In the realm of Forex trading, where currencies collide and fortunes are made and lost, having a keen eye for volatility is essential. Enter the Standard Deviation (SD) indicator, a statistical tool that measures the dispersion of price data away from its mean, providing invaluable insights into market volatility and potential trading opportunities.

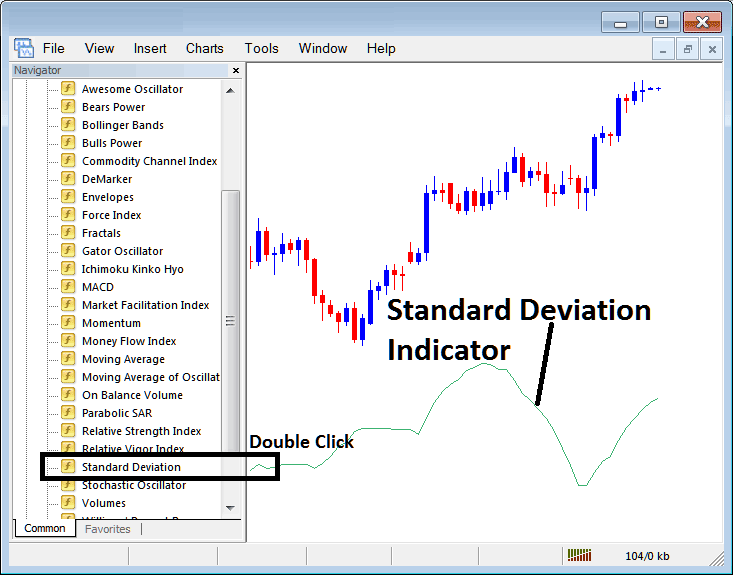

Image: www.tradeforextrading.com

Understanding the Standard Deviation Indicator:

The Standard Deviation measures the dispersion or “spread” of price data around its average value over a specific period. A higher SD indicates a more volatile market with larger price fluctuations, while a lower SD suggests a less volatile market with smaller price movements.

Applications in Forex Trading:

-

Volatility Assessment: The SD indicator provides a quantitative measure of market volatility, helping traders gauge the level of price fluctuations they can expect in the short term. This information is crucial for determining trading strategies, such as risk management and position sizing.

-

Trend Identification: Market volatility is often associated with trends. A rising SD often indicates an emerging or strengthening trend, while a declining SD suggests a potential reversal or correction. By tracking the SD indicator, traders can identify potential opportunities to enter or exit trades in line with market trends.

-

Support and Resistance Identification: Volatility can influence the formation of support and resistance levels. A high SD suggests a stronger support or resistance level, as traders anticipate larger price swings around those levels. Identifying these key price areas can help traders make informed trading decisions.

-

Range Trading: The SD indicator can assist traders in identifying potential range-bound markets. Markets with a low SD often consolidate within specific price ranges, providing opportunities for scalping or range-bound trading strategies.

-

Risk Management: Volatility plays a fundamental role in risk management. A high SD indicates higher potential risk, while a low SD suggests a lower risk of large price swings. Traders can adjust their trading style and position sizing accordingly to manage risk effectively.

Conclusion:

The Standard Deviation indicator is an indispensable tool for Forex traders seeking to navigate the volatile waters of currency markets. By understanding market volatility through the lens of the SD indicator, traders can make informed decisions, identify potential trading opportunities, and manage risk more effectively. In the ever-evolving world of Forex trading, the SD indicator empowers traders with valuable insights to seize market opportunities and mitigate potential losses.

Image: www.financebrokerage.com

Standard Deviation Indicator In Forex