate to reach out to HDFC for assistance. Remember, staying informed and being proactive can ensure a seamless and enjoyable international experience.