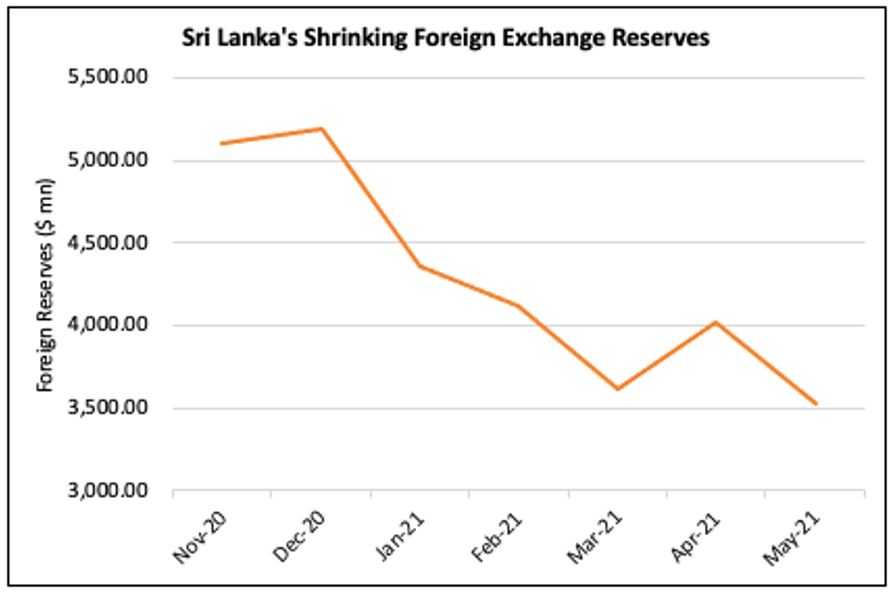

In recent times, Sri Lanka has faced a worrying decline in its foreign exchange reserves, raising concerns about the country’s economic stability and the well-being of its citizens. To fully comprehend the implications of this decline, we must delve into the significance of foreign exchange reserves and the factors contributing to their depletion in the case of Sri Lanka.

Image: economynext.com

Foreign exchange reserves, simply put, are the financial assets held by a country’s central bank in foreign currencies, such as US dollars, euros, and gold. These reserves play a vital role in maintaining a country’s economic health as they enable the government to intervene in the foreign exchange market, stabilize the currency’s value, and ensure the availability of foreign currencies for essential imports, such as fuel, food, and medicines.

In the case of Sri Lanka, the decline in foreign exchange reserves has become increasingly apparent. According to the latest data released by the Central Bank of Sri Lanka, the country’s gross foreign exchange reserves stood at a mere $1.9 billion at the end of April 2023, marking a significant drop from the $7.5 billion recorded in April 2018. This alarming depletion has left Sri Lanka with only enough reserves to cover about two months of imports, falling far short of the recommended three to four months of import coverage.

Several factors have converged to drive down Sri Lanka’s foreign exchange reserves. One major factor is the widening trade deficit, where the country’s imports far outpace its exports. This imbalance has put pressure on the country’s foreign exchange resources as more foreign currencies are needed to pay for imports. Another contributing factor is the decline in tourism revenue, which had been a significant source of foreign exchange earnings for Sri Lanka. The COVID-19 pandemic has caused a sharp drop in tourism, further exacerbating the foreign exchange crunch.

Furthermore, Sri Lanka’s sizable external debt burden has put additional strain on its foreign exchange reserves. The country has been struggling to repay its foreign loans, which have reached unsustainable levels. The servicing of these debts has been a major drain on the country’s foreign exchange resources, leaving less available for essential imports and other critical needs.

The dwindling foreign exchange reserves have had far-reaching consequences for Sri Lanka. The country’s currency, the Sri Lankan rupee, has come under severe pressure, losing value against major foreign currencies. This has led to inflation, making essential commodities such as food and fuel more expensive for ordinary citizens. The economic outlook is bleak, with businesses facing challenges in accessing foreign inputs and consumers feeling the pinch of rising prices.

To address the crisis, the Sri Lankan government has embarked on a series of economic reforms in collaboration with the International Monetary Fund (IMF). These reforms include raising interest rates to curb inflation, increasing taxes to reduce budget deficits, and implementing structural reforms to improve the efficiency of the economy. The government has also sought financial assistance from international lenders to bolster its foreign exchange reserves.

The decline in Sri Lanka’s foreign exchange reserves serves as a cautionary tale about the importance of prudent economic management. The country’s failure to address its trade deficit, reliance on foreign debt, and inadequate diversification of its export sector has created a vulnerability that has come to the fore during times of economic stress.

Foreign exchange reserves not only underpin economic stability but also provide a safety net during emergencies. They provide a buffer to withstand external shocks and give policymakers the flexibility to respond to crises without resorting to drastic measures that could further damage the economy. It is imperative that policymakers prioritize the rebuilding of Sri Lanka’s foreign exchange reserves, implement sustainable economic policies, and create an environment that encourages foreign investment and export growth to mitigate future risks.

Image: bondblox.com

Sri Lanka Declining Forex Res